Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – SEPTEMBER 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2023/2024

The harvest season in Côte d’Ivoire is ending, with a shortfall of approximately 25% compared to the last year. About 1,754,000.00 tons of cocoa beans have been delivered to the ports as of September 22, 2024.

It is likely that port deliveries in the final week will be scarce, as farmers are expecting a price increase for the new harvest of up to 25%, reaching 1,800.00 CFA, which is roughly equivalent to $3,040.00 per ton.

Ghana plans to collect at least 700,000.00 tons in the next season. Additionally, the purchase price from farmers has been raised to 48,000.00 CEDI, which is approximately $3,070.00 per ton, representing an increase of around 45%.

Ghana also announced that about 160,000.00 tons have been illegally exported to Togo and Côte d’Ivoire. Arrests of individuals involved in the illegal export of cocoa beans continue.

The market continues to experience a physical shortage of cocoa beans. Certified stock in London warehouses have been decreasing in September, and major processors have stated that the cocoa beans currently available on the London Commodity Exchange are unsuitable for chocolate production due to excessive defects and FFA elevated levels.

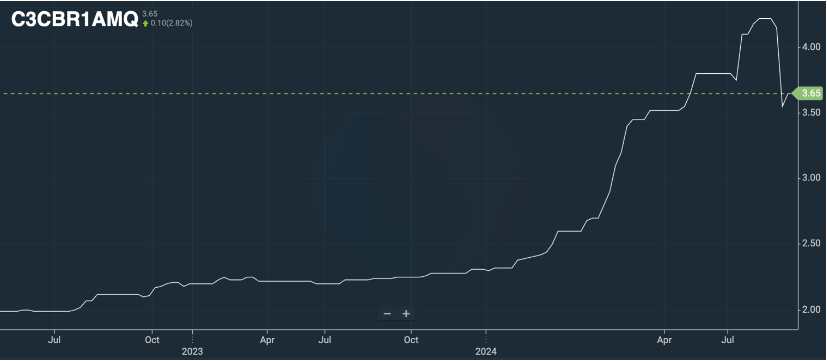

The cocoa butter ratio is currently at 3.65, indicating a significant correction.

The cocoa liquor ratio is at 2.18, remaining almost unchanged.

The cocoa powder ratio is at 1.11, reflecting a growth of approximately 10% during the last month

FOB West Africa ratios are at the following levels for Q4 2024 deliveries.

Cocoa mass

2.18 and demonstrating a stable decrease trend towards 1.95 in the period from the 1st to the 2nd quarter of 2025. At the current level on the exchange, the price will be about 14,000.00 euros/t in the 4th quarter.

Natural cocoa butter

3.65 for natural cocoa butter and a decrease trend for the next 4 quarters that may bring it to 3.85. The price at the current levels of the exchange will be about 23,000.00 euros/t in the 4th quarter.

Cocoa powder

The ratio for cocoa powder has not almost changed since the last month. The ratio is at the level of 1,11 compared to the stock price. As of today, the exchange price in euros starts from 7,050.00 euros/t.

Natural cocoa powder price starts from 7,050.00 euros/t.

Alkalized cocoa powder is at 7,700.00 euros/t.

2. Technical analysis

In September, the price stabilized, and our advice to clients remains the same: buy any price correction. Given the current market volatility, corrections may not last long, and we could see price movements of over $1,000.00 per day. As correctly noted in the chart below, we are expected to see the value of wave C in the corrective model. The price must be at least $1 lower than in wave A.

However, we must keep in mind that the gap on the chart is due to the transition to trading the December futures. It’s quite possible that we will need to fill this gap.

The New York market continues to move within an upward channel and will likely trade in the range of $6,300.00-$7,500.00 per ton for some time against the March 2025 contract.

The London market is trading within an equilateral triangle, and a breakout could occur in either direction. However, according to technical analysis theory, if we are trading below the 200-day moving average (200MA), the market is likely to move downwards. Conversely, if we trade above the 200MA, it would lead to an upward breakout.

At the moment, we are trading below the 200-day moving average.

WEATHER

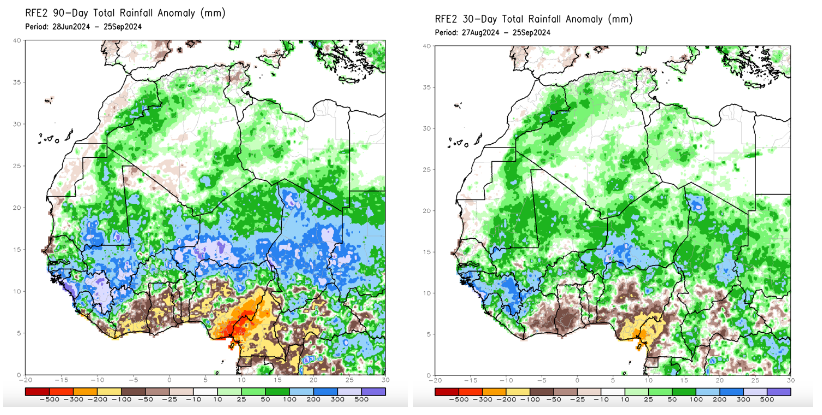

Rainfall in West Africa over the past 30 and 90 days has been below average, suggesting a weaker start to the 2024/2025 main harvest. We do not have high expectations for a good yield.

While the upcoming season is definitely expected to be better than the current one, we would prefer to avoid very optimistic forecasts. Weak rains during the summer and early fall may impact overall harvest numbers. Currently, the number of pods on the trees is above average, but if there is no significant increase in rainfall soon, we are unlikely to see a surplus harvest in the 2024/2025 season.