Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – MAY 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2023/2024

Arrivals at ports in Côte d’Ivoire, as of May 26, 2024 are 29% less than the previous year. A total of 1,469, 000.00 tons have been delivered to the ports.

The market continues to experience a physical shortage of cocoa beans. The middle harvest did not improve the general yield results for the 2023/2024 season.

An update on some important news: Côte d’Ivoire has stopped the Fairtrade certification system, since 97% of exported beans fall under the Fairtrade system. A new tracking and certification system, EUDR, will be introduced in the new year. The approximate premium per ton of goods will start from 200 euros per MT.

Ghana plans to sell the future 2024/2025 harvest for $1.5 billion, indicating 810,000 tons as the expected future harvest volume.

However, Ghana failed to deliver 250,000 tons this season, for which they still have obligations that cannot be covered by the next season’s harvest. It is likely that even the 2025/2026 season’s harvest will not cover these obligations, and this situation is expected to last for several years.

The second issue to be mentioned: cocoa trees in Ghana are at risk for diseases caused first by drought and then by heavy rains. According to some estimates, Ghana needs about $2 billion to treat all cocoa trees. Currently, only 100,000.00 hectares of land have been treated, while 500,000.00 hectares of land where cocoa trees are cultivated are still waiting for their turn. Considering these facts, the 2024/2025 harvest of 810,000 tons seems improbable; and based on rainfall information that will be provided below, it would be good news if the harvest exceeded 700,000.00 tons.

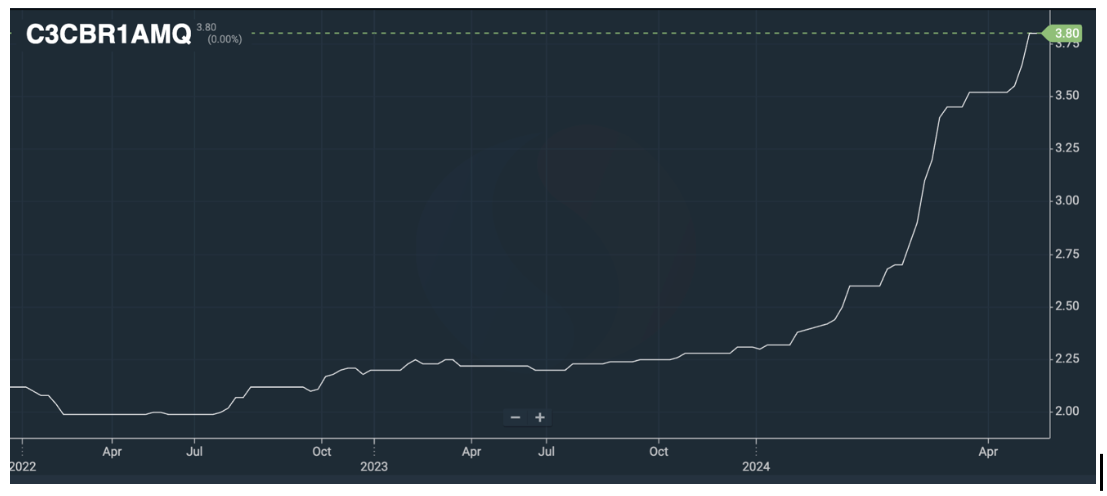

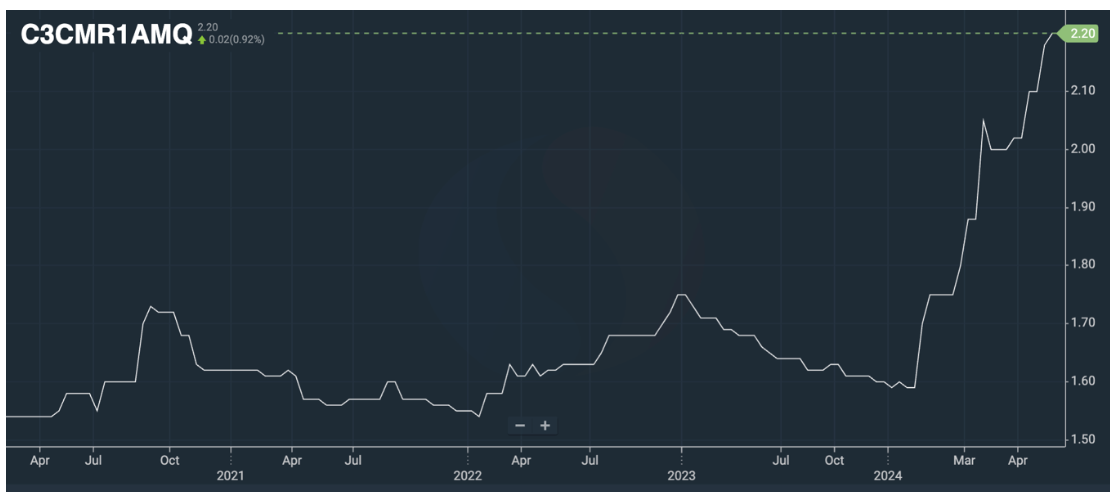

The long-awaited price correction occurred in the futures market. However, an interesting fact is that the fall in futures market is accompanied by the rise in the ratios for cocoa products. As a result, the prices of cocoa products did not decrease as much as the final consumer would have hoped.

For example, the prices of cocoa powder are reaching new maximum levels.

Consumption and production of cocoa products proceed under a certain degree of pressure. Although we do not yet see the final figures, rumors in the chocolate market indicate a decline in both production and consumption. It is difficult to predict at this time how big this decline may be.

Forecasts suggest a decrease in consumption ranging from 10% to 30%. However, it is quite possible that we will see this data with a significant delay.

Cocoa butter ratio

Cocoa mass ratio

Cocoa powder ratio

FOB West Africa ratios have stabilized at the following levels for June 2024 deliveries.

Cocoa mass

2.20 and demonstrating a stable trend towards 2.30 from the 3rd to the 4th quarter of 2024. At the current level on the exchange, the price will be about 19,000.00 euros/t in the 2nd quarter.

Natural cocoa butter

3.80 for natural cocoa butter and an uptrend for the next 4 quarters that may bring it to 4.00. The price at the current levels of the exchange will be about 32,000.00 euros/t in the 2nd quarter.

Cocoa powder

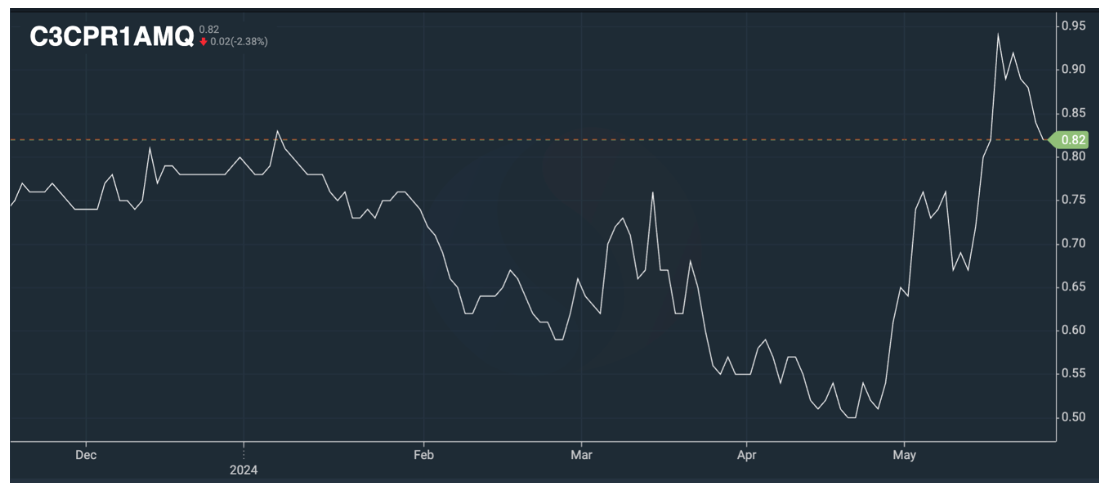

The ratio for cocoa powder has significantly increased since the last month. The ratio is at the level of 0.8 – 0,9 compared to the stock price. As of today, the exchange price in euros comprises 9,000.00 euros/t.

Natural cocoa powder price starts from 7200 euros/t

Alkalized cocoa powder is at 7500 euros/t

2. Technical analysis

In May, the long-awaited price correction occurred, and our advice to clients remains the same: buy at any price correction. Given the current market volatility, with changes exceeding $1,000 per day, this correction may not last long. As correctly noted on the chart below, we expect growth in the short term.

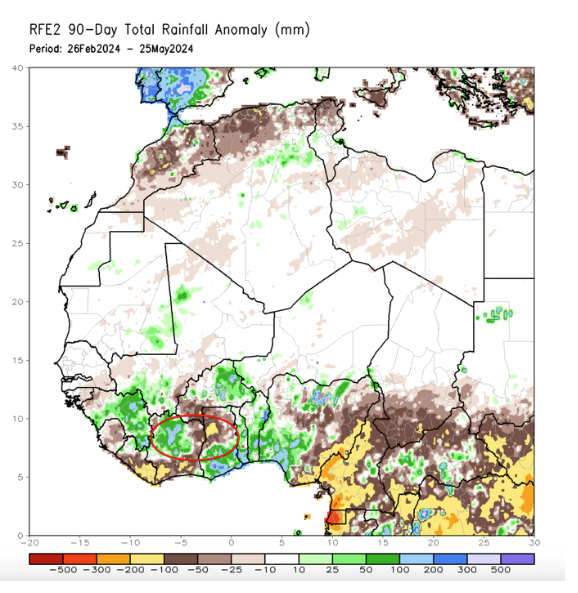

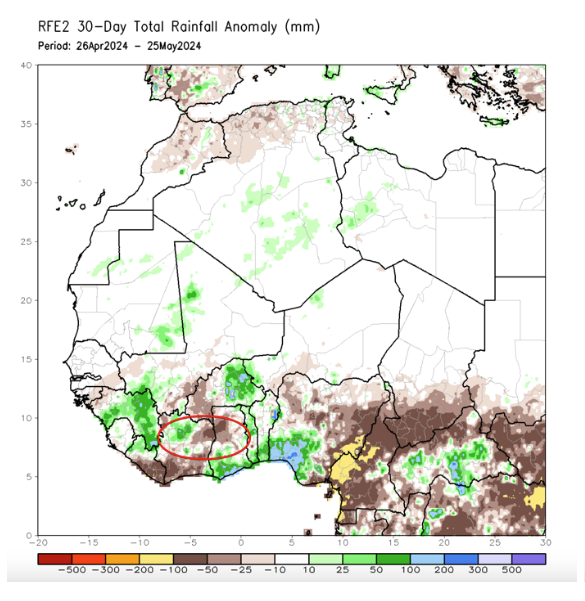

WEATHER

Rainfall scopes in West Africa have been significantly below normal over the past 30 and 90 days. Despite forecasts predicting a weakening of El Niño, these forecasts have not proved to be correct so far. As a result, we are likely to see a weaker start to the main harvest for 2024/2025. The brown and yellow spots on the map are located along the equator in the cocoa-growing regions (the main cocoa-growing area is marked with a red circle).