Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET

November 2021

Season 2021/2022

In 2021/2022 years harvest collection began with a small delay; in Côte d’Ivoire a very good harvest was collected (2,189,000 tons) in the 20/21 season, but this year forecasted quantity is 10% less.

For the first 5 weeks, the delivery to the port comprised 8% less than the last year which is 79,000 tons less.

In Ghana the situation is similar: so far the arrivals comprise 10 thousand tons less compared to the last year.

Côte d’Ivoire and Ghana give substantial discounts on the collected harvest to ensure the LID inflow (400 dollars per ton) to the Treasury; they schedule the meeting of Ministers in November to discuss the situation. The market is tending towards the growth of differentials.

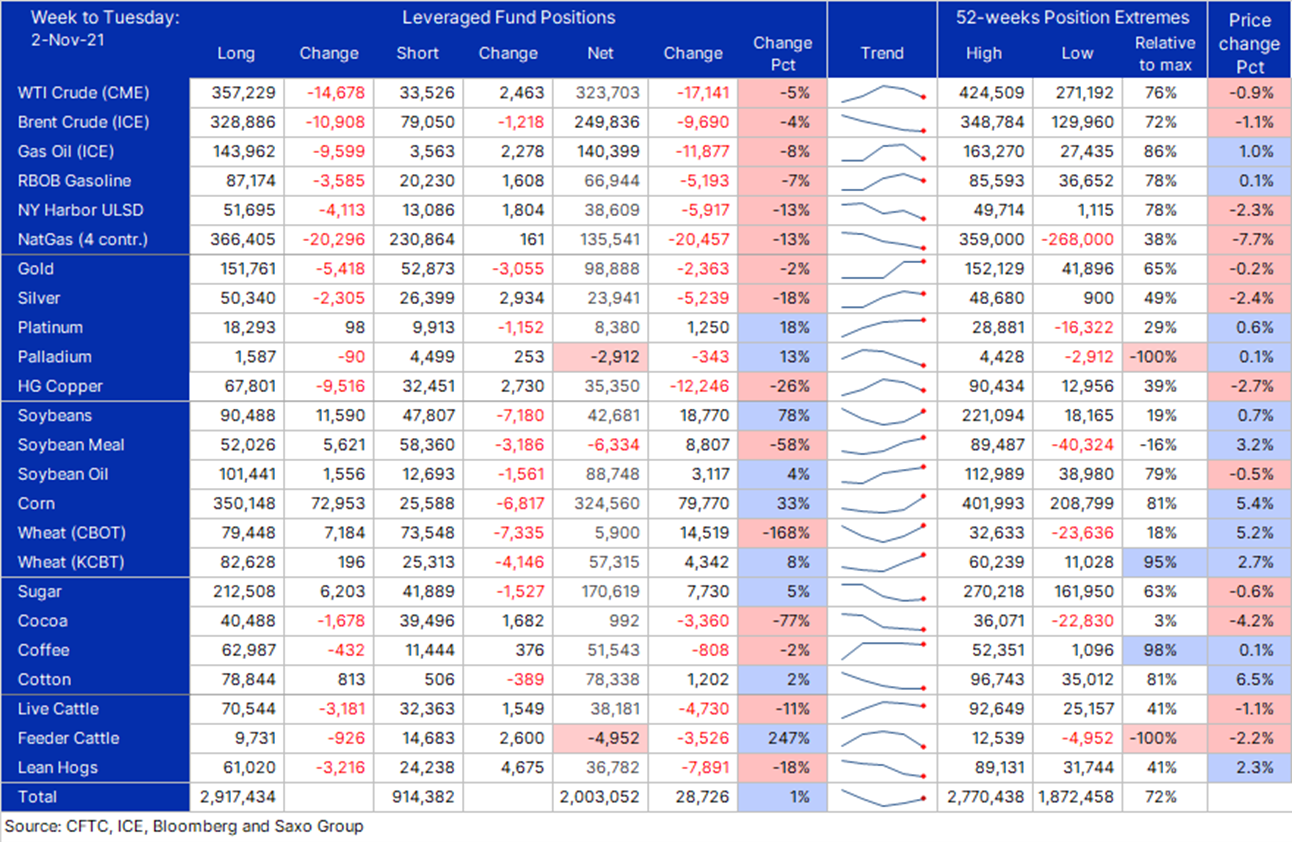

Hedge funds demonstrate a stabilization of the number of long positions in relation to the short positions in cocoa market as of November 2, 2021 (chart below). At the moment the number of positions is balanced, which means that the prices should stabilize for a while.

COCOA PROCESSING, 3Q DATA

In mid-October, global data on the cocoa beans processing became available, which worked as a trigger to prices’ reduction in the cocoa bean market. In general, the data is very optimistic, but the market had even bolder expectations.

Most likely, the decline in prices was also caused by the fact that hedge funds started to sell their long positions, while the countries of the product origin started hedging their future harvests.

On 06.11 it was stated that sales were suspended for a while and on 9-10 November we see some price increase

USA demonstrated some increase in processing: + 4,35%

EU: + 8.7%

Côte d’Ivoire: +12,8%

Malaysia: +3,44%

I would like to go into details as regards the Asian market figures: although the market believes that the increase is insignificant, however, taking into account the rates applicable to the containers from Asia, we believe that even such a slight increase is a good trend. Usually a container from Asia to the EU or the United States costs $ 100 per ton. In the current conditions the price is 600-700 dollars per ton.

This means that the average freight cost component for goods from Asia increased from 3% of the price per average ton of cocoa products up to 20%. The growth of product processing in this situation is a wonderful sign which was underestimated for some reason by the market.

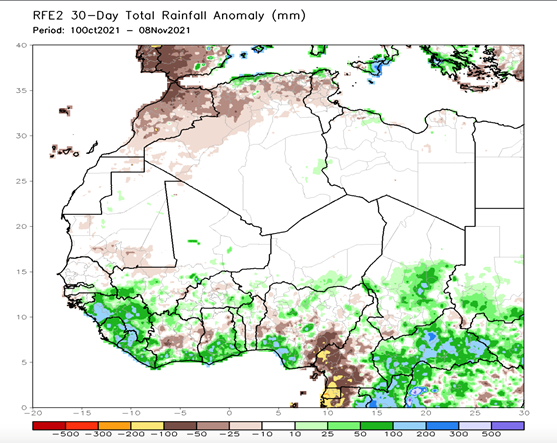

WEATHER

Weather conditions in West Africa remain favorable.

Cocoa trees blossom abundantly in West Africa which was preconditioned by good rains in the previous periods.

Besides, we see almost complete absence of trees diseases (Black Pod).

Below please see the rain-map for the last 90 days, we see excessive rainfalls (blue and green colors).

Probably, we can expect a very good medium-level harvest from May to September 2022.

TECHNICAL ANALYSIS OF THE MARKET

From a technical point of view, the market passed through the resistance levels of 50, 100 and 200 day averages on the London and NY Stock Exchanges, and is held at the lower level. The market has formed a new support point and an upward trendline.

The correction was in Fibonacci levels, the market reached the lowest point, and was resold in great share.

Currently, a new turn showed up and we observe the correct growth waves as defined by the Elliot Wave theory. Probably the growth trend will continue on the US market to the levels of 2588-2668 as regards the month of December when the further market trend will be set.

Probably from this point the market will try to achieve a resistance line of 2943 dollars that we indicated earlier.

Main resistance points will be on London Stock Exchange CH2 (March 2022 trading month)

10 daily average – 1700

200 daily average – 1716

100 daily average – 1748

50 daily average- 1789

PRICES FOR COCOA BEANS AND COCOA PRODUCTS

Cocoa liquor

Ratio spot (immediate deliveries) – 1.8

Ratio for 4Q 2021 year – 1.7

Cocoa powder

Natural powder of standard quality IC1 – 2370 EUR/mt

Natural powder of premium quality ICP – 2520 EUR/mt

Alkalized cocoa powder of premium quality А6 – 2620 EUR/mt, limited offer

Alkalized cocoa powder of premium quality А8 – 2770 EUR/mt, limited offer

Cocoa bean, Ghana

Supplies, 4 Q 2021 year

Stock Exchange CZ1 (Dec2021) +500 GBP/mt

Price FCA Tallinn 3000 USD/mt

Cocoa beans, Côte d’Ivoire

Supplies, 4 Q 2021 year

Stock Exchange CZ1 (Dec 2021) +385 GBP/mt

Price FCA Tallinn 2835 USD/mt

Wishing You Good Health & Happiness

Panamir OÜ is carrying out an investment project aimed at launching a cocoa powder production line. This project is within the framework of the investment support for the processing and marketing of agricultural products of micro and small enterprises (ERDP 2014-2020 measure 4.2.1), the amount of the support is 175,120.80 euros.

Panamir OÜ publishes a monthly market report on the cocoa market.