Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET September 2022

1. Season 2021/2022

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – September 2022

As of 21.08.22 Côte d’Ivoire demonstrates a 4,1% harvest decrease this year. Ivory Coast delivered to the ports 2, 050, 000. tons against 2, 140, 000. tons the year before.

Ghana did not demonstrate a miraculous result as well; we still observe a 35% decrease compared to the last year; the reasons of such a serious deficiency we set forth in detail in our previous report.

General data – 685, 000.00 tons harvested – compared to an approximate 1 mln. tons harvested in the previous year. The forecast for the next year predicts 850, 000.00 tons.

This is the smallest harvest in the last 12 years.

ICCO International Cocoa Organization warns that shortage of fertilizers may cause other problems with the harvest such as the size of fruits and quality of cocoa beans as a consequence.

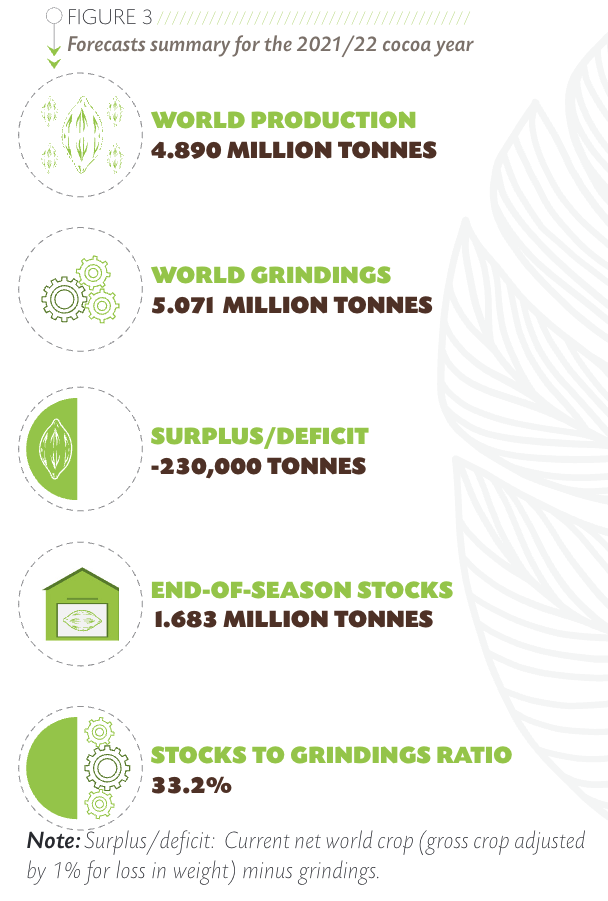

Besides according to ICCO data the deficiency observed in the final results of season 2021/2022 will cause the shortage of cocoa beans in the world in the amount of 230,000. tons, whilst the year before we observed a surplus of 215 000 tons.

The Africa end-of-season harvest will comprise 75% of the total world stocks, South America – 20%, Asia – 5%.

Nigeria is investing actively into cocoa beans production and attempts to produce 500, 000.00 tons harvest already in 2024 whilst this end-of-season harvest reached 340, 000.00 tons. It sounds reassuring but I am ready to remind you that a tree starts to bring fruit 3 years after planting. Even if the trees are planted in 2022, the best case scenario is an obvious increase from 2025, while the trees will have a peak of harvest in 2028. Therefore, these ambitious statements are nothing more than a wish to get financing from European banks for these purposes.

2. Cocoa processing.

Barry Callebaut reported a 9,1% increase in chocolate sales in the first 9 months of their fiscal period which ended on May 31, 2022.

Due to increasing prices for gas and electricity in Europe, we observe ratio increase for cocoa products. For example, as of August 15 production costs for 1 ton increased by 300-500 euros per ton depending on the manufacturing country; meanwhile the production costs continue increasing.

Could well be the case that we will see the cocoa products reach their price peak with a small delay following the gas prices peak in Europe. According to all the forecasts the prices will reach their peak within the heating season of November 2022 – February 2023, unless something outstanding happens.

However, this will be the trend for spot supplies mostly. Europe sells 9 months in advance more often and as an average. Therefore, most probably we shall not expect processing decrease in the nearest 2 quarters.

The decrease is likely to start from the 1st quarter of 2023.

3. Technical analysis

So far we still see the cocoa in the descending corridor at the New-York Stocks Exchanges despite all the fundamental data. After all, hedge funds moving the market are afraid too much of the recession, and as we know chocolate is one of the raw materials that suffers market drops more than others in case of an economic recession.

The price at the London Stock Exchange remains at the level of 1,850.00 pounds, to a great extent the weakness of GB pounds put the price out of the descending corridor.

In its turn the Dollar hit resistance and moves upwards, now the currency is outbid but there is a real probability that the currency still has the resource for increase since EU lives an internal military and energy-related crisis, in such conditions even 0.5% stakes rising does not allow EURO increase and enhances the further growth of Dollar value.

That could well be the case, and we will see EUR-USD exchange rate at the level 0.95-0.98 in the nearest time.

The long Elliott wave diagram covering the period of 2 years shows a downward trend and shaping of an ABC correction wave as well as a second downward wave in the weekly diagram. As soon as the price target is reached at the level of 2,150.-2,250.00 USD dollars per ton in the autumn of 2022, we are supposed to see the formation of a third wave as the nearest prospective at the New-York Stocks Exchanges by the spring of 2023; in the long run the price may grow to the amount of 3,100.00 USD dollars which is a 30% increase compared to the current prices.

WEATHER

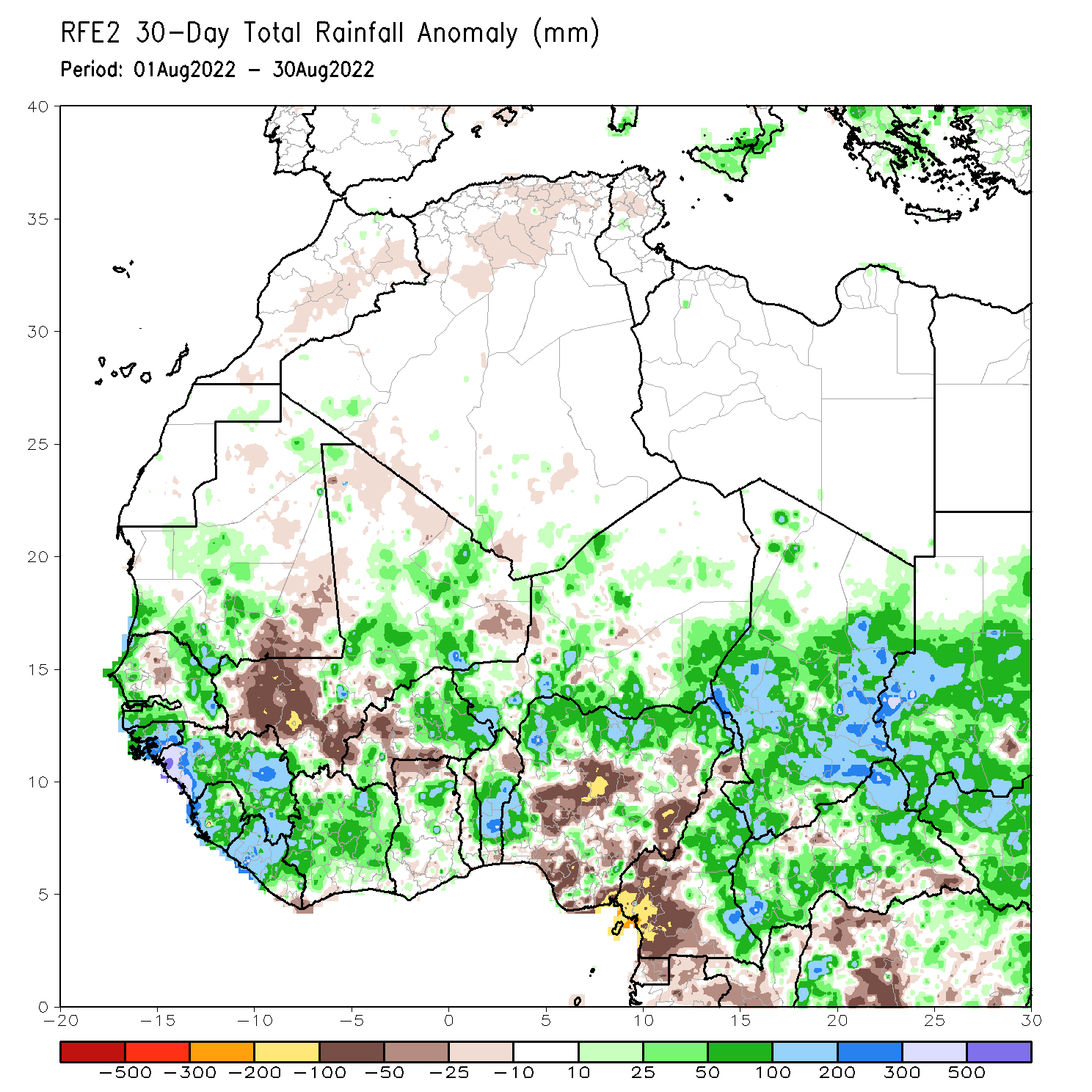

Weather conditions in West Africa in the last 30 days were favorable and a bit better than the normal ones. Quantity of precipitations demonstrates that rainfalls in the summer period were missing in the most regions that grow cocoa, however, the last weeks demonstrated weather improvements which is expected to produce a harvest better than in the current season as a minimum.