Market report

TRENDS AND KEY EVENTS IN THE COCOA MARKET

April 2022

Season 2021/2022

TRENDS AND MAIN EVENTS IN THE COCOA MARKET

Harvest 2021/2022 continues with some changes. According to the updates as of April 4, 2022 this season deliveries to the port of Côte d’Ivoire are increased by 3% compared to the previous year at the same period. If at the beginning of the season we witnessed a 9% backlog, however, 7 months later we see that the export of cocoa beans outruns the last year at least in Côte d’Ivoire.

The quality of cocoa beans delivered to the ports of Côte d’Ivoire leaves much to be desired. We see that more and more cocoa beans do not correspond to the criteria established for cocoa beans that can be exported according to the laws and regulations of Côte d’Ivoire.

Consumption does not fall behind, in the middle/end of April we will see fresh processing data from the USA, EU, and Asia. We do not expect that consumption will decrease due to the conflict of Russia and Ukraine since most likely the whole scope that was supposed to be exported to the markets of Russia and Ukraine was produced until mid-February. In the worst case the shipment is in transit on its way to the final customers.

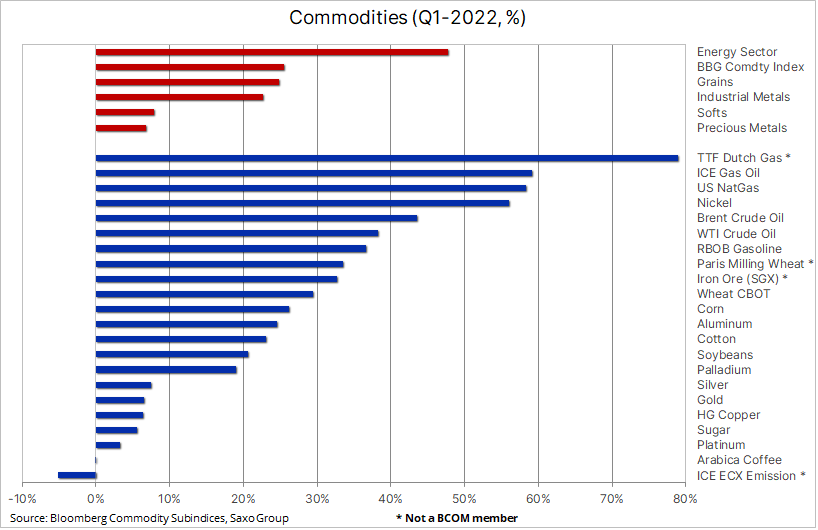

The below diagram shows the growth of prices for raw materials in the first quarter of 2022. Cocoa and coffee markets are mostly under pressure due to the concerns that demand will fall in view of the current war episodes, and although the markets directly and indirectly participating in the conflict occupy not more than 5% of total world demand, it has a certain psychological pressure on prices.

All other raw materials showed 7 – 80% increase.

For comparison, we use the Commodity index diagram, and 2 points: the beginning of the pandemic and the beginning of hostilities. Super cycle of commodities continues and, maybe, we will see the peak by the autumn of this year.

Further I quote the Chairman of the Ghana Cocoa Board (GCB) who stated that due to the lack of fertilizers as the consequence of the military crisis between the Russian Federation and Ukraine, we urge farmers to use chicken litter instead of fertilizers.

Unfortunately, not only cocoa farmers face this situation, so we believe that a food crisis is approaching which will cause even greater increase in prices for food including cocoa beans.

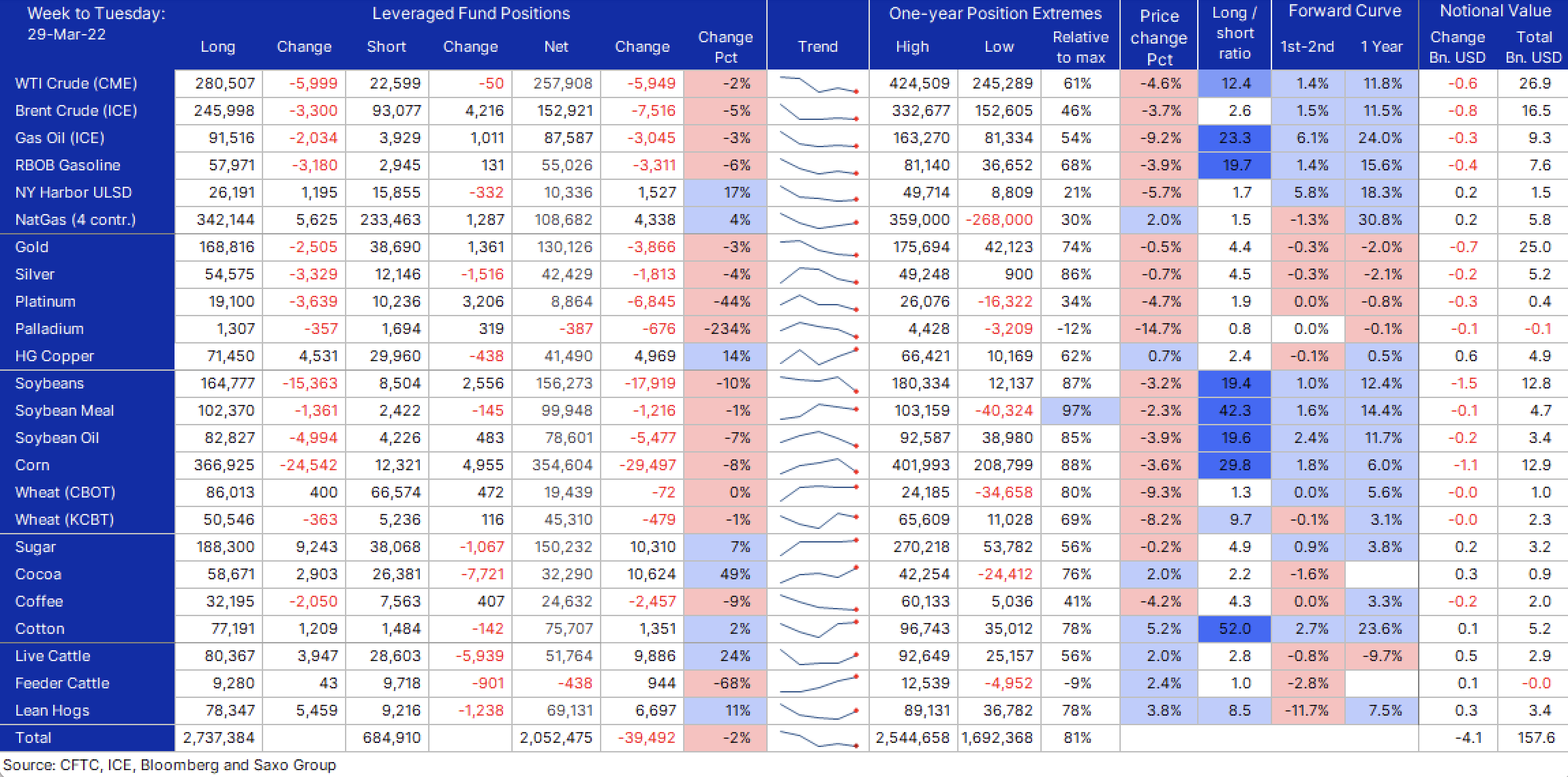

Further I show the positions of “smart” money, hedge funds.

We see that the long positions for cocoa increased by 10,000 lots (100,000 tons) compared to data as of the beginning of March. The price in the London Stock Exchange increased by 50 pounds per ton, and most likely cocoa and coffee will increase in price due to raw materials index increase. Several factors may constitute fundamental basis for increase or decrease of cocoa prices: the weather, good / bad data on cocoa processing globally, the quality of raw materials in countries of origin.

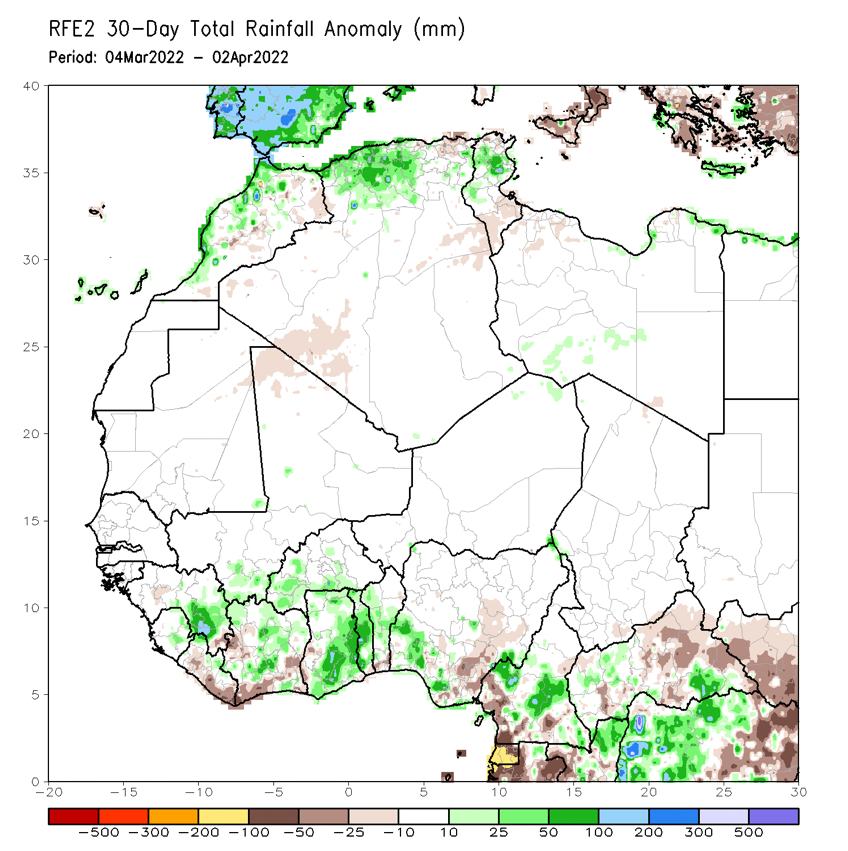

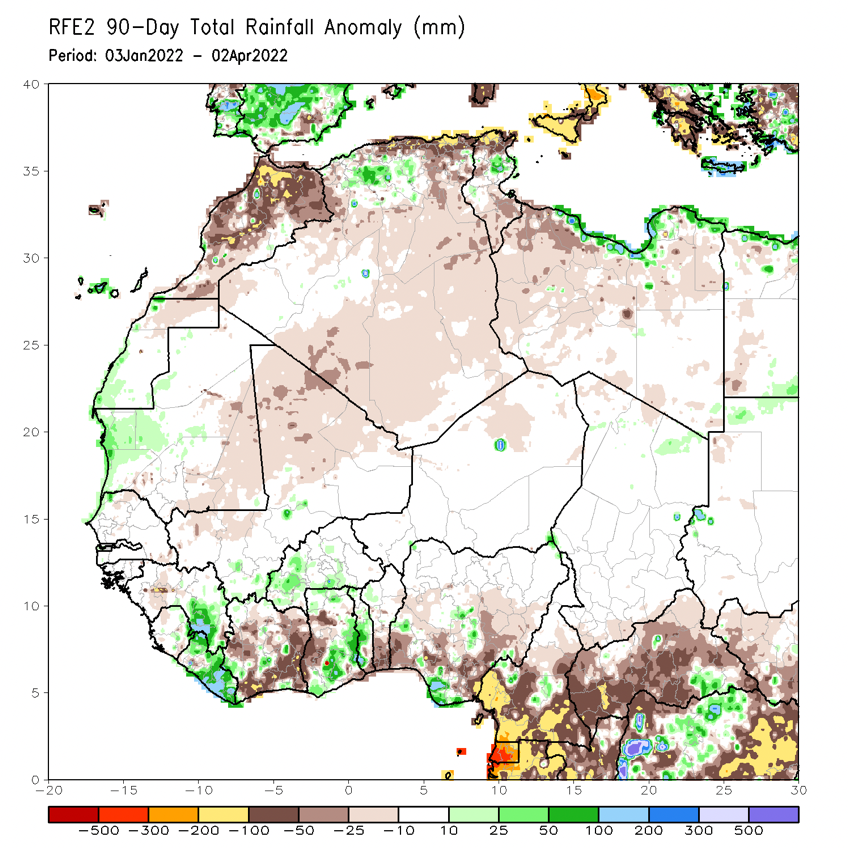

WEATHER

Weather conditions in West Africa improved during the last month for the main harvest of 2022/2023.

The upper picture shows the last 30 days situation and depicts in green the excessive rains as compared to the standard precipitations in this region.

The second picture shows the period of 90 days, and here we are still below the norm for the last 90 days. The weather situation in Ghana is a bit more favorable than in Côte d’Ivoire.

TECHNICAL ANALYSIS OF THE MARKET

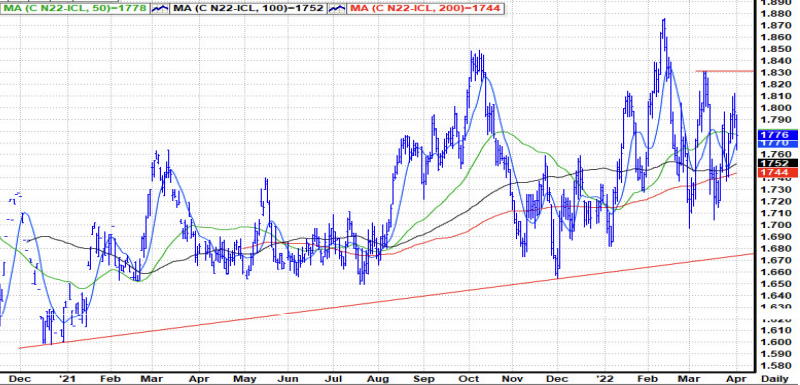

From a technical point of view, the upward market trend is continuing for a long time and currently we do not see any preconditions that might ruin this trend. Taking into account a rather strong foundation from the viewpoint of informational support and the long position of the hedge funds from the technical viewpoint we expect to see the market only above the current levels in a mid-term perspective.

The news about cocoa processing on the 15/16 week will be the main drivers of price dynamics.

Besides, we still (at the opening of the market 04.04) traded above 100/200 day medium lines.

The last week also closed above these values; this is a rather important signal confirming the fact that the market will continue its growth. The following resistance lines will be at the level of 1830 and 1880 pounds per ton against trading in July 2022.

Cocoa beans from Ghana

Deliveries 2Q 2022

Stock Exchange CH2 (May2022) +530 GBP/mt

Price FCA Tallinn 3010 USD/mt

Cocoa beans from Ivory Coast

Deliveries 2 Q 2022

Stock Exchange CH2 (May2022) +395 GBP/mt

Price FCA Tallinn 2830 USD/mt

Wishing You Good Health & Happiness

Panamir OÜ is carrying out an investment project aimed at launching a cocoa powder production line. This project is within the framework of the investment support for the processing and marketing of agricultural products of micro and small enterprises (ERDP 2014-2020 measure 4.2.1), the amount of the support is 175,120.80 euros.