Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – OCTOBER 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2024/2025

The cocoa harvesting season has begun in Côte d’Ivoire, and we are seeing controversial data regarding cocoa bean arrivals at the port. The initial weeks witnessed a certain decrease, but in the past two weeks, arrivals have surpassed last year’s numbers. As of 29th of October 285,000.00 tons were delivered to the ports, which is 26% more than in the last year.

The main challenge with the harvest in October has been the rains, which interfere with the fermentation and drying of the cocoa beans.

Although initially, many forecasted 2024/2025 season harvest in Côte d’Ivoire to be no less than 2 million tons, after the first month, this figure has been adjusted down to 1.85–1.9 million tons. This result would still be better than last year’s, though lower than the five-year average. We may be heading toward the fourth consecutive year of cocoa bean shortages.

Excessive rains impede the development of new fruits and prevent trees from blossoming. Between 65-70% of new blossoms failed in October, compared to 25% in September. This suggests that late February/early March will see very weak arrivals at Côte d’Ivoire ports, and the main harvest season will end sooner than usual.

According to the September forecast the main harvest was expected to be around 1.5 million tons of cocoa beans, but this has now been revised down to 1.3–1.35 million tons.

On the other hand, Côte d’Ivoire has made a statement that an expected yield of 2.1–2.2 million tons is possible, though no official has confirmed this. These announcements led the market to establish new price lows for the month, and the market remains under pressure from speculators driving prices down. By November 1, with the expiration of December options on the New York market, there may be a clearer sense of where prices are headed.

The cocoa market continues to experience a physical shortage of cocoa beans. Certified stock in European and U.S. warehouses decreased throughout October, reaching the lowest levels in at least the past ten years.

In Ghana, the expected harvest is around 590,000.00 tons, which is significantly higher than the 450,000.00 tons produced in the 2023/2024 season, though much lower than 654,000.00 tons in the 2022/2023 season.

Ecuador’s harvest is also expected to decline to 440,000.00 tons, which is below last year’s output.

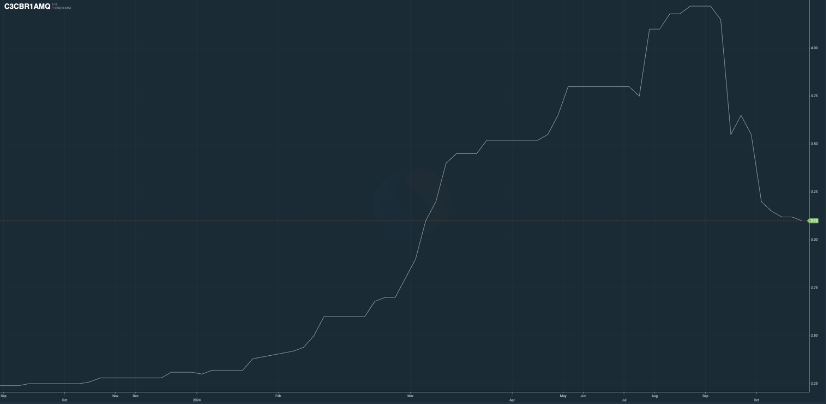

The cocoa butter ratio is currently at 3.1, marking a considerable correction from peak levels of over 4 just two months ago.

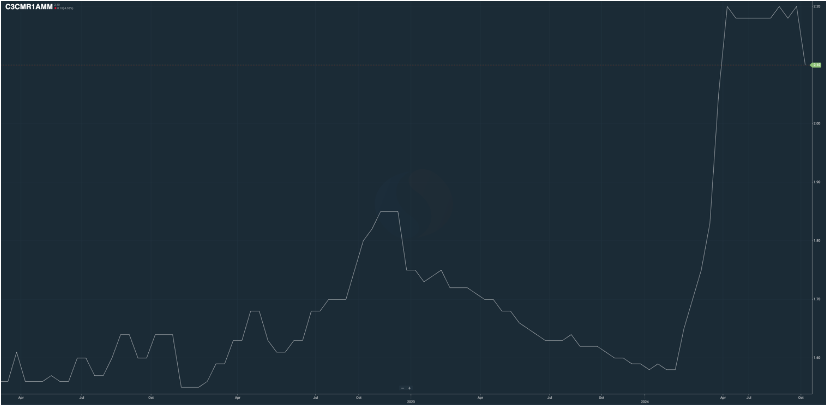

The cocoa liquor ratio is at 2.10 with a slight downward correction.

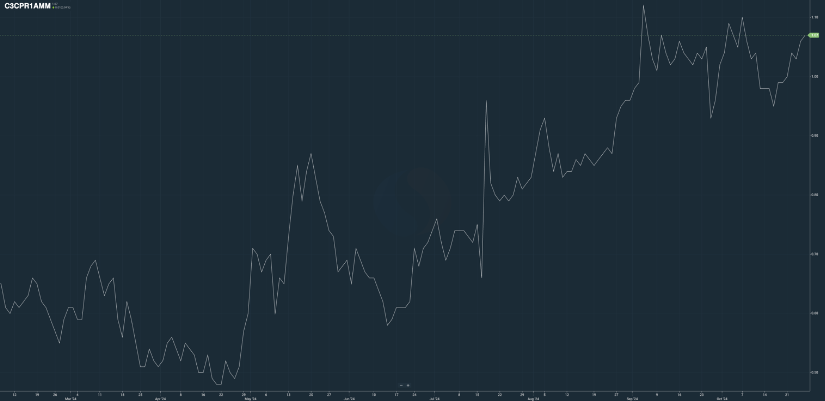

The cocoa powder ratio remains stable at 1.07, almost unchanged from last month’s figures.

The FOB ratio levels for West Africa for October/November 2024 deliveries are as follows:

Cocoa Liquor

Ratio is at 2.10, with a steady downward trend expected to reach 1.95 by Q1–Q2 of 2025. At the current exchange rate, the price for the fourth quarter is expected to be approximately €13,200.00 per ton.

Natural Cocoa Butter

Ratio is at 3.10, with a declining trend over the next four quarters, anticipated to fall to 3.85. Based on current exchange rates, the price for the second quarter is estimated at around €19,500.00 per ton.

Cocoa Powder

The cocoa powder ratio has remained stable from the previous month at 1.07 against the exchange. Currently, the exchange price in euros starts at €6,350.00 per ton.

Natural Cocoa Powder: starting from €6,750.00 per ton

Alkalized Cocoa Powder: starting from €7,000.00 per ton

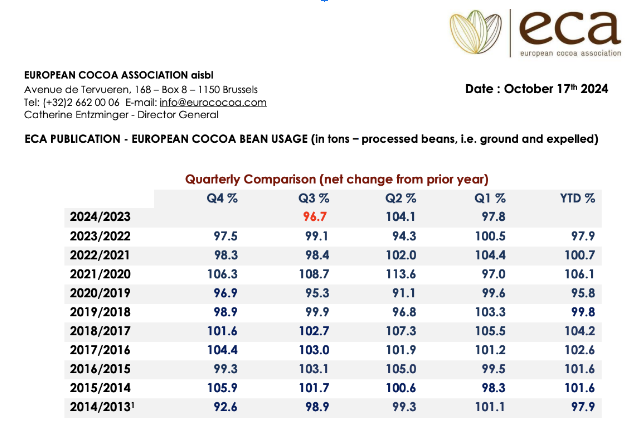

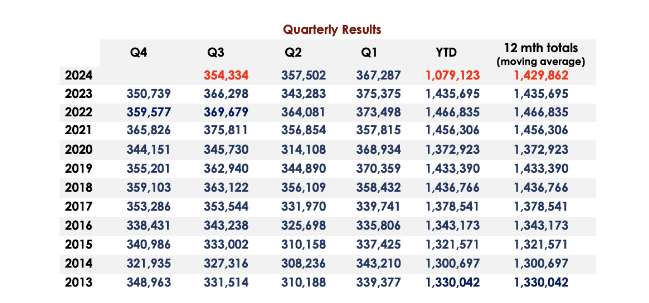

Processing in the EU decreased by 3,3%, however it remains more or less at the level of the previous year.

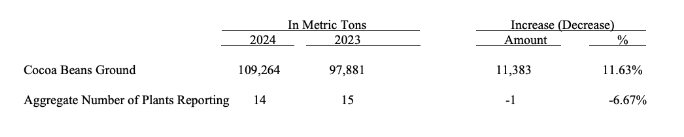

Cocoa processing in the U.S. has increased by over 11%, despite one less processing facility compared to last year.

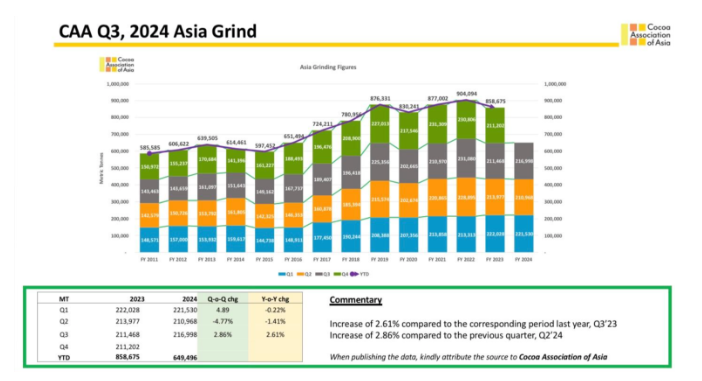

In Asia, there has been a growth of around 3%, with this trend likely to continue as the market develops rapidly.

Other data shows a 13% decrease in processing in Brazil during the third quarter.

In Africa, preliminary data indicates a decline of about 15% due to a poor harvest, though Gepex has not provided exact figures for the third quarter.

Overall, comparing all numbers in terms of tonnage, the lag from last season is expected to be less than 2%, despite a 25% shortage of cocoa beans.

2. Technical Analysis

In October, prices were pressured by selling from producing countries and speculative sales. Our advice to clients remains consistent: buy on any price corrections, as these may be short-lived. Given current market volatility, price swings of over $500- 1,000.00 per day are possible.

The New York market continues to move in corrective waves and will trade within the range of $6,500.00 –$8,000.00 per ton for the March 2025 contract for some time.

We suggest , we have seen the lowest price in end of October for coming months, from where an upward correction begins

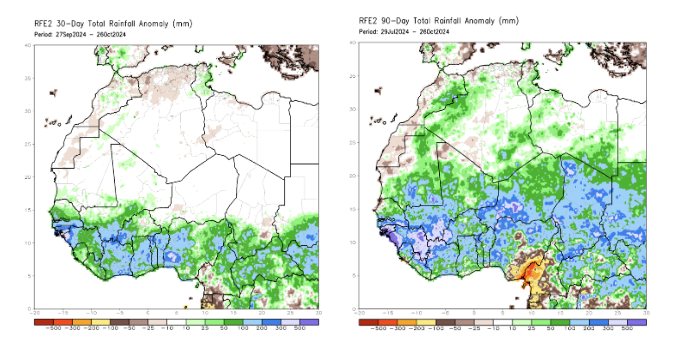

Weather

Rainfall levels in West Africa over the past 30 and 90 days have been significantly above average, leading to delays in the main 2024/2025 harvest. Given the damage to cocoa pods and flowers from the heavy rains, as previously noted, we are not optimistic about a particularly strong harvest.

The upcoming season is expected to be better than the current one, though highly positive forecasts are cautious. Sparse rains in summer and early fall, followed by heavy rains during the peak season, could impact the overall harvest yield.