Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – DECEMBER 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2024/2025

The harvest season in Côte d’Ivoire is ongoing, and we have excellent data on cocoa bean arrivals at the ports. As of December 16, 895,000.00 tons have been delivered to the ports. These figures are ahead of the previous year, marking a good performance. For example, compared to last season, we are 32,8% ahead.

However, when compared to the 2022/2023 season, we have 15% decrease.

The expected harvest for the 2024/2025 season in Côte d’Ivoire is projected to be under 2 million tons. At present, there is already a noticeable lag in shipments against the current obligations of exporters.

The harmattan season (a dry, warm wind from the desert) has begun in Côte d’Ivoire, and the strength of this wind will determine how poor the final harvest will be. However, we will probably witness the fourth consecutive year of deficits in terms of yield.

The International Cocoa Organization has revised the deficit for the past season, increasing it from the preliminary figure of 462,000.00 tons published in May to 478,000.00 tons. This marks the largest recorded deficit in cocoa history.

Nigeria aims to increase its harvest to 500,000.00 tons in 2025, up from 340,000.00 tons in 2022. However, for now, this goal looks promising only on paper, as there is no clear indication of how the increase in yields will be achieved.

Ghana has decreased the crop perspectives from 650 000t in August 2024 to 617 500t this week.

Despite rising prices, statistical data shows that chocolate consumption per capita in Germany grew by 10%, from 9 kg per person to 9.9 kg per person in a year.

In terms of volume, the German industry produced 4.6% more chocolate than in the previous year.

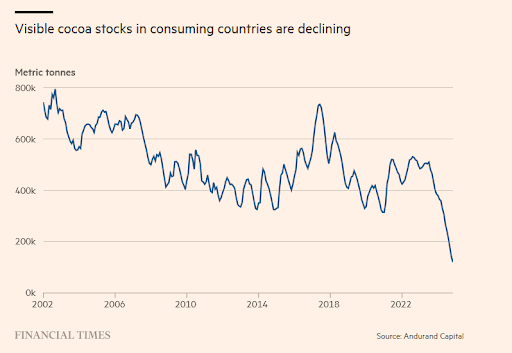

The market continues to experience a physical shortage of cocoa beans.

Certified stock in U.S. warehouses decreased in November, reaching its lowest level in at least the past 10 years. As of December 20, the number of bags stands at 1,400,000,00 equivalent to less than 90,000.00 tons.

On the London Cocoa Exchange, the current stock of cocoa beans is below 10,000.00 tons.

We can say that there is no physical cocoa bean stock remaining. This amount would supply the global cocoa industry for less than two weeks of processing without fresh harvest arrivals from producing countries.

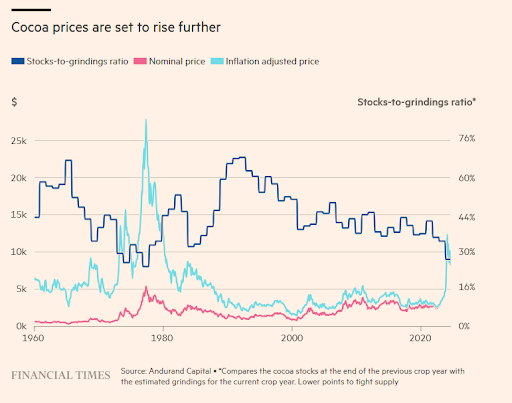

If we compare cocoa prices against the inflation component and analyze the crisis of the late 1970s, which also saw one of the most significant crop failures due to diseases and the cutting down of cocoa trees, then the fair price today could reach $25,000.00 per ton or higher.

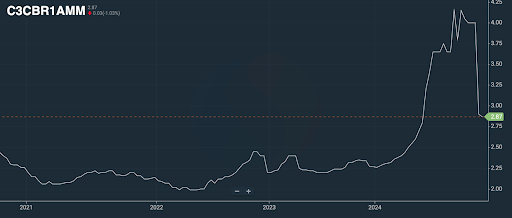

The ratio for cocoa butter is currently at 2.87, showing a significant correction from peak values of over 4 ratio points during the 2024 summer.

The ratio for cocoa liquor is at 1.90, with a slight downward correction trend projected for 2025.

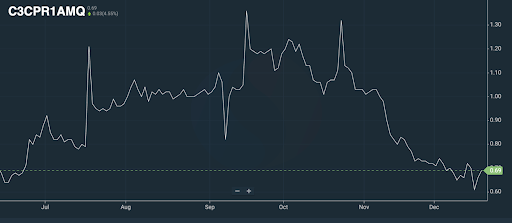

The ratio for cocoa powder is 0.69, lower than the previous month; however, the final product price has increased compared to last month.

The ratios on FOB terms for West Africa for December 2024 deliveries are at the following levels:

Cocoa Liquor:

1.90, with a steady downward trend toward 1.85 between the first and second quarters of 2025. At the current exchange level, the price for the fourth quarter is estimated at around €22,000.00 per ton.

Natural Cocoa Butter:

2.87 for natural cocoa butter, with a decreasing trend for the next four quarters down to 2.85. Based on current exchange levels, the price for the first/second quarter of 2025 will be approximately €33,300.00 per ton.

Cocoa Powder:

The ratio for cocoa powder has remained practically unchanged from the previous month. The ratio is at 0.69 relative to the exchange. As of today, the exchange price in euros is €12,000.00 per ton.

Natural cocoa powder: starting from €8,200.00 per ton

Alkalized cocoa powder: starting from €8,500.00 per ton

2. Technical Analysis

In December, hedge funds continued purchasing cocoa bean futures, with the investment bank Goldman Sachs also encouraging everyone to go long (expecting increases). Our advice to clients remains the same: buy any price corrections. Such corrections may be short-lived given the current market volatility, where we may see price movements exceeding $1,000.00 per day.

The New York market has shifted its direction, and we have resumed explosive growth without any fundamental reasons or corrections. It is likely that the market will trade in the range of $10,000.00 per ton and higher through March 2025.

It is highly probable that we reached the bottom of the correction in the short term by late October. Currently, we are in a new growth phase, completing the upward movement of Wave 1. This is expected to be followed by a correction of 10–15% from peak prices before further price increases form Wave 3—the longest and fastest wave—potentially driving prices to $15,000.00 per ton or higher.

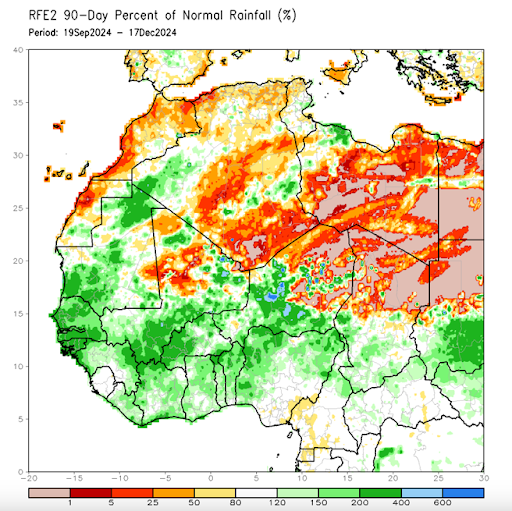

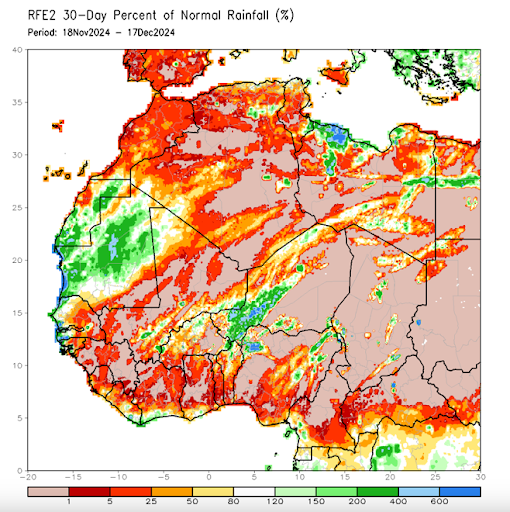

Weather

The amount of rainfall in West Africa over the past 90 days has been slightly above average. However, in the past month, we have observed drier weather in areas north of the coast, which are regions where cocoa trees grow. Considering the 90-day trend, the soil still has sufficient moisture to nourish the trees, and so far, this has only facilitated the harvesting, as reflected in the data on cocoa bean arrivals at ports. Nevertheless, we have no illusions about a good harvest, as mentioned earlier.