Cocoa Market Report

COCOA MARKET TRENDS – JANUARY 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2024/2025

The cocoa harvest season in Côte d’Ivoire is ongoing, and we have decent figures for cocoa bean deliveries to the ports. As of 19th of January, 1,191,000.00 tons have been delivered, putting us ahead of last year’s harvest figures. The data is promising, with an increase of 24% compared to the previous season. However, there is a clear trend of decreasing deliveries to the ports over the past six weeks, fewer beans have been delivered compared to the same period last year. Over the next 10 weeks, until the end of the main harvest, approximately 100,000.00 tons less will be delivered to the ports compared to the same period last year.

The main harvest will outperform last year’s, but it will still not be strong enough. It is highly likely that we will see the fourth consecutive deficit year.

Ghana reported that 370,000.00 tons of cocoa beans, which were sold to clients but not delivered last year, will be included into the current season deliveries. Additionally, this year Ghana planned to sell 570,000.00 tons of the new harvest.

The expected harvest is projected at 617,500.00 tons. Altogether, this leaves us with a carryover deficit of at least 300,000.00 tons, and likely the actual number will be much more.

The market continues to experience a physical shortage of cocoa beans.

Certified stock levels in U.S. warehouses decreased in November, reaching their lowest point in at least the last 10 years. As of 24th of January, there are 1,263,000.00 bags, equivalent to about 80,000.00 tons, which is enough for approximately six days of global consumption. This is lowest number for 21 years.

The leading shares of the cocoa market – Barry Callebaut – have dropped about 10% in recent days due to a 2.7% decline in sales. However, this drop is relatively insignificant compared to the rise in cocoa bean prices. Similarly, Hershey’s shares have decreased by 12% over the past month and 25% over the past six months.

Hershey caused panic buying in the futures market in mid-January when it announced its intention to purchase and hedge 90,000.00 tons, which the American Exchange does not have the coverage for.

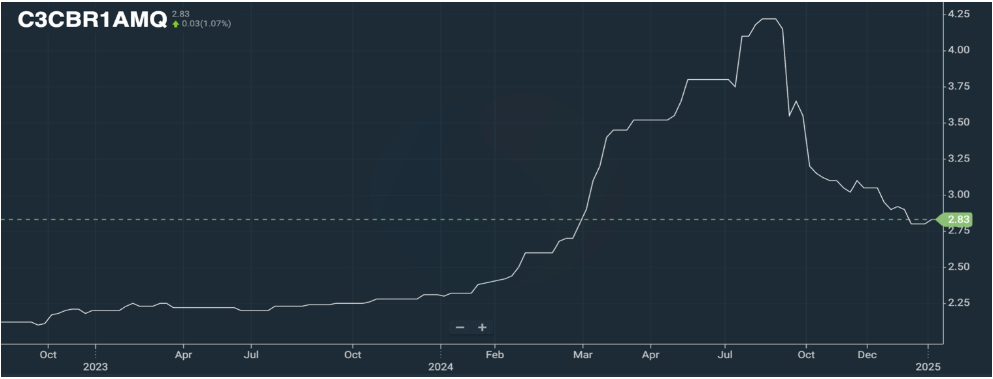

The cocoa butter ratio is currently at 2.83, marking a significant correction from the peak values of over 4 ratio points during the summer of 2024. The actual price is stable, with a possible slight decline expected in the next two quarters.

The ratio for cocoa liquor is at 1.90, with a slight downward correction trend projected for 2025.

The ratio for cocoa powder is 0.82, higher than the previous month, and the final product price has increased compared to last month.

As of today, the market price in euros stands at €11,000.00 per ton.

The ratios for FOB West Africa deliveries in December 2024 are as follows:

Cocoa Liquor

1.90 with a stable downward trend toward 1.85 from the 1-st to the 2-nd quarter of 2025. At the current market level, the price in the first quarter will be approximately €20,900.00 per ton.

Natural Cocoa Butter

2.83 for natural cocoa butter, with a declining trend over the next four quarters down to 2.7. At current market levels, the price in the first/second quarter will be approximately €31,130.00 per ton.

Cocoa Powder

The cocoa powder ratio has remained nearly same from last month, holding at 0.82 to the Exchange price.

Natural Cocoa Powder: starting from €9,000.00 per ton.

Alkalized Cocoa Powder: starting from €9,500.00 per ton.

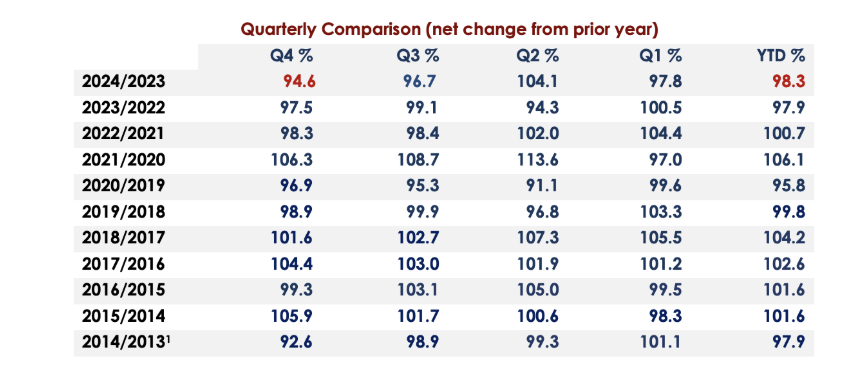

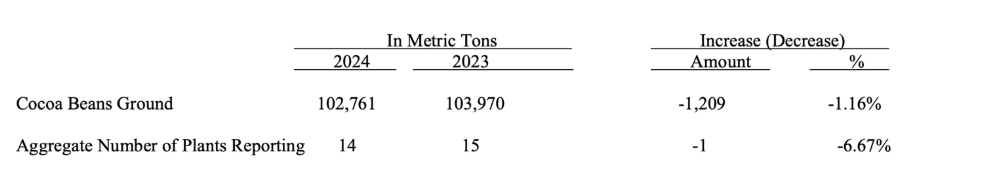

Cocoa Bean Processing in the 4th Quarter of 2024

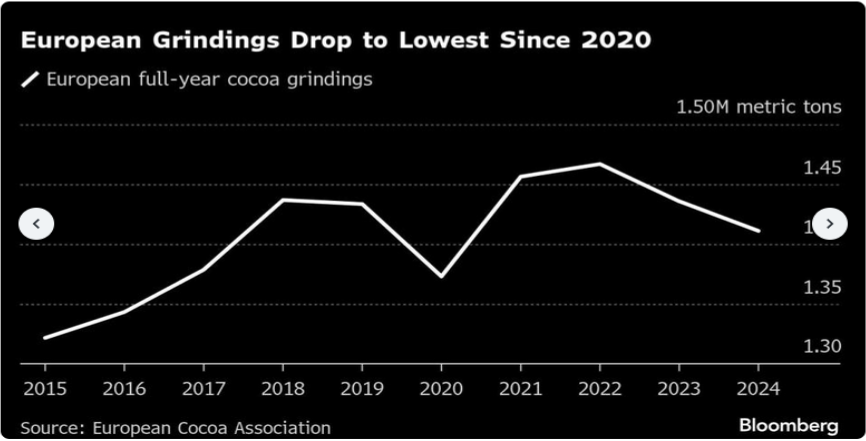

- The EU reported its weakest quarter in the past four years.

- The U.S. recorded an increase of 16,000.00 tons compared to the previous year.

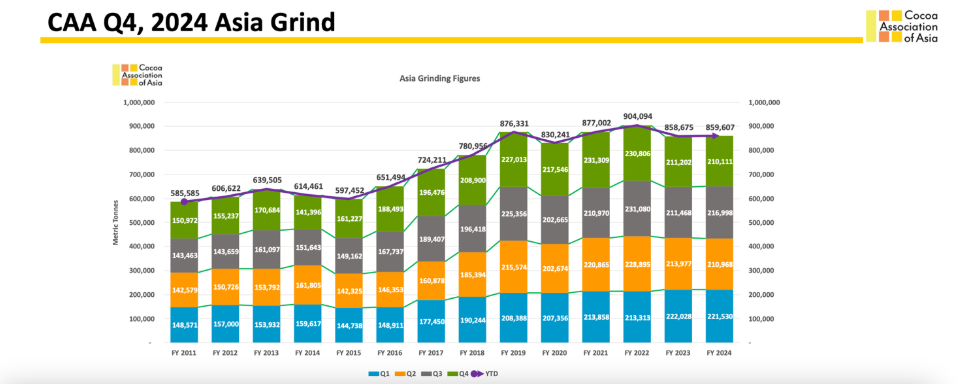

- Asia demonstrated slight increase on the year-to-year basis

- Brazil closed the year demonstrating a processing decrease of 5% in the 4th quarter

- Eastern European markets together with Russia showed a decline of chocolate consumption of about 9%

If we look at the overall global consumption and processing data, we see that there has indeed been a decrease in consumption, but it is so insignificant compared to the deficit. Most likely, the total reduction in consumption does not exceed 50,000.00 tons, while the deficit exceeds 500,000.00 tons.

ICCO says that global grinders stock has decreased 36% y/y. Showing a number of 260 000 MT decrease. This is significant difference from the grinding numbers. As if we take grinding figures and crop figures, we should see stock decrease of 450 000 MT.

Something should be wrong, either grinds are lower or stock numbers are incorrect.

2. Technical Analysis

The New York market has shifted its trajectory, and the explosive growth continued without any fundamental reasons or corrections. It is likely to trade within the range of $12,000.00 per ton and above for March 2025 contracts for some time.

There is a big probability that we reached the bottom of the correction at the end of October in the short term. Currently, we are in a new growth phase, completing the corrective movement of wave 2. Following this, price growth will form wave 3, which is the longest and fastest, reaching levels of $15,000.00–$18,000.00 per ton.

Our advice to clients remains the same: buy any price correction. As it may not last long, given the current market volatility, we could see movements exceeding $1,000.00 per day.

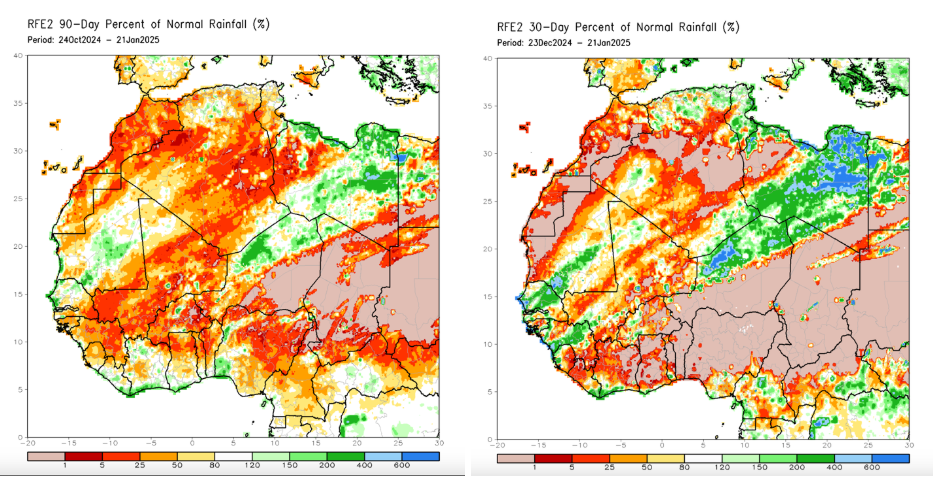

Weather

Rainfall in West Africa over the past 30 and 90 days has been below average. In the northern areas away from the coast, where cocoa trees grow, the weather has been drier over the past month. However, we have no illusions about a good harvest, as mentioned earlier.

Currently, rain is only falling along the coast, where cocoa beans do not grow.

The bean count per 100 grams will start exceeding 100 pieces as early as in February, which typically happens in April.