Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – JUNE 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2023/2024

Port arrivals in Côte d’Ivoire, as of end of June are 29% less than the previous year. A total of 1,570, 000.00 tons have been delivered to the ports.

Cocoa has shown its first quarterly price decline in two calendar years, which is probably the most important news of the past month.

The market continues to experience a physical shortage of cocoa beans. Certified stock in London warehouses decreased by 5.6% over the month.

The average harvest has not improved the yield situation for the 2023/2024 season. Around 15,000.00 tons are delivered to ports every week. A year earlier, this figure varied between 25,000.00 and 30,000.00 tons weekly.

Ghana signed an agreement to restructure its $13 billion debt in bonds, which will allow them to further attract funds from international institutions. This will enable Ghana to return to the list of reliable countries and is likely to attract additional financing for land reclamation on the territories where cocoa trees grow. At this point it is worth noting that Ghana needs about $2 billion for this purpose.

On the futures market, a long-awaited price correction is ongoing. However, it’s interesting to note that as prices on the futures market fall, the ratio for cocoa products has begun to rise. Consequently, the prices for cocoa products have not decreased as much as the final consumer might have hoped. For example, the prices of cocoa powder are reaching new maximum levels.

Consumption and production of cocoa products proceed under a certain degree of pressure. Although we do not yet see the final figures, rumors in the chocolate market indicate a decline in both production and consumption. It is difficult to predict at this time how severe this decline may be.

Forecasts suggest a drop in consumption ranging from 10% to 30%. However, it is possible that we will see these figures with a significant delay, and it is not excluded that the numbers in the second quarter that will be released in mid-July, could be much worse than expected.

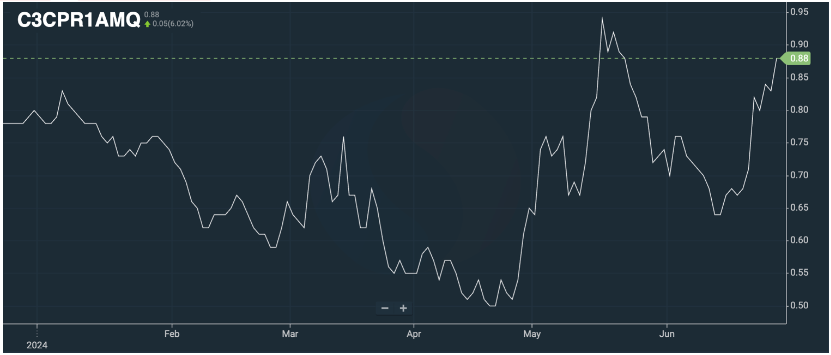

Cocoa butter ratio

Cocoa mass ratio

Cocoa powder ratio

FOB West Africa ratios have stabilized at the following levels for June-July 2024 deliveries.

Cocoa mass

2.18 and demonstrating a stable trend towards 2.35 from the 3rd to the 4th quarter of 2024. At the current level on the exchange, the price will be about 16,500.00 euros/t in the 2nd quarter.

Natural cocoa butter

3.65 for natural cocoa butter and an uptrend for the next 4 quarters that may bring it to 3.95. The price at the current levels of the exchange will be about 27,400.00 euros/t in the 2nd quarter.

Cocoa powder

The ratio for cocoa powder has not changed since the last month. The ratio is at the level of 0.8 – 0,9 compared to the stock price. As of today, the exchange price in euros comprises 7,500.00 euros/t.

Natural cocoa powder price starts from 6750 euros/t

Alkalized cocoa powder is at 7000 euros/t

2. Technical analysis

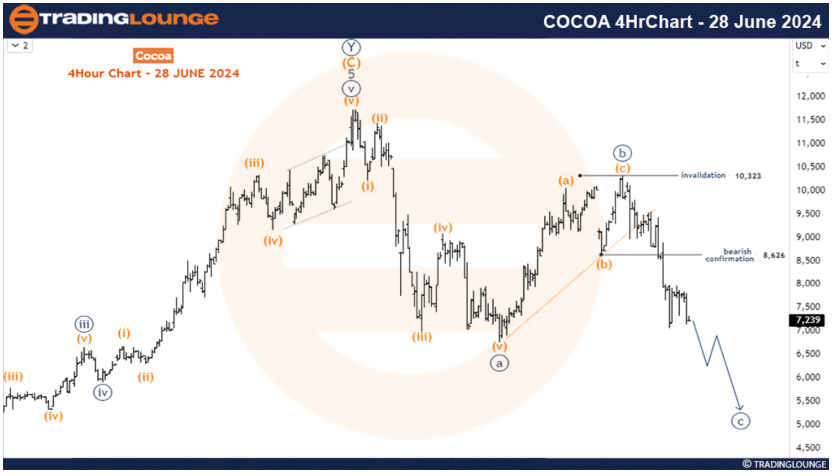

In June, the long-awaited price correction occurred, and our advice to clients remains the same: buy at any price correction.

Given the current market volatility, this situation might not last long, and we could see movements exceeding $1,000.00 per day. As noted in the chart below, we should see the value of wave C in the correction model. The price needs to be at least $1 lower than in wave A.

From the current levels, a slight increase is possible. However, the cocoa processing statistics for the second quarter will be released in July, which will likely exert further pressure on prices.

WEATHER

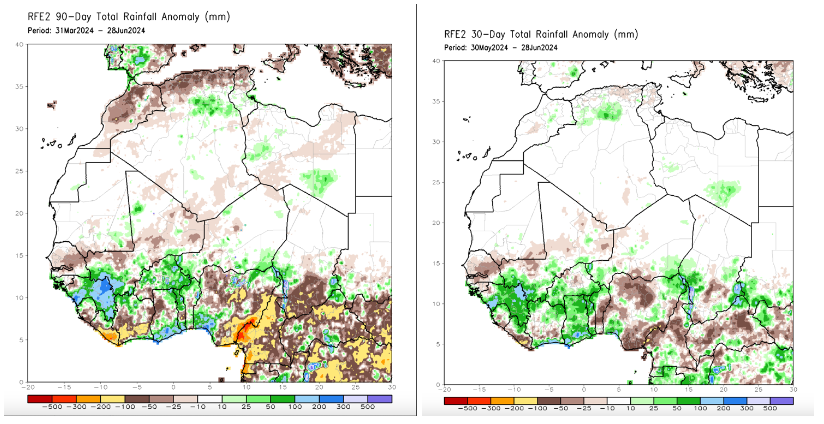

Rainfall in West Africa over the past 90 days has been significantly below average, therefore we may witness a weaker start to the main 2024/2025 harvest.

However, in the last 30 days, conditions have become much more favorable, as also indicated by the fruit count on the trees. The most favorable situation is in Ghana.

We can definitely expect a better season than the current one, but it is better to avoid too optimistic forecasts since the scarce rainfalls in April and May can still impact the overall harvest results.