Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET April 2023

1. Season 2022/2023

The main harvest of cocoa beans in West Africa finished, the prices for the middle harvest in Cote d’Ivoire increased from 825 CFA in the previous year to 900 CFA in the current year: the increase comprised more than 8%.

The main part of the harvest remains in the country for processing by local facilities.

The number of producers in Côte d’Ivoire is increasing every year and we expect an increase in domestic processing by at least 400,000.00 tons by the end of the 2023-2024 season.

This already affects the amount of cocoa beans available for export, thus fulfilling the LID rule ($400 surcharge on the price) because local producers pay it by default. Meanwhile the new season will bring only a new increase in differentials, the level of which is already observed at the level of the exchange + LID (400 dollars or 320 pounds) on FOB Africa terms.

According to the Minister of Agriculture of Côte d’Ivoire, the middle harvest is expected to decrease by 25% compared to the previous two years. This is likely to cause another prices increase, however, a short-term correction on the market due to overbid prices and oversaturation of the market with speculators cannot be excluded.

According to the results of the main season 2022-2023, port arrivals to Côte d’Ivoire, as of March 26, are 5.2% less on a year-to-year basis. 1,750,000.00 tons were delivered to the ports.

However, if we compare the last 4 years, the numbers are not so critical.

If at the beginning of December compared to the previous year, we were ahead of the schedule by 10%, then during the last 3 months the export of beans has decreased extremely, and continues to decrease.

At the beginning of the year, a surplus of cocoa beans was forecasted in Côte d’Ivoire, however, currently, a shortage of cocoa beans is already expected in the amount of 175,000 tons – 200,000 tons.

Over the past 4 weeks, the underrun from previous periods is 30,000 tons per week; should this trend persist, then the predicted deficit figures may be even higher.

At the moment, according to rumors, about a million tons have already been sold in Côte d’Ivoire for the 2023-2024 season, which means, among other things, that the pressure on the exchange, which ensures that Côte d’Ivoire’s arranges hedging of its future supplies, may soon disappear; this may lead to a rapid increase in quotations on the stock exchange. The question is whether we will see a correction of at least 10% in the interval or will the market continue to grow steadily?

Cocoa prices were under slight pressure in late February/early March due to the US banking crisis, but an uptrend returned towards the end of the month.

Ratio for processed cocoa in Africa on FOB West Africa terms got stable for Cocoa Mass at the level of 1.75 demonstrating a stable trend, showing no signs of increase or decrease for the next 4 quarters. At the current level on the exchange, the price will be about 4,250.00 euros/t.

The number of new processing facilities in West Africa will put pressure on cocoa mass prices in the future, however, currently we are still experiencing a shortage of supply.

Natural cocoa butter

2.37 for natural cocoa butter and an uptrend for the next 4 quarters. The price at the current levels of the exchange will be about 5,800.00 euros/t.

Cocoa powder

Natural cocoa powder – 3,050.00 euros/t .

Alkalized cocoa powder is at the level of 3,300.00 euros/t and demonstrates a stable trend without particular signs of increase or decrease.

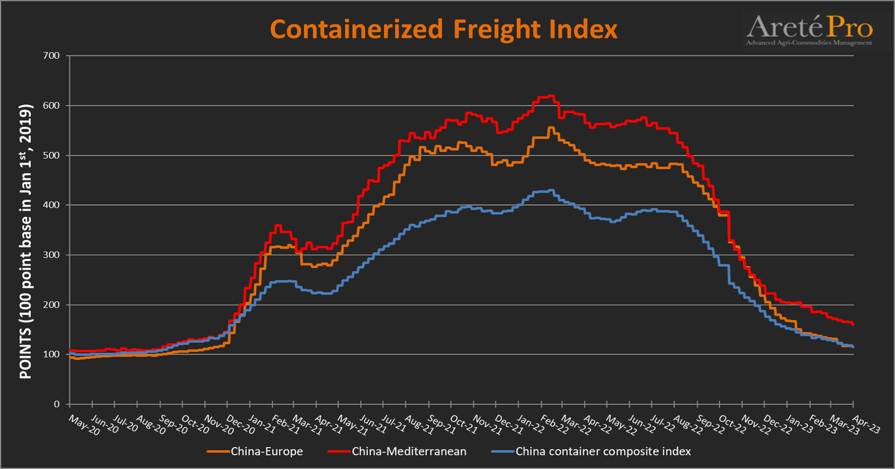

The global shipping market has returned to 2019-2020 levels, which is encouraging for international trade.

2. Technical analysis

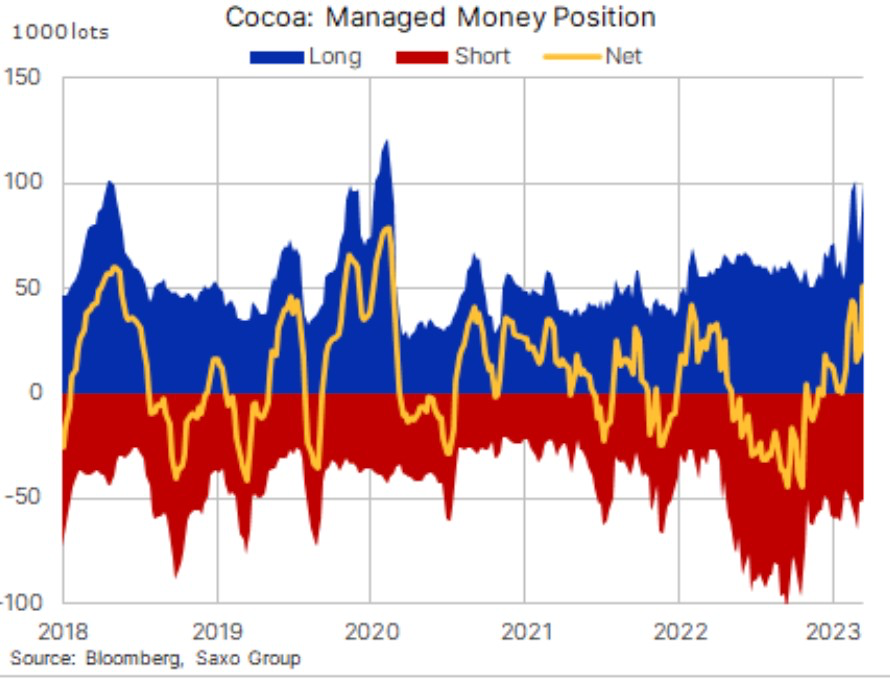

The number of long positions, betting on the market growth is the highest in 3 years, but it is still far from the record levels we witnessed at the end of 2019; however, the prices at that moment were lower than the current ones, and it is reasonable to assume that the potential for prices growth has not yet reached its peak and after price stabilization in the range of 2,000.00 -2,200.00 pounds we may as well observe prices at the level of 2,300.00 – 2, 500.00 pounds per ton of cocoa beans by the end of the year.

We have observed the last correction in early March, however, there were not a single strong correction for more than half a year.

In late March we observed unprecedented prices reaching almost 2,200.00 pounds per ton on the London Exchange due to weakness of GBP.

The first price underpinning levels which we can reach during the next correction.

The London Exchange CK3(May Contract) 2,060.00 and later 1,990.00

The New York Exchange CСK3 (May Contract) 2,670.00 and later 2,600.00

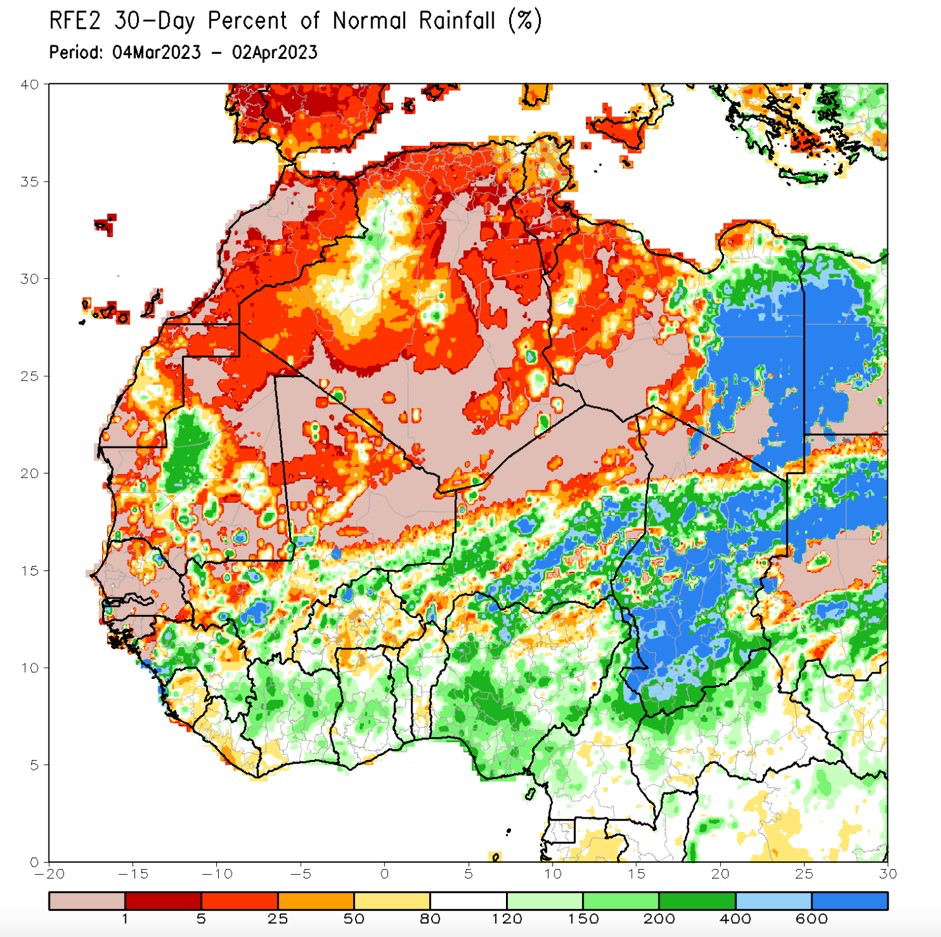

WEATHER

Weather conditions in West Africa have improved over the past 30 days, below is the chart with abnormal rainfalls. Precipitation scope shows that March rainfalls were slightly above average in most cocoa growing regions in Ghana and Cote d’Ivoire.

These data will have a favorable effect on the formation of the main harvest in 2023-2024 yy.