Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET April 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2023/2024

Arrivals at ports in Côte d’Ivoire, as of April 28, 2024, are 28% less than the previous year. A total of 1,337,000.00 tons have been delivered to the ports.

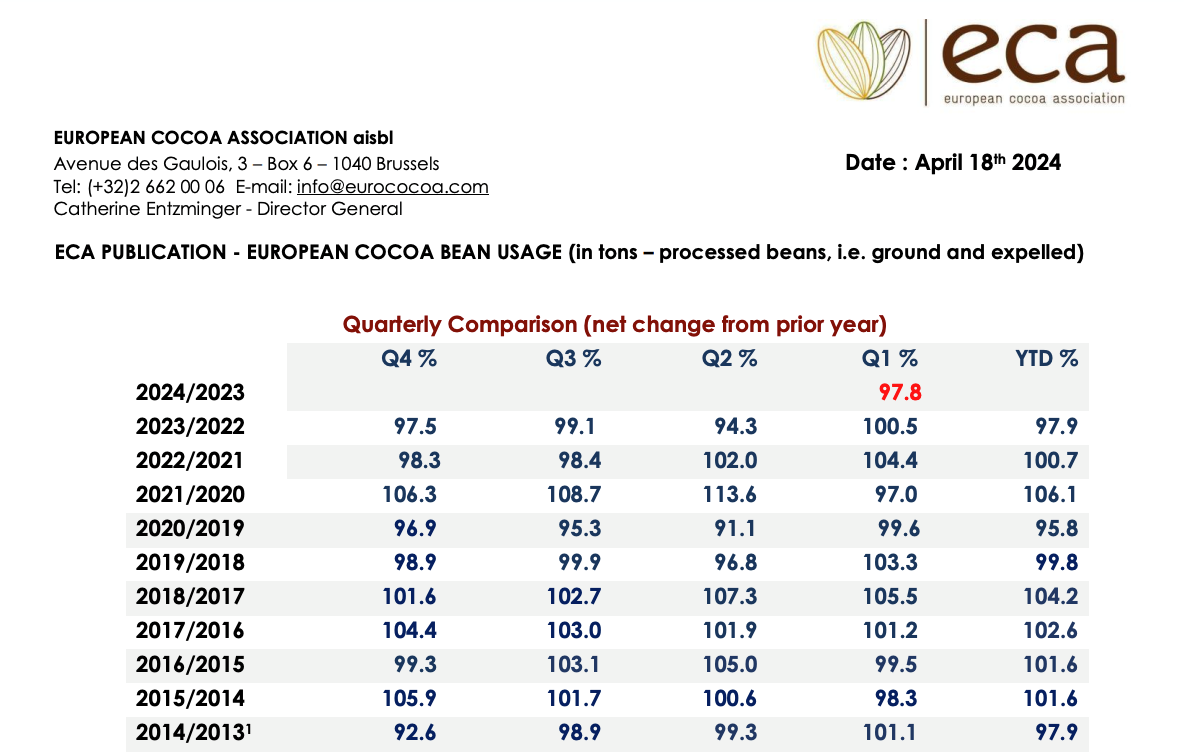

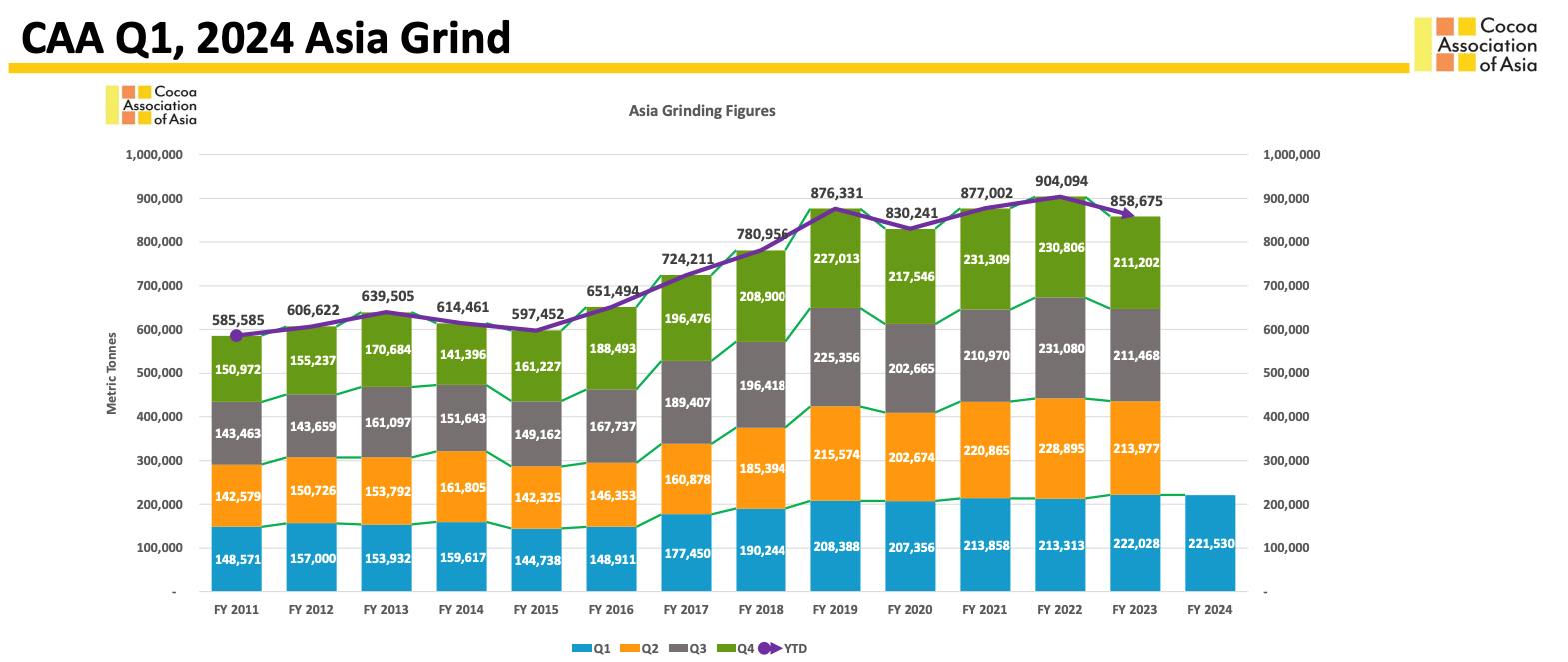

Cocoa beans processing in the first quarter of 2024 remained at a high level despite forecasts.

For EU grinds are down 2.2%

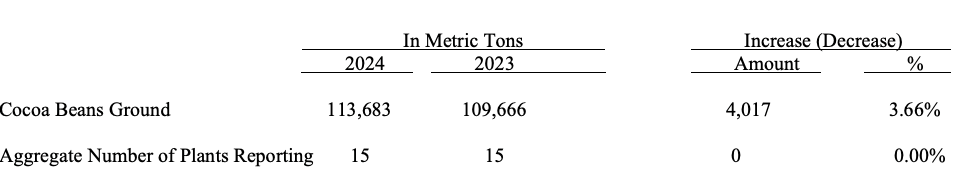

USA plus 3.66 %

For Asia it makes 0.22% less

In terms of tons, we have shown a total decrease of approximately 4,000.00 tons in the main processing markets which is a minor issue compared to the news on the crop failure. If we divide the forecasted global crop failure of 800,000 tons into 4 quarters in equal shares, we would get a consumption decrease of 4,000.00 tons against a 200,000.00 tons crop failure in the first quarter.

Most likely, we will only see the actual consumption levels in the fourth quarter of 2024 or the first quarter of 2025.

FOB West Africa ratios have stabilized at the following levels for May 2024 deliveries.

Cocoa mass

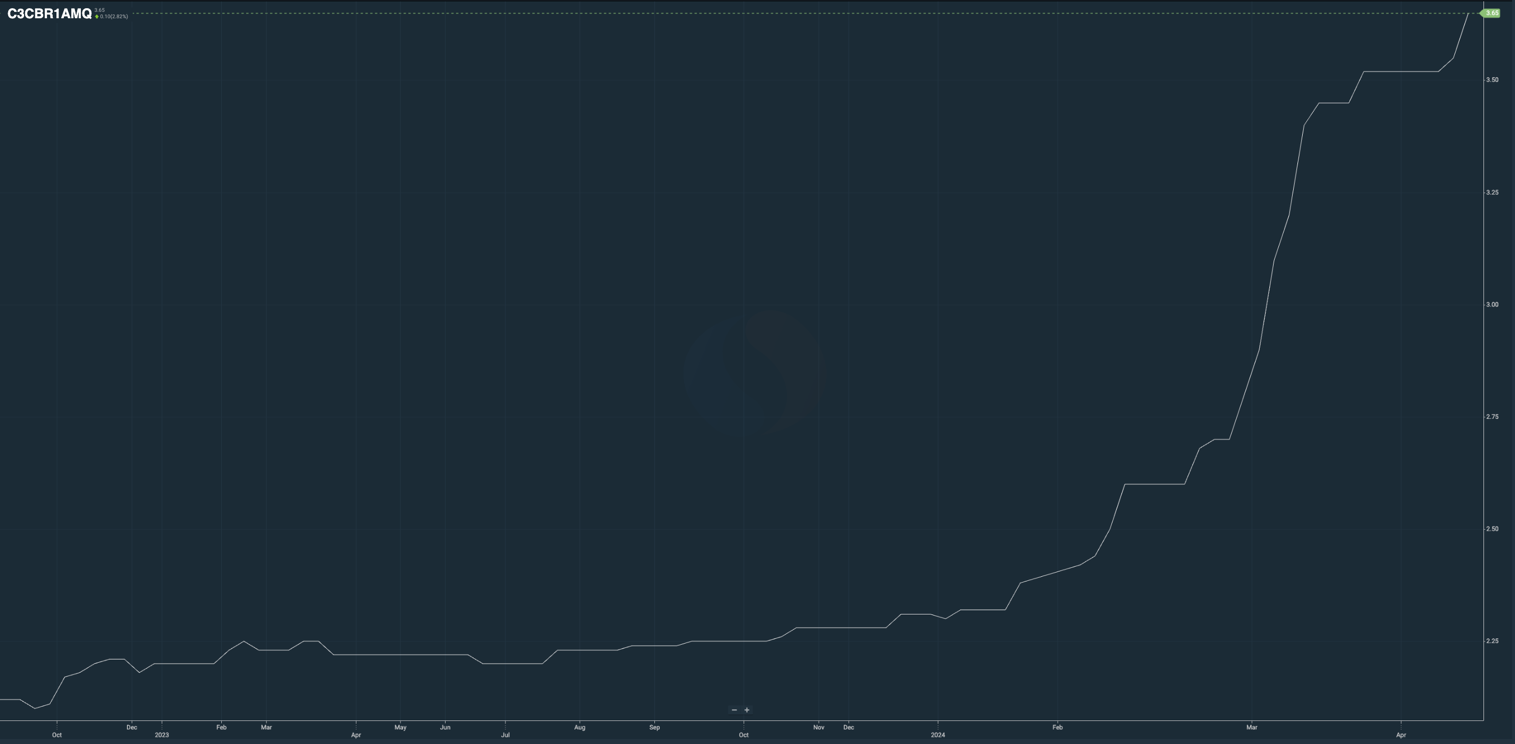

2.10 and demonstrating a stable trend towards 2.20 from the 3rd to the 4th quarter of 2024. At the current level on the exchange, the price will be about 21,800.00 euros/t in the 1st quarter.

Natural cocoa butter

3.40 for natural cocoa butter and an uptrend for the next 4 quarters that may bring it to 3.60. The price at the current levels of the exchange will be about 35,200.00 euros/t in the 1st quarter.

Cocoa powder

The ratio for cocoa powder has not changed since the last month. The ratio is at the level of 0.56 compared to the stock price. As of today, the exchange price in euros comprises 10,500.00 euros/t.

Natural cocoa powder is at 5,800.00 euros/t.

Alkalized cocoa powder is at 6,700.00 euros/t.

Please find below the graph of Ratio for cocoa butter.

2. Technical analysis

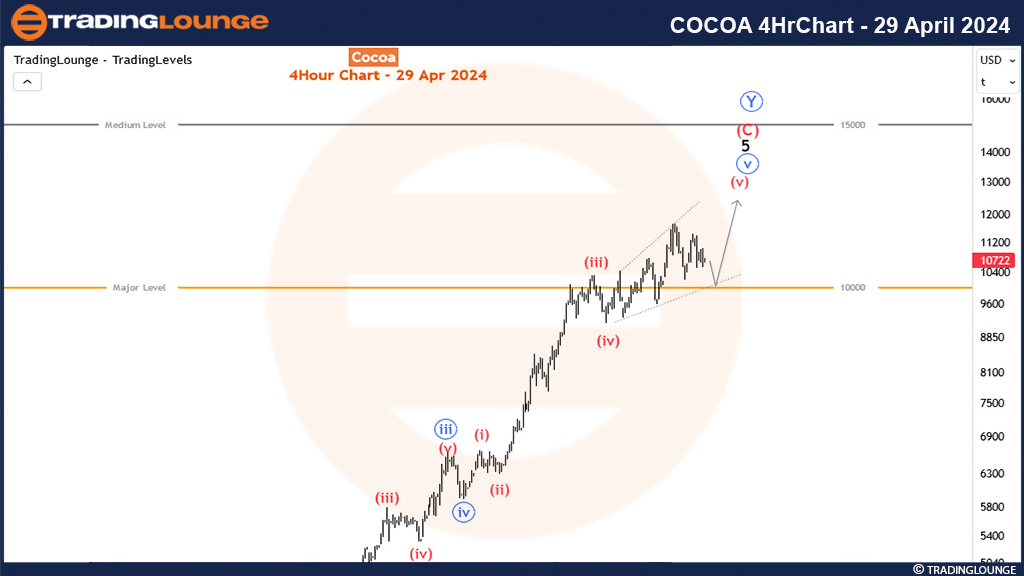

In the last days of April, there has been a decline in exchange prices, breaking the upward trend observed since the beginning of spring 2024.

On April 29th and 30th, we witnessed the largest prices decrease in cocoa industry history (as shown in the graph), with prices dropping by more than $3000 or 30%.

If we make a forecast based on market reaction, it seems we have entered into a certain correction phase. On the hourly chart, we see a realistic correction picture on the New York market to levels around $7000 for July, or to $6000 on the London market for July.

However, on the other hand, many specialists still forecast further price growth to the level of $15,000 this year, which cannot be completely denied. Physical deficit remains.

WEATHER

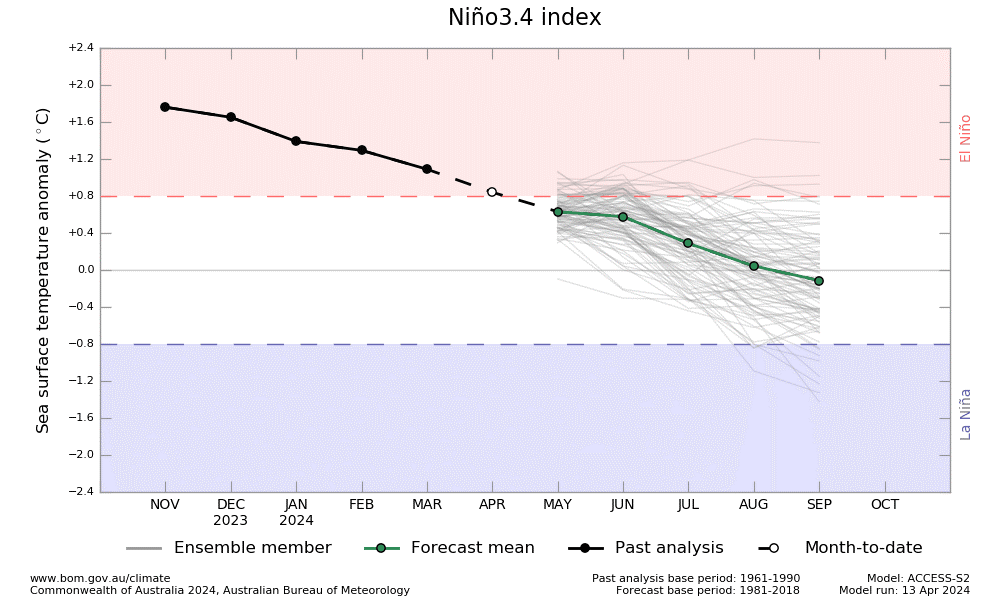

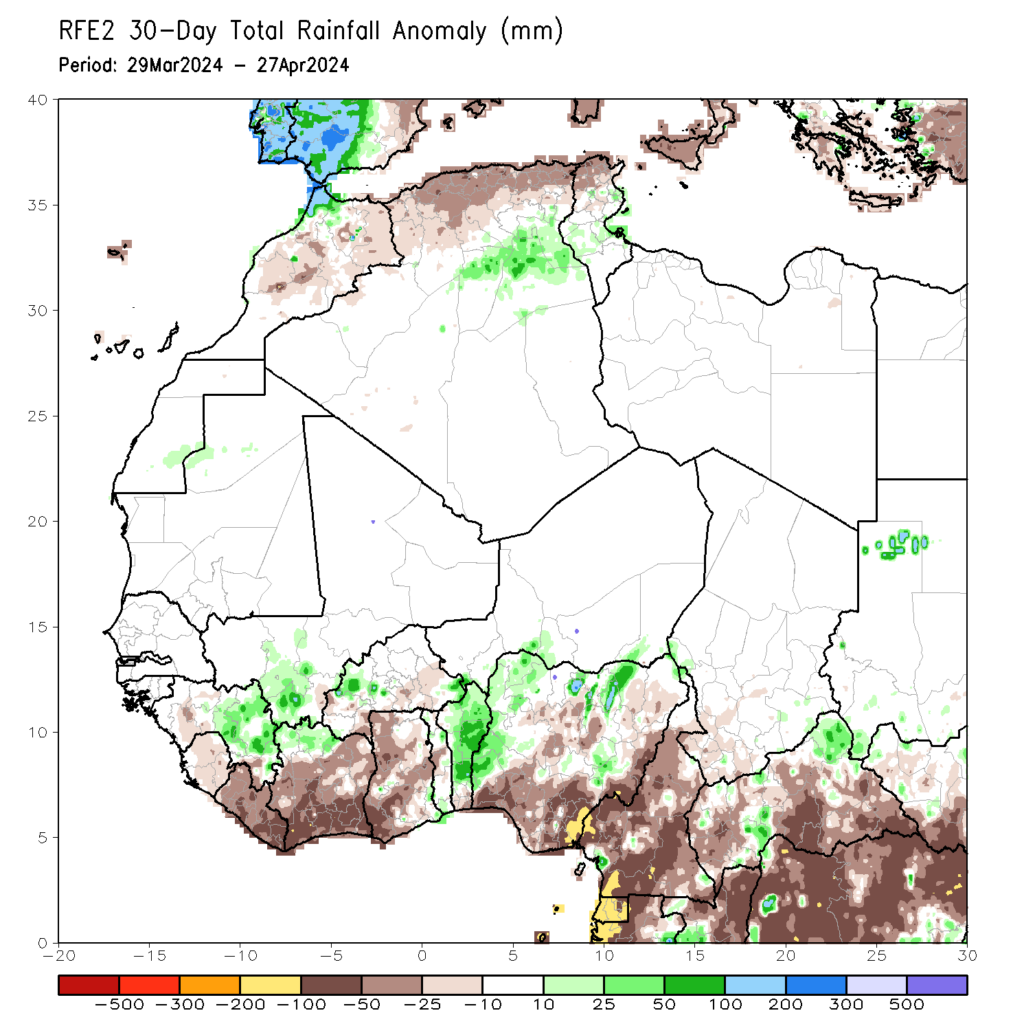

The amount of rainfall in West Africa is still significantly below normal; despite forecasts of El Niño weakening, the forecasts do not go in line with the real situation; so we will likely see a slower start to the main harvest of 2024/2025. The brown and yellow spots on the map coincide with the equator line in the cocoa-growing zones.

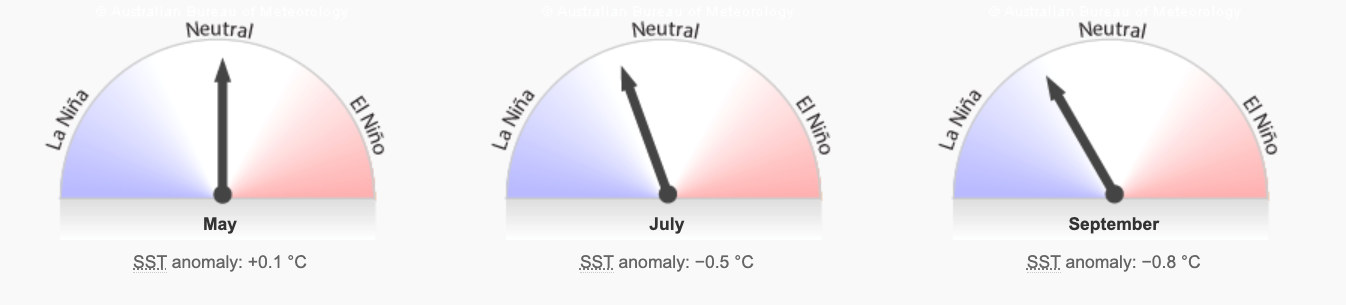

We see a forecast of the weakening of the El Niño effect in the graphs below, which will improve the weather conditions for cocoa and other agricultural crops in 2025.