Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET August 2023

1. Season 2022/2023

According to the results of June 2023, port arrivals in Côte d’Ivoire as of June 26 comprise -4.2% on a year-to-year basis. 2,300,000.00 tons were delivered to the ports and the situation has been stable for a long time. We do not expect changes. The year will demonstrate a short supply and we have the same expectations for the next main harvest.

Excessive rains have caused the spread of viral diseases in cocoa trees in West Africa, which may well have a negative impact on the next main harvest. However, this is already noticeable looking at the prices on trading floors, the New York and London Stock Exchanges show consistently high numbers despite weak data about cocoa grinding for the 2nd quarter of 2023.

In Ghana, port arrivals are higher than in the previous year, but exact numbers are not available for May and June. Ghana is experiencing big problems financing its agriculture: after the country defaulted on external debts, some European banks suspended signing loan agreements for the 2023/2024 season. This jeopardizes the entire harvest, which, if a loan agreement with the EU is not signed, will have a chance to be transported illegally across borders to neighboring countries.

In Nigeria, exports of cocoa beans fell by 20.6% YoY. Local exporters predict that the 23/24 harvest will be even worse than the current one.

FOB West Africa Ratios have stabilized at the following levels for supplies in July:

Cocoa mass

1.70 and demonstrating a stable trend, showing no signs of increase or decrease for the next 4 quarters. At the current level on the exchange, the price will be about 5,300.00 euros/t.

Natural cocoa butter

2.23 for natural cocoa butter and an uptrend for the next 4 quarters. The price at the current levels of the exchange will be about 6,950.00 euros/t.

Cocoa powder

The ratio for cocoa powder has been stable since the last month. The ratio is at the level of 0.98 compared to the stock price. Today, the exchange price in euros comprises 3,130.00 euros/t.

Natural cocoa powder is at 3,050.00 euros/t.

Alkalized cocoa powder is at 3,300.00 euros/t with a stable trend without strong signs of increase or decrease.

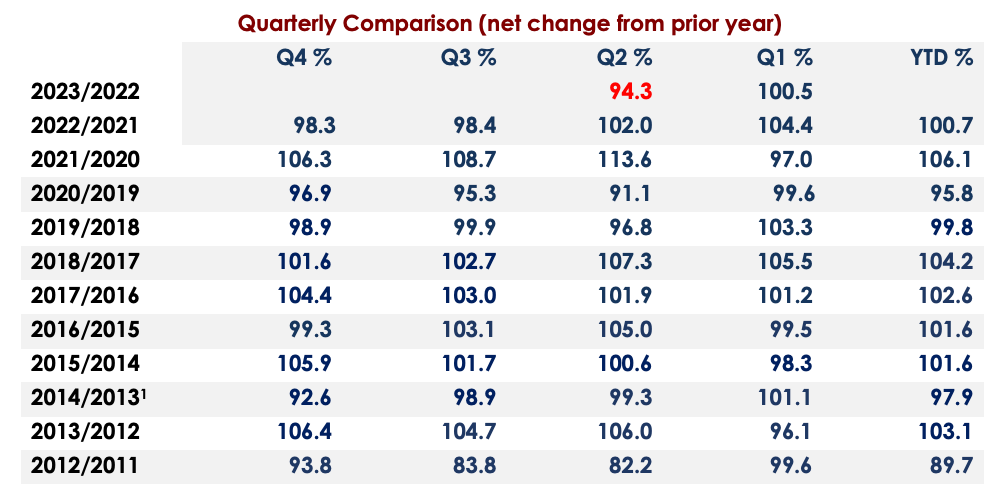

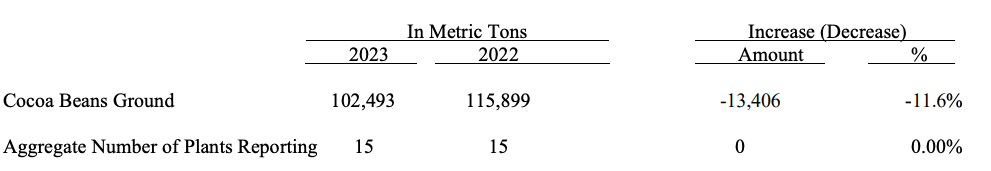

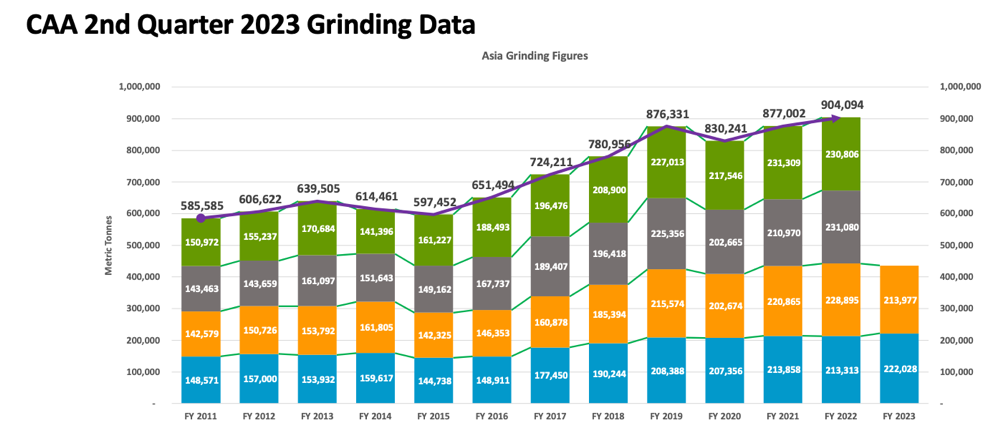

Cocoa grinding data globally

In EU a decrease of 5,7% or 19, 000.00 tons less than in the previous year

In the USA a decrease of 11,5% or 13, 400.00 tons less than in the previous year

In Asia a decrease of 6,5 % or 15, 000.00 tons less

Africa processed 19,000.00 tons more in the second quarter of 2023, Brazil 23% or about 15,000.00 tons more than in the previous year.

Generally speaking, we see an overall decrease of approximately 13-14 thousand tons in the second quarter globally, which is about 1.5% YoY decrease in the second quarter.

In the first quarter, we observes an increase of 33,000 tons YoY, which is just a bit over 3%.

Given these data for the first six months the global increase comprises about 1.5%, which is an average number for the last 10 years. However, data from the US, for example, showed the lowest grinding volume since 2009, when there was a recession due to the economic crisis.

Analyzing a single quarter data it is difficult to conclude whether the high price for cocoa beans, higher interest rates, or global inflation has affected demand.

At the moment, cocoa bean prices continue to increase; therefore, we can conclude that the funds are more serious about the news of a poor harvest than a decreasing scope of cocoa grinding.

2. Technical analysis

Fundamental and technical analysis clearly state that the market is sufficiently outbid; at the beginning of July we observed a correction with record high prices, which lasted for a short time, and as we mentioned in the previous report we found the resistance line at the level of 2,400 pounds, now due to strong fundamental news we observe a further increase.

On the London Stock Exchange, we see unprecedented prices reaching up to 2,860.00 pounds per ton in the first trading month. Given the strong exchange rate position of the British pound, prices in dollars exceeded $3,500 per ton on the New York Stock Exchange.

Data from the American Exchange with regard to long and short positions shows that the number of long positions for price growth exceeds the number of short positions and is at record levels, which may indicate to an upcoming correction in August – September.

The market is trading in a trendline, where above we still see a resistance line at the level of 2,900.00-3,000.00 on the London Stock Exchange; depending on the time when we approach these levels, this line is calculated based on the two previous peaks in 2010 and 2016 yy., and we will definitely try to break the line in the next months, and 3,700.00, respectively, on the New York Stock Exchange.

At the bottom, we will find a support line with a correction at the level of 2,600.00 pounds per ton in August; if we break this line, then most likely we will test the level of 2,400.00 pounds again.

Côte d’Ivoire has stopped its sales for the next 2023/2024 harvest due to weather factors and the instability of raw materials quality, as well as the raw materials support provided to local producers; therefore, since mid-July we haven’t seen them trading, which used to limit the price increase for the last couple of months.

WEATHER

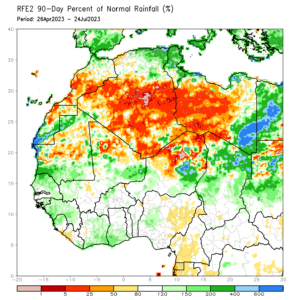

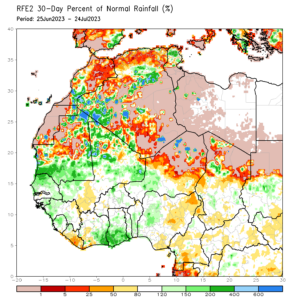

The weather conditions in West Africa have been better than usual in the last 3 months, there were good precipitations which, however, enhanced spreading of viral diseases of the trees. For comparison we provide 2 charts: for 30 days and 90 days with deviations from standard conditions.

Despite the abundant precipitations, the fruit counts show that most probably the surplus of rainfall prevented formation of cocoa blossoms in their proper size; therefore, we can expect a new season with crops delay.