Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – AUGUST 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2023/2024

As of the end of August, arrivals at Côte d’Ivoire ports remained 27% less than the year before.

Important news came from Ghana this month: it was announced that the season this year would start on September 1st instead of October 1st as usual.

Ghana has reached an agreement with buyers on a new crop purchase system, which will involve a deposit system against future cocoa bean deliveries. Thanks to this, the country will receive 600 million US dollars before the start of the season (September 1st). The deposit is expected to be around 60% of the contract value.

Ghana plans to harvest at least 700,000.00 tons in the next season. This season’s harvest will be around 450,000.00 tons. Ghana has failed to fully meet its contracts for the third year in a row. Currently, it is unclear how much will be sold for the upcoming season or whether the next harvest will cover most of the previous year’s shortfalls.

The ICCO is expected to release updated data this week regarding the deficit for the 2023/2024 season. The figure is expected to be around 475,000.00 tons.

The market continues to experience a physical shortage of cocoa beans. The certified stock in London warehouses continued to decrease in July.

According to investment fund analyses, confectionery company stocks have moved from a ‘sell’ rating to ‘neutral’ while prices at cocoa market were stable over the past two months.

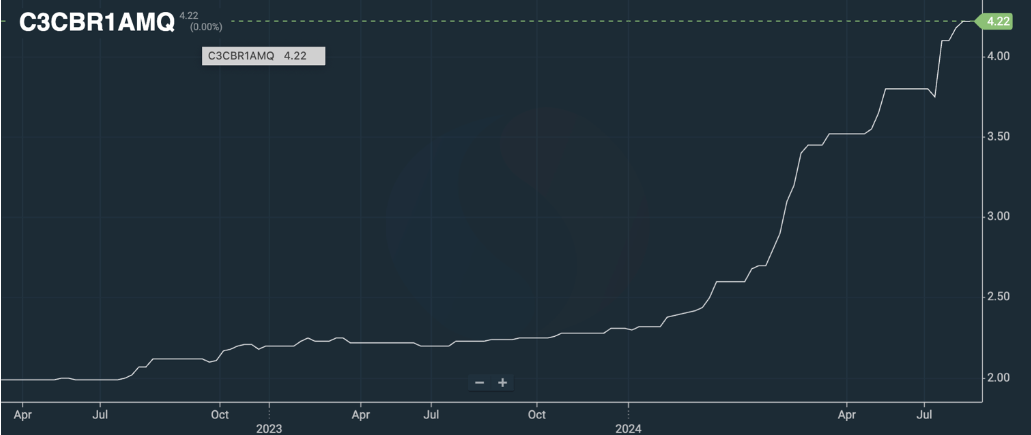

Currently cocoa butter ratio is at the level of 4.22.

Cocoa mass ratio is at the level of 2.20.

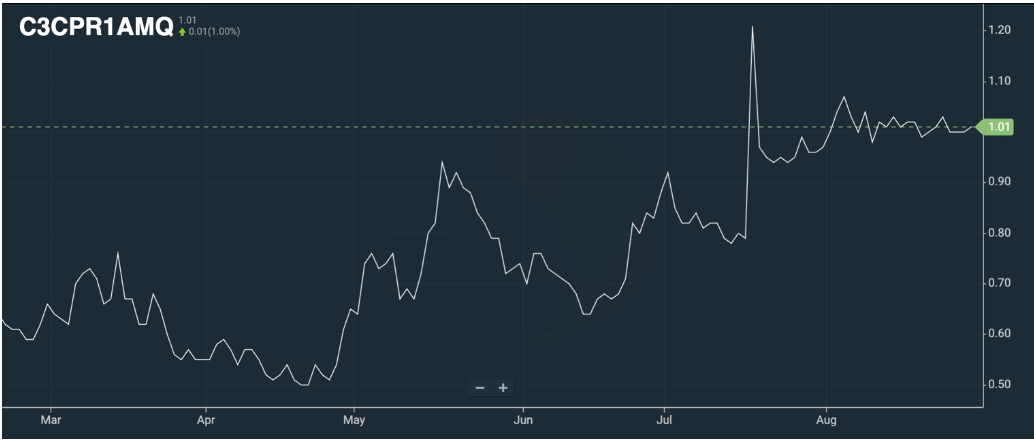

Cocoa powder ratio is at the level of 1.01.

FOB West Africa ratios are at the following levels for August 2024 deliveries.

Cocoa mass

2.20 and demonstrating a stable trend towards 2.35 from the 3rd to the 4th quarter of 2024. At the current level on the exchange, the price will be about 16,000.00 euros/t in the 2nd quarter.

Natural cocoa butter

4.22 for natural cocoa butter and a decrease trend for the next 4 quarters that may bring it to 3.85. The price at the current levels of the exchange will be about 27,000.00 euros/t in the 2nd quarter.

Cocoa powder

The ratio for cocoa powder has not almost changed since the last month. The ratio is at the level of 1,01 compared to the stock price. As of today, the exchange price in euros comprises 6,700.00 euros/t.

Natural cocoa powder price starts from 6,700.00 euros/t.

Alkalized cocoa powder is at 7,500.00 euros/t.

2. Technical analysis

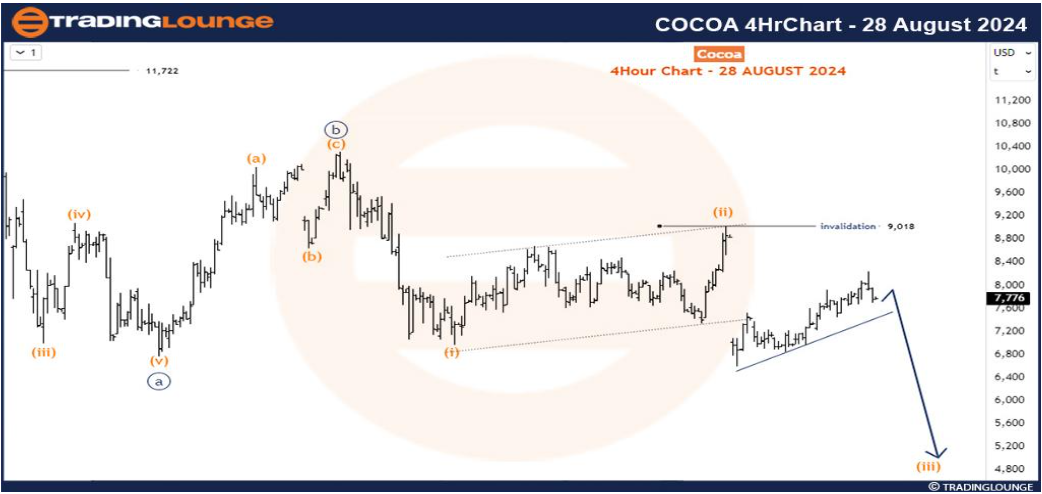

In August, the price stabilized, and our advice to clients remains the same: buy at any price correction since it may not last long. With the current market volatility, we can see movements exceeding 1,000.00 US dollars per day. As correctly noted in the chart below, we should indicate the value of wave C in the corrective pattern. The price should be at least 1 US dollar lower than in wave A.

It is possible that until the expiration of the September cocoa bean contract on September 15th, we will see sideways price movement, without significant increases or decreases.

However, it is important to remember that the gap on the chart is due to the transition to the December futures. It is quite possible that we will need to fill this gap.

WEATHER

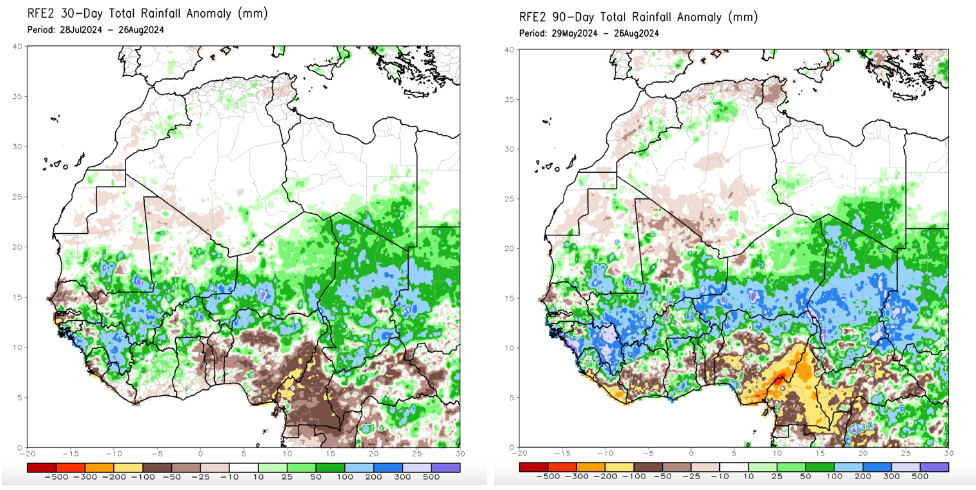

Rainfall in West Africa over the past 30 days has been decent, but it has been below average over the past 90 days, which is why we anticipate a weaker start of the main 2024/2025 harvest.

We are likely to have a better season than the current one; however, we would avoid making overly positive forecasts, as weak rains in the summer could affect the overall harvest data.

At the moment, the number of pods on the trees is above average, however, if we don’t see more rain soon, we are unlikely to have an abundant harvest in the 2024/2025 season.