Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET January 2024

1. Season 2023/2024

As of 21st of January, 2024 the port arrivals in Côte d’Ivoire are 36% less compared to the previous year, this decrease is stable since the season start and the decrease trend persists; starting with the decrease trend being less than 30%, now we reached 36%; following the most negative forecasts we will see a number exceeding 40% at the end of the season.

955, 000.00 tons were delivered to the ports.

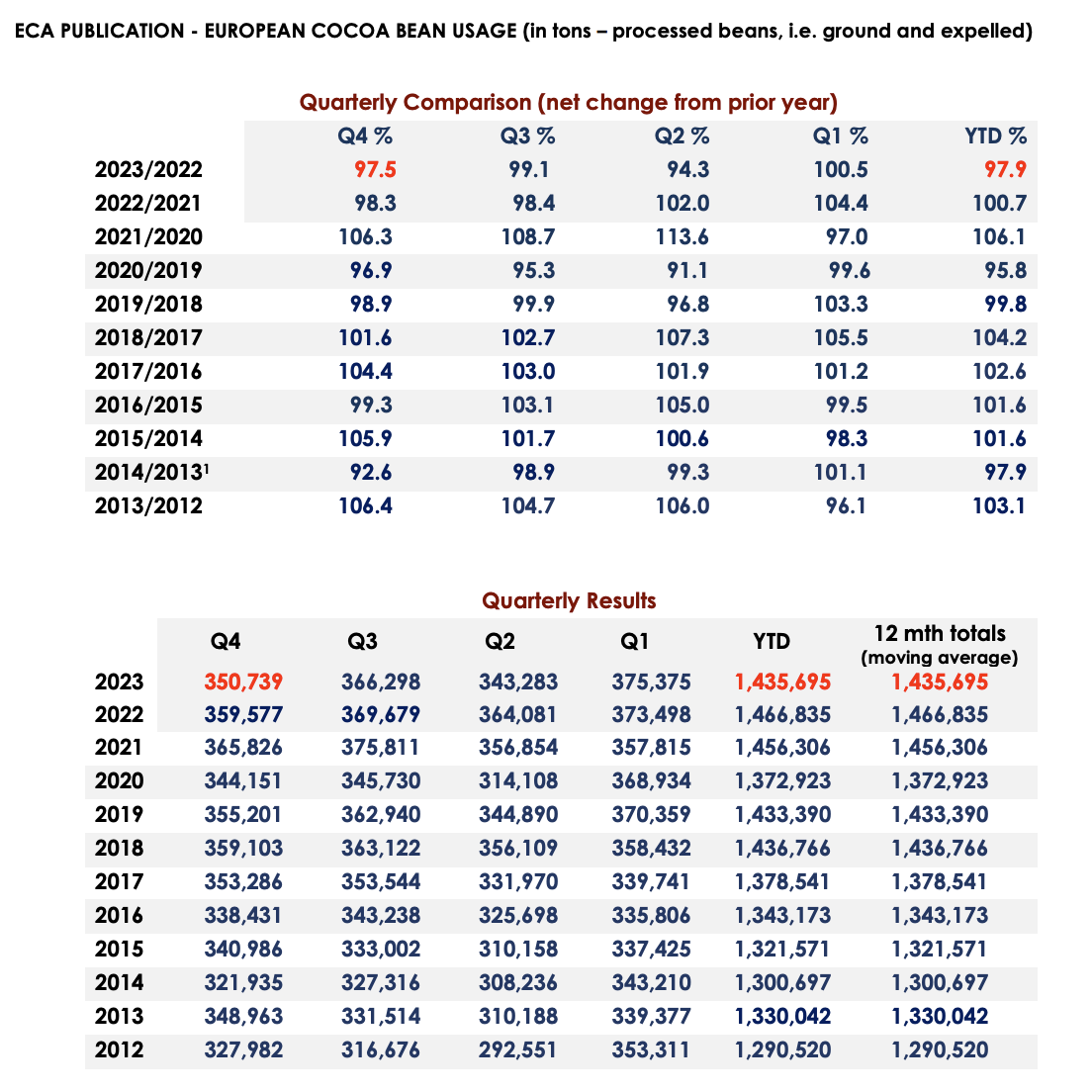

Processing in the EU in the 4th quarter decreased by 2.5% on a year-to-year basis. The overall figure for 2023 stopped at -2.1% compared to 2022 year. Expectations for processing scopes decrease were at -5%. Expressed in tons, the total drop comprised 31,000 tons during the year.

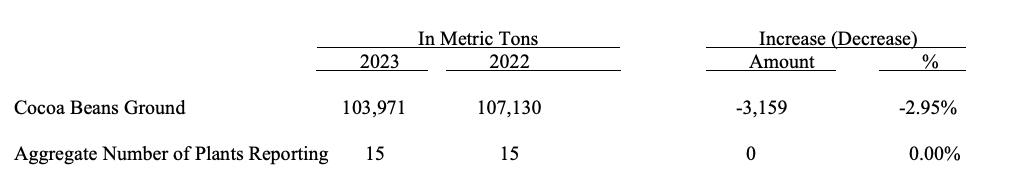

In the USA, beans processing, unexpectedly for all experts, decreased much less than the predicted 10%; the 4th quarter showed a drop of 2.95%.

The overall decrease for the year comprised 9.4% or 43,000.00 tons.

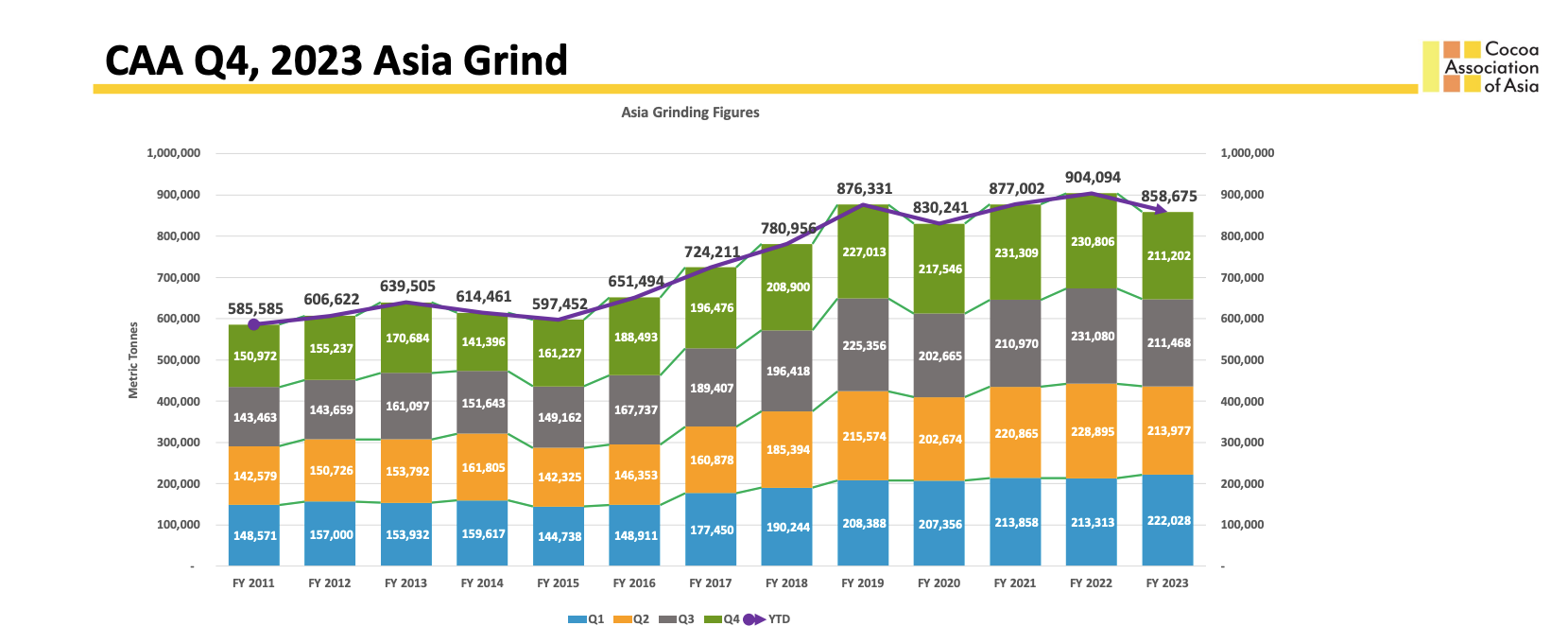

In Asia, the decrease in the fourth quarter comprised 8.5%. The overall annual decrease comprised 5%, which is 46,000.00 tons.

According to GEPEX data, despite 1.5% processing decrease in the fourth quarter from October 1 to December 31, Africa demonstrated a general processing increase by 59,000 tons compared to 2023 year.

According to Reuters, we see a 12% increase of processing on a year-on-year basis in Brazil. Overall processing comprises 253,000, 00 tons which is 30,000 tons more than the year before.

According to data from the customs office, cocoa beans processing in Russia comprised 17,000 tons. Total 68,000.00 tons in 2023 versus 51,000.00 tons in 2022.

If we take into account all the numbers we have, we see that processing decreased by only 14,000.00 tons in 2023, which is about 0.3% of global production. It is not surprising that we observe such an increase of prices with a crop failure being 36%.

FOB West Africa ratios have stabilized at the following levels for November deliveries.

Ratios are decreasing, but the exchange price is increasing, which causes an increase in the prices for cocoa products.

Cocoa mass

1.58 and demonstrating a stable trend towards 1.65 from the 1st to the 4th quarter of 2024. At the current level on the exchange, the price will be about 6,845.00 euros/t in the 1st quarter.

Natural cocoa butter

2.25 for natural cocoa butter and an uptrend for the next 4 quarters that may bring it to 2.35. The price at the current levels of the exchange will be about 9,750.00 euros/t.

Cocoa powder

The ratio for cocoa powder has decreased since the last month. The ratio is at the level of 0.76 compared to the stock price. Today, the exchange price in euros comprises 4,330.00 euros/t.

The diagram demonstrates a descend that is proportional to the prices increase on the cocoa bean stock exchange. Therefore, we will not see changes in the price for cocoa powders and ratio sharp changes in the next 3-4 quarters.

Natural cocoa powder is at 3,300.00 euros/t.

Alkalized cocoa powder is at 3,650.00 euros/t with a stable trend without strong signs of increase or decrease.

2. Technical analysis

The price diagram for cocoa beans continues to move in an ascending channel, which started a year ago, and the price has more than doubled; we continue to move within the channel, since the channel is ascending, each new day sets new upper limits.

At the moment, we saw the market moving sideways in December and early January. In December the price remained virtually unchanged.

Then, during January, the market showed growth and most likely formed or continues to form the 5th wave of increase, where we will see an ABC correction, which will range from 5-10% of the peak price in wave 5, most likely wave 5 will not exceed 4,000 GB pounds per ton of cocoa beans; technically in this version of wave counting, this is not possible, since the 5th wave of increase cannot exceed the length of the 3rd wave.

WEATHER

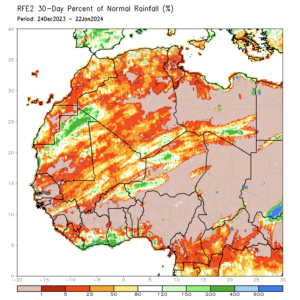

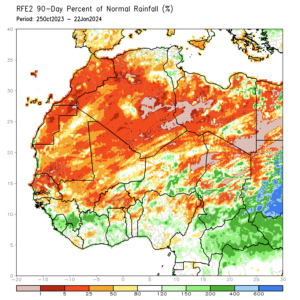

Weather conditions in West Africa are not stable. Looking at the precipitation for 90 days, we see that it exceeded the standard levels for this period; therefore, we most likely expect a longer harvest that will not end at the end of March, and most likely we will see good and big cocoa beans in April and possibly in May of 2024.

However, in the last 30 days the rains have stopped and we have entered the Harmattan season, i.e. the season of hot winds from the Sahara. According to eyewitnesses, this season the wind does not have a destructive power and most likely will not damage the crop.

We will end our Report on this positive note hoping to see a better harvest in February 2024.