Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET July 2023

1. Season 2022/2023

According to the results of June 2023, port arrivals in Côte d’Ivoire as of June 26 comprise -4.2% on a year-to-year basis. 2,196,000.00 tons were delivered to the ports and the situation has been stable for a long time. We do not expect changes. The year will demonstrate a short supply and we have the same expectations for the next main harvest.

Assessment of harvest on cocoa trees proves that we are in for a third consecutive year of shortage. Besides, this is already obvious when looking at the prices on futures markets: New York and London stock exchanges show an incredible prices increase.

In Ghana, January port arrivals are higher than in the previous year, but exact numbers are not available for May and June.

In Nigeria, cocoa beans’ export decreased by 20.6% on a year-to-year basis. Local exporters predict that the harvest of 23/24 season will be even worse than this year.

Prices, amid the backdrop of heavy rains in Côte d’Ivoire and a larger-than-expected deficit, have renewed new highs since the beginning of the year, and most likely this is not the end point. Against this background, the main ratio for cocoa products began to decrease.

FOB West Africa Ratios have stabilized at the following levels for supplies in July.

Cocoa mass

1.71 and demonstrating a stable trend, showing no signs of increase or decrease for the next 4

quarters. At the current level on the exchange, the price will be about 5,300.00 euros/t.

Natural cocoa butter

2.23 for natural cocoa butter and an uptrend for the next 4 quarters. The price at the current levels of the exchange will be about 6,950.00 euros/t.

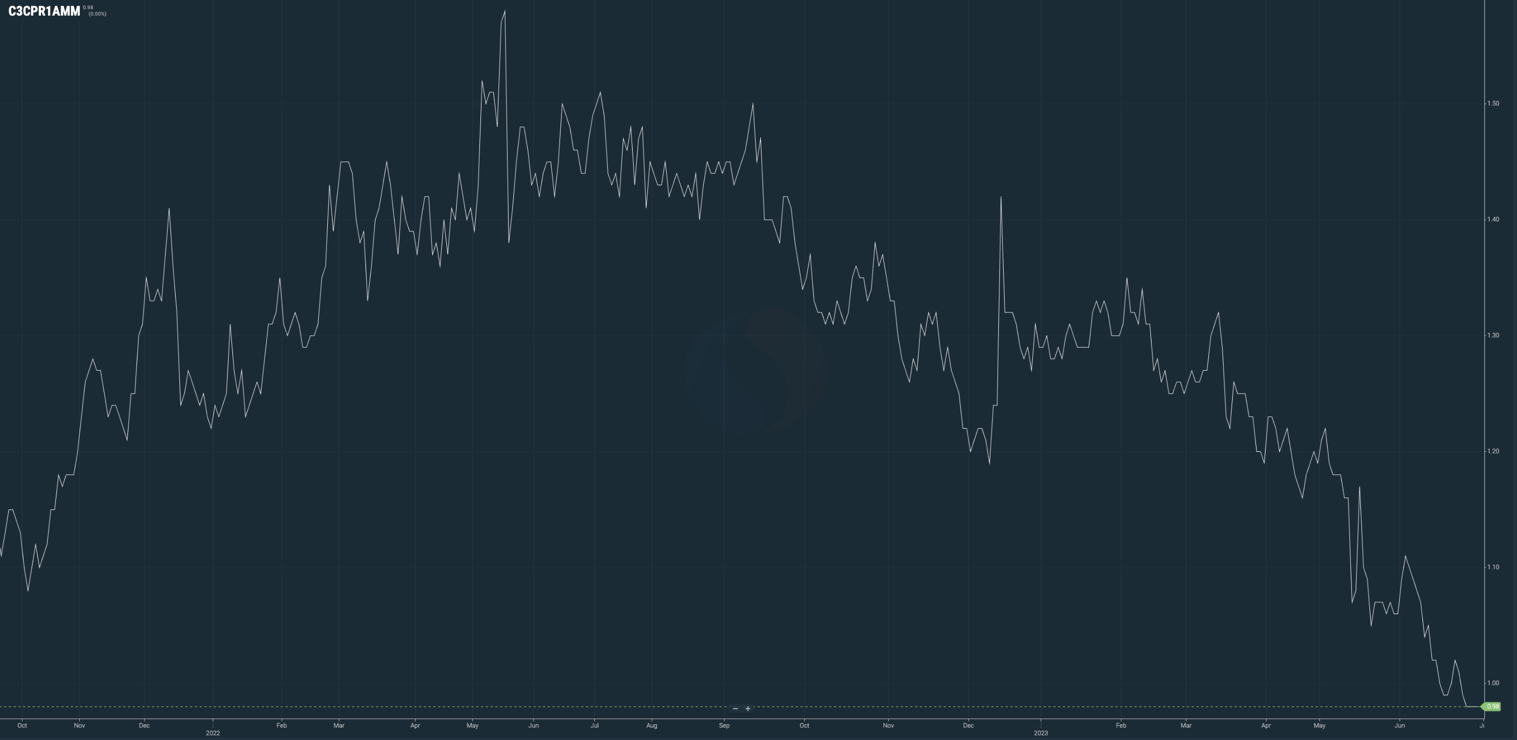

Cocoa powder

Below is a graph of the ratio for cocoa powder. The ratio is descending, but the stock price is rising.

Today, the exchange price in euros comprises 3,130.00 euro/t.

The graph demonstrates a descend that is proportional to the prices increase on the cocoa bean exchange. Therefore, we will not see changes in the price for cocoa powders and ratio sharp changes in the next 3-4 quarters.

Natural cocoa powder is at 3,050.00 euro/t.

Alkalized cocoa powder is at 3,300.00 euro/t with a stable trend without strong signs of increase or decrease.

2. Technical analysis

Fundamental and technical analysis clearly state that the market is sufficiently outbid as we also made relevant forecasts in the previous reports; however, due to strong fundamental news, the market tries to keep the pace from the technical viewpoint and does not leave a chance to strong correction waves.

We have seen the last correction at the beginning of February. Let’s see whether the options closing in the trading month of July will trigger the long expected correction. On June 30 at the end of the trading session, a large number of options expire at the levels of 2,600/2,650/2,700.00 pounds.

In the trading month of July, most likely we will finish the 3rd wave of growth which is the longest and most “explosive” at the level of 2700 + – 30 pounds; most likely in the next 2-3 calendar months we will trade in a long corrective fourth wave.

On the London Stock Exchange, due to the weakness of the pound, we see unprecedented prices reaching up to 2,730.00 pounds per ton. Given the strong exchange rate position of the British pound, prices in dollars exceeded $3,300 per ton on the New York Stock Exchange.

Data from the American Exchange with regard to long and short positions shows that the number of long positions for price growth exceeds the number of short positions and is at record levels, which may indicate to an upcoming correction.

However, the correction is unlikely to be strong, most likely the strongest support line will be at the level of 2,400.00 pounds per ton compared to July data on the London Stock Exchange and 3,100.00 dollars on New York Stock Exchange.

Should we proceed with the support level at 2,400 pounds, the next support line will be at the level of 2,230.00 and 2,130 pounds.

Above we still see a resistance line at the level of 2,900.00 – 3,000.00 on the London Stock Exchange depending on the timing when we approach these levels, this line is calculated taking into account the two previous peaks in the period from 2010 to 2016 yy., and in the next months we will definitely try to pass it through, and 3,430 and 3,700.00 respectively on New York Stock Exchange.

Besides, not for the first time, we remind you of the long-term technical channel for the movement of prices for cocoa beans in the US market, where the peak prices in the next 10 years can reach up to $10,000.00 per ton.

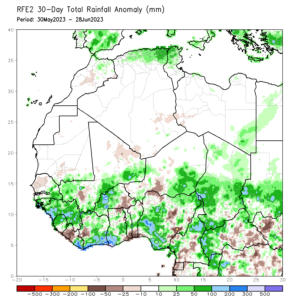

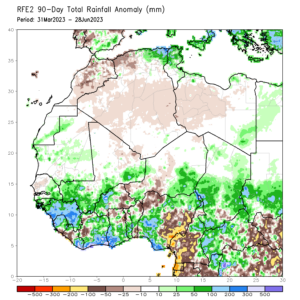

WEATHER

The weather conditions in West Africa have been better than usual in the last 3 months, there were heavy rains that caused some flooding; for comparison we provide 2 charts: for 30 days and 90 days with deviations from standard conditions. However, the rainfalls occurred in a very short period of time causing floods and some tree diseases (black pod) due to overwatering.

Most probably, we will not witness a surplus crop early in the season, with too much rain preventing formation of cocoa blossoms in their proper size; therefore, early fruit counts provided by leading analysts in West Africa range from below average to shockingly low. At the moment, based on the fruit count on trees, up to 1.5 – 5% shortage of cocoa beans is predicted for the 2023/2024 season. Apparently in the provinces marked with brown spots we expect a greater deficit, while in the provinces where there are more blue spots of precipitation we expect a smaller deficit