Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – JULY 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2023/2024

Port arrivals in Côte d’Ivoire, as of end of June are 27% less than the previous year.

Important news has come from Ghana this month. Ghana has completed signing debt restructuring agreements and received an income of $150 million for the past reporting period of 2022/2023. Ghana is aiming to attract around $2.8 billion from creditors in the current season.

Ghana plans to collect at least 700,000.00 tons in the next season. This season’s harvest will amount to about 450,000.00 tons. For the third year in a row, Ghana has not fully met its contracts, and it is currently unclear how much will be sold in the upcoming season or whether the next harvest will be able to cover the shortfall of previous years.

According to ICCO research, around 81% of cocoa trees in Ghana are infected with various diseases. Therefore, investors are cautious about the yield forecasts in Ghana.

The market continues to experience a physical shortage of cocoa beans. The certified stock in London warehouses decreased again in July.

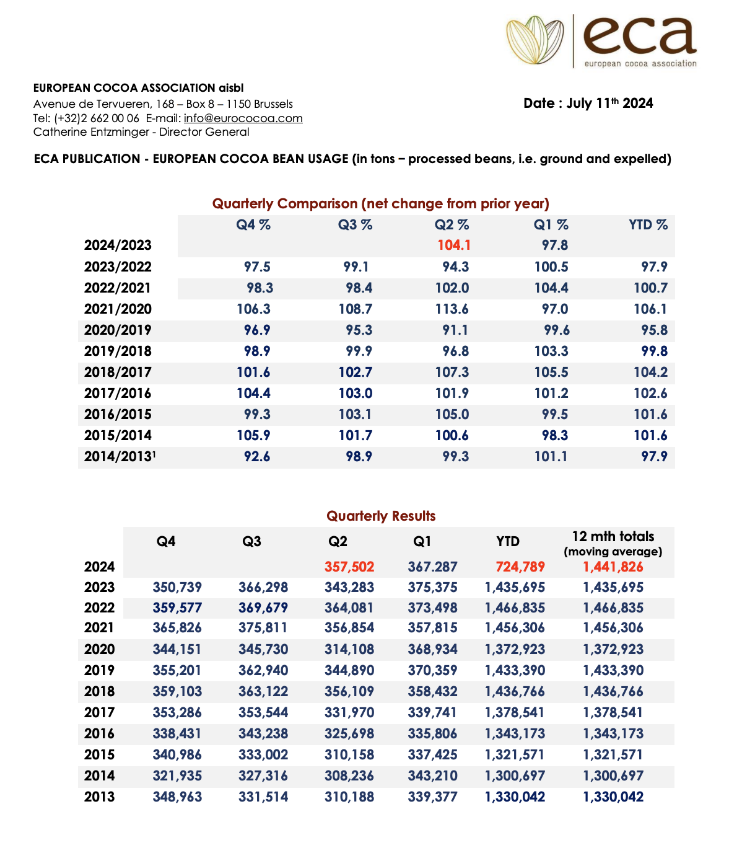

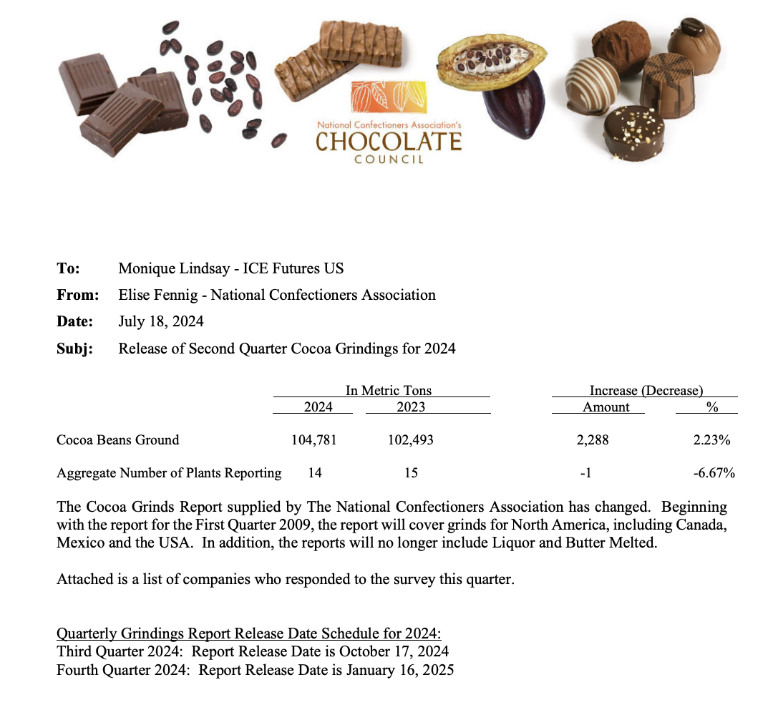

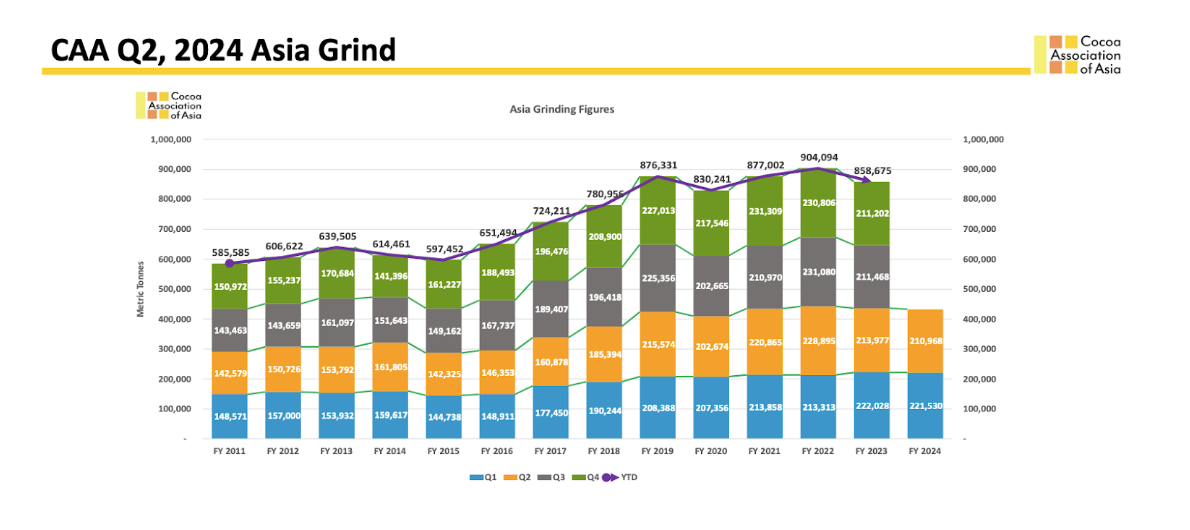

Cocoa beans processing in the 2-nd quarter

EU + 4,1%

USA +2,23%

Asia -1,41%

Forecasts for further declines in consumption remain in the range of 10% to 30%. However, it is quite possible that we will see this data with a significant delay; it is likely that the result in figures will be only available by the fourth quarter, with data for this period available only in January 2025.

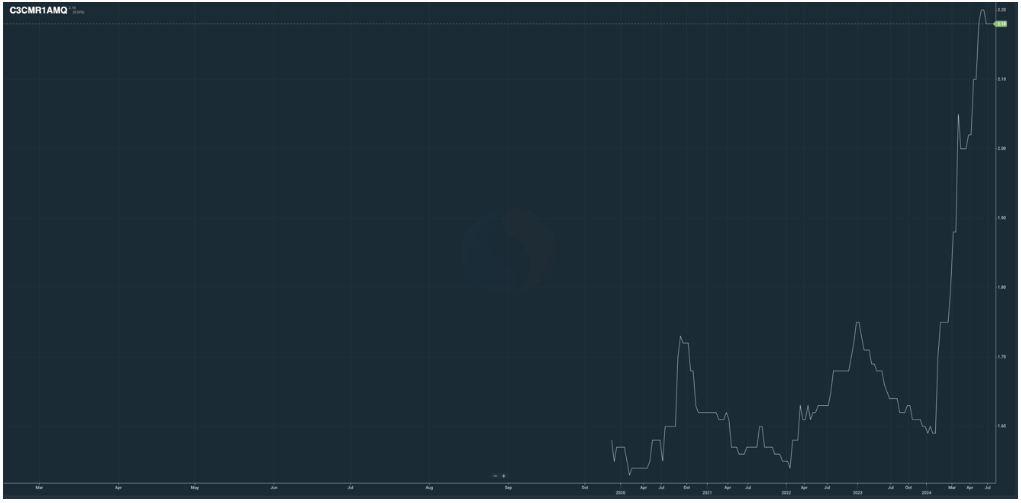

The ratio for cocoa butter is currently at the level of 3.75.

Cocoa mass ratio is 2.18.

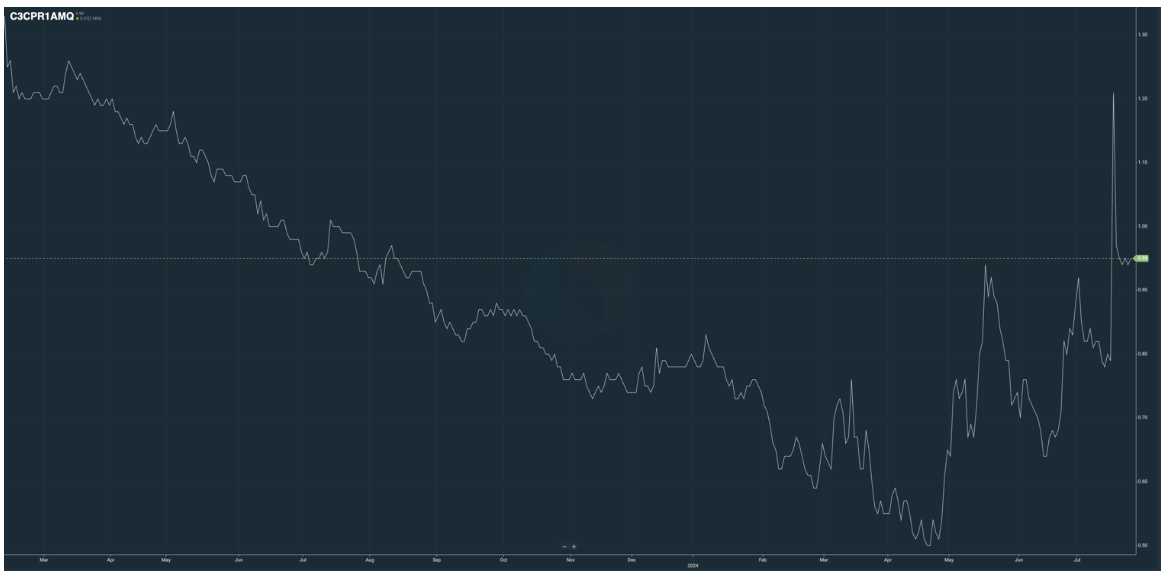

Cocoa powder ratio is 0.95

FOB West Africa ratios are at the following levels for August 2024 deliveries.

Cocoa mass

2.18 and demonstrating a stable trend towards 2.35 from the 3rd to the 4th quarter of 2024. At the current level on the exchange, the price will be about 17,100.00 euros/t in the 2nd quarter.

Natural cocoa butter

3.65 for natural cocoa butter and an uptrend for the next 4 quarters that may bring it to 3.95. The price at the current levels of the exchange will be about 29,900.00 euros/t in the 2nd quarter.

Cocoa powder

The ratio for cocoa powder has not changed since the last month. The ratio is at the level of 0.95 compared to the stock price. As of today, the exchange price in euros starts from 7,900.00 euros/t.

Natural cocoa powder price starts from 6700 euros/ton.

Alkalized cocoa powder is at 7500 euros/ton.

2. Technical analysis

In July, the price stabilized, and our advice for clients remains the same: buy at any price correction. Since such corrections may not last long with the current market volatility, we could see movements of over $1,000 per day. As noted correctly in the chart below, currently we should demonstrate the value of wave C in the corrective model. The price must be at least $1 lower than in wave A.

Due to current levels, a small corrective rise is possible. It is quite likely that until the expiration of the September cocoa bean contract on September 15, we will see sideways price movement without significant growth or decrease.

WEATHER

At the moment, weather conditions are starting to favor the growth of cocoa beans. We observe entering a La Nina phase, which is expected to ensure good harvests in Africa.

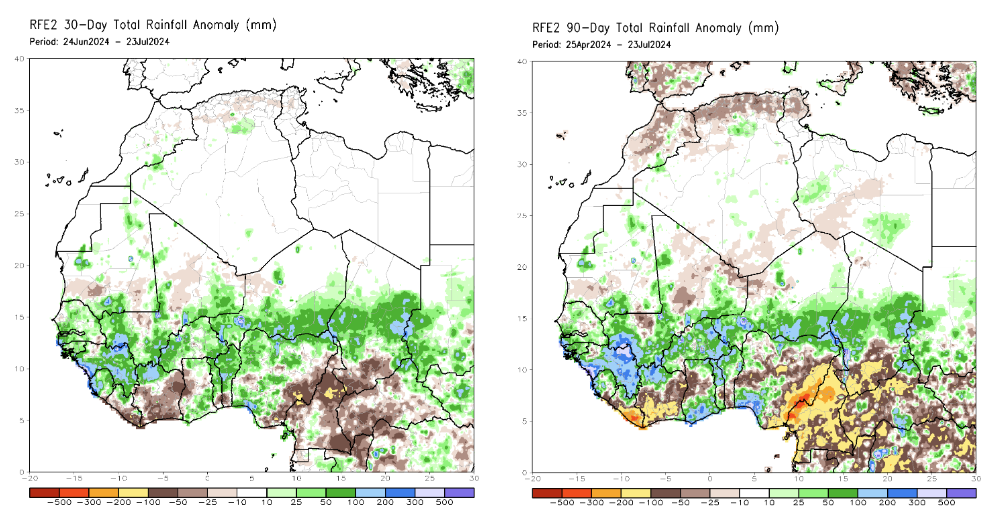

Rainfall in West Africa over the last 30 and 90 days has been below average, so we can expect a weaker start to the main harvest in 2024/2025 season.

While the upcoming season is likely to be better than the current one, we are hesitant to make overly optimistic forecasts since the shortage of rains in June and July could adjust the overall harvest figures. Currently, the number of pods on the trees is above average, but if it does not start raining more soon, we are unlikely to have an abundant harvest in the 2024/2025 season.