Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET June 2023

1. Season 2022/2023

Taking into account the results of May 2023 port arrivals to Côte d’Ivoire as of May 15, 2023 comprise 5.0% less on a year-to-year basis. 2, 068, 000.00 tons were delivered to the ports and there is a decrease trend.

At the beginning of the year, a surplus of cocoa beans was forecasted in Côte d’Ivoire; however, at the moment, a shortage of cocoa beans of more than 250,000 tons is already expected.

Besides, the GEPEX announced an increase in local processing from the beginning of the season up to 408,000.00 tons; this figure is more than in the previous year by 12.5%, again this creates a shortage of cocoa beans that can be exported.

In January port arrivals to Ghana increased if compared to the previous year: 576, 000.00 tons against 524, 000.00 tons as of 30.03.

In Nigeria, exports of cocoa beans fell by 30% in March. We would like to remind that all the previous months demonstrated supply shortage, for example, in December it was 70% less compared to the previous year.

Besides in Nigeria, it is planned to launch an additional processing facility having capacity of up to 100,000 tons of cocoa products per year, which would mean more than 50% of the cocoa beans local processing in the 5th country that produces cocoa beans.

Prices, against the backdrop of heavy rains in Côte d’Ivoire and a larger-than-expected deficit, have updated new maximum values since the beginning of the year, and most likely this is not the end. Against this background, the main ratio for cocoa products began to decline.

Ratio on FOB West Africa conditions have stabilized at the following levels for supplies in June

Cocoa mass

1.73 and demonstrating a stable trend, showing no signs of increase or decrease for the next 4 quarters. At the current level on the exchange, the price will be about 4,750.00 euros/t.

Natural cocoa butter

2.33 for natural cocoa butter and an uptrend for the next 4 quarters. The price at the current levels of the exchange will be about 6,450.00 euros/t.

Cocoa powder

Natural cocoa powder – 3,050.00 euros/t .

Alkalized cocoa powder is at the level of 3,300.00 euros/t and demonstrates a stable trend without particular signs of increase or decrease.

2. Technical analysis

Fundamental and technical analysis clearly state that the market is sufficiently outbid as we also made relevant forecasts in the previous reports; however, due to strong fundamental news, the market tries to keep the pace from the technical viewpoint and does not leave a chance to strong correction waves.

We have seen the last correction at the beginning of February.

On the London Stock Exchange, due to the weakness of the pound, we see unprecedented prices reaching up to 2,400 pounds per ton in mid-December and February. Given the strong exchange rate position of the British pound, prices in dollars exceeded $3,100 per ton on the New York Stock Exchange.

Data from the American Exchange with regard to long and short positions shows that the number of long positions for price growth exceeds the number of short positions and is at record levels, which may indicate to an upcoming correction.

However, the correction is unlikely to be strong, most likely the strongest support line will be at the level of 2,100 pounds per ton compared to September data on the London Stock Exchange and 2,800.00 dollars on New York Stock Exchange.

Above we still see a resistance line at the level of 2,444.00 on the London Stock Exchange and 3,200.00 on New York Stock Exchange.

While countries of origin have already sold half of the future harvest as of 30.03, as of the beginning of April in total 1,356,000 tons of the 2023/2024 crop have been sold out of an expected harvest of 2,800,000 tons (put together for Ghana and Côte d’Ivoire). These figures should have caused a price correction or at least create a pressure on the prices, but this did not happen since the hedge funds pressure was too strong. When the pressure created by selling the products by Côte d’Ivoire and Ghana disappears, we will see even higher prices, but until then, more than 1,400,000 tons will be offered to the market, which will sooner cause a long-awaited decline in prices.

As we mentioned in the previous reports for 2023, the dollar index reversed and strengthened going back from 1.11/ euro to 1.07/euro and we continue to observe further strengthening of the American currency. This will put pressure on the New York Cocoa Exchange.

However, let’s not forget that the pound is also strongly tied to the general movement of currencies, and substantial weakening of the pound with quite predictable levels of 1.05-1.07 pounds / US dollar during 2023, will serve as a catalyst for prices increase on the London Stock Exchange, bringing them to 2,600.00 – 3,000.00 pounds per ton.

At the moment, the cocoa market very much resembles the condition of the coffee market a couple of years ago, when coffee per pound went up from 120 cents to 200+ ; and it remains at these levels for 3 years already. A rise of around 60-70% from the minimum levels is quite possible and if we take an average cocoa bean price of 1,700.00 pounds per ton over the past 5 years we could well predict pound prices around 2,700.00-2,800.00 pounds per ton.

Also, not for the first time, we would like to remind about the long-term technical channel for the movement of prices for cocoa beans in the US market, where the peak prices in the next 10 years can reach up to $10,000 per ton.

In the chart below, we see that over the past 15 years the market has reached a resistance trend line that starts at the times of the military conflict in Côte d’Ivoire, the 2nd peak is the El Niño effect of 2016, and most likely, given the whole news background, we will break this line of resistance this year.

WEATHER

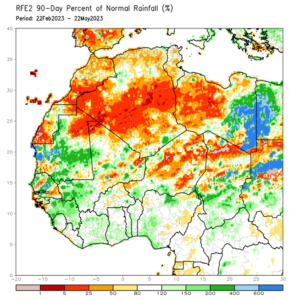

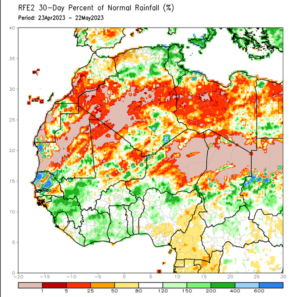

The weather conditions in West Africa have been better than usual in the last 30 days, for comparison we provide 2 charts: for 30 days and 90 days with deviations from standard conditions. Quantity of precipitations demonstrates that rainfalls in the winter months were above the normal levels in most cocoa growing regions in Ghana and Côte d’Ivoire. However, the rainfalls occurred in a very short period of time causing floods and some tree diseases due to overwatering.

In the last 10 days the rains stopped, and most probably this is the first sign of El Nino starting.

This data will have a positive impact on the start of the main harvest, most probably at the beginning of the cocoa harvesting season in October and November the harvesting may be ahead of schedule.

However, at the end of the season we expect very poor port arrivals due to the impending El Nino, the highest level of threat has been declared by the forecast center; El Nino is expected to arrive in August, which will most negatively impact the cocoa bean crop in Africa.