Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET March 2023

1. Season 2022/2023

As of 27 February 2023, cocoa port arrivals in Côte d’Ivoire comprised -2.9% on a year-to-year basis.

1, 700, 000.00 tons were delivered to the ports.

If at the beginning of December we were ahead of the previous year by 10%, currently for 2 months already the export of beans decreased extremely, and continues to decline.

At the beginning of the year, a surplus of cocoa beans in Côte d’Ivoire was forecasted, however, at the moment, a deficit of cocoa beans in the scope of 150,000.00 tons is already expected.

Over the past 4 weeks, compared to previous periods the underrun comprises 30,000.00 tons per week. Should this trend continue, then the forecasted deficit figure of 150 thousand tons may be even higher.

In January port arrivals in Ghana are much more than the year before: 440, 000.00 tons versus 286, 000.00 tons y/y.

Nigeria demonstrates a downturn with cocoa beans export scopes decreased by 5,9% in January. At this point we would like to point out that in December it was 70% less compared to the data of the previous year.

Exporters in Côte d’Ivoire are having difficulty to fulfill their contracts, as first of all speculations were noticed when the exporter sold 50,000.00 tons of beans at the level of 1,850.00-1,900.00 pounds per ton at the market and was going to buy the same beans cheaper from farmers during the season.

However, the market situation does not allow them to do this, as the market is trading at the level of 2,100.00+, and they respectively announce their inability to fulfill their contracts, thereby stimulating the market to raise the prices even more, as their final clients go to other exporters and buy cocoa beans at any price, trying to avoid complete suspension of their production.

The second important aspect is the construction of new factories in Côte d’Ivoire for processing cocoa beans into cocoa products. According to preliminary estimates, already in 2022/2023 plants with a total capacity of up to 300,000.00 tons can be launched, which makes about 15% of the harvest. As there are subsidies for local production and a preference is given to beans processing in the country of origin, Côte d’Ivoire is expected to export beans even less that may cause the next increase in exchange prices or cocoa bean differentials.

Ratio for cocoa products in Africa is on FOB conditions, West Africa stabilized at the following levels:

Cocoa mass

1.75 with a stable trend, demonstrates no signs of increase or decrease for the next 4 quarters. At the current exchange level the price will be about 4,200.00 euro/t.

Natural cocoa butter

2.37 for natural cocoa butter and an increase is expected during the next 4 quarters. The price at the current levels of the exchange will be about 5,700.00 euro/t.

Cocoa powder

Natural – 3,050.00 euro/t.

Alkalized cocoa powder – 3,300.00 euro/t with a stable price line without strong signs for increase or decrease.

2. Technical analysis

Fundamental and technical analysis clearly state that the market is sufficiently outbid as forecasted in the previous reports; however, due to strong fundamental news the technical market tries to keep the pace and gives no chance to strong correction waves.

We observed the last correction at the beginning of February.

Due to the weakness of GB pound we saw unprecedented prices at the London Exchange that reached 2,150.00 GB pounds per ton in the mid-December and mid-February.

For a couple of weeks since the end of January, we have not received data from the American Exchange regarding long and short positions, however, despite the rapid growth in prices, as of February 24, 2023 the number of long positions for price growth exceeds the number of short positions by only 10%.

While countries of product origin are very reluctant to sell the future harvest, apparently expecting higher prices on the exchange, only 260,000.00 tons of the 2023/2024 harvest have been sold as of mid-January, out of expected 3,000,000 tons of joint harvest (Ghana and Côte d’Ivoire). We are unlikely to see a strong price correction as long as these numbers do not grow.

As we indicated in the previous report on 01/02/2023, the dollar index changed and gained 4% while in February USD/Euro index going back from 1.11 to 1.06, as we continue to witness further strengthening of the American currency. This will put pressure on the New York Cocoa Exchange.

But let’s not forget that the GB pound is also strongly tied to the general movement of currencies, and a strong weakening of the pound, predictable at levels of 1.05-1.07 against the US dollar during 2023 year, will stimulate prices increase on the London Stock Exchange to 2,500.00 – 2,700.00 GB pounds per ton.

The first price support levels, which we may achieve during the next correction.

London Exchange CK3(May Contract) 2,050.00 and later on 1,975.00 and 1,930.00

New York Stock Exchange CСK3 (May Contract) 2,650.00 and later on 2,585.00 and 2,500.00.

WEATHER

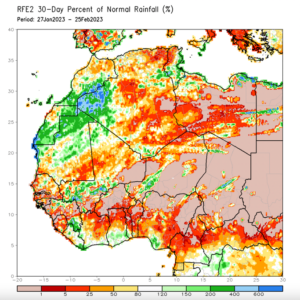

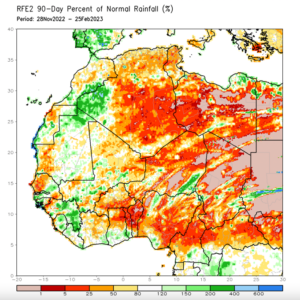

Weather conditions in West Africa almost did not change, below please see two maps for comparison: for 90 days and for 30 days with deviations from standard conditions. Quantity of precipitations demonstrates that rainfalls in the winter period were missing in the most regions that grow cocoa in Ghana and Côte d’Ivoire.

However, while these data do not have a strong impact on the main harvest before February, we mentioned several times in the previous reports that the precipitations levels were below the normal rainfall levels and now we observe the results of missing rains in the autumn. The data given on the maps may affect the average (summer) harvest, which may cause a shortage exceeding the forecasted 150,000.00 tons in May-August 2023.