Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET November 2022

1. Season of 2022/2023

On October 1, the new harvest of 2022/2023 started

In Ivory Coast, as of 23.10, there is a lag in the harvest year-on-year by 26.4%. 204,000 tons were delivered to the ports.

These figures were mainly due to heavy rains and the inability to deliver cocoa beans from rural areas to ports. Counting the fruits on the trees suggests that the harvest promises to be good, and the initial figures of arrivals at the port are only due to technical problems of delivery. However, since a risk remains that there was a lack of fertilizers during 2022, we assume that there will be fewer cocoa beans in the fruits or they will be smaller, which in theory can yield 5% less than a year earlier.

In Ghana, they experience the catastrophic inflation rate of 45%, and even the increased price in the local currency cedi, is still lower than in Ivory Coast, which can lead to the same problem as it was a year earlier, namely illegal transportation from Ghana and Ivory Coast, thereby most likely hopes to harvest 960,000 tons will fail.

We must not forget that about 3-4 years ago, many new cocoa trees were planted throughout the cocoa belt in Africa, which can positively affect the harvest of the new year. This can add positivity to the harvest figures of 22/23.

The ratio for cocoa mass continues to be at a very high level compared to previous years, currently it is trading above 1.8 and the ratio for cocoa butter exceeded 2.3 on the terms of instore Amsterdam.

Processing of cocoa products 3Q 2022.

USA – 3.37 year on year. But the important fact is that 15 plants reported compared to 16 plants a year earlier. Therefore, if we recalculate the number of processors, then most likely this figure is + 2-3% year to year.

EU – 1.6% year-on-year. Most likely, the drop is due to rising energy prices in the EU, but let’s remember that in comparison there was the strongest quarter in the entire history of observations, the 3Q of 2021 was a record-bearing for the last 10 years, and the 3Q of 2022 was the second strongest quarter in the last 10 years. At a minimum, we can see an average annual growth of 1.4% year-on-year if we take data from previous reporting periods.

Also, do not forget about the downtime of the Barry Callebaut factory in Wieze due to technical problems in August, most likely if there had been no downtime, we would have seen a positive recycling.

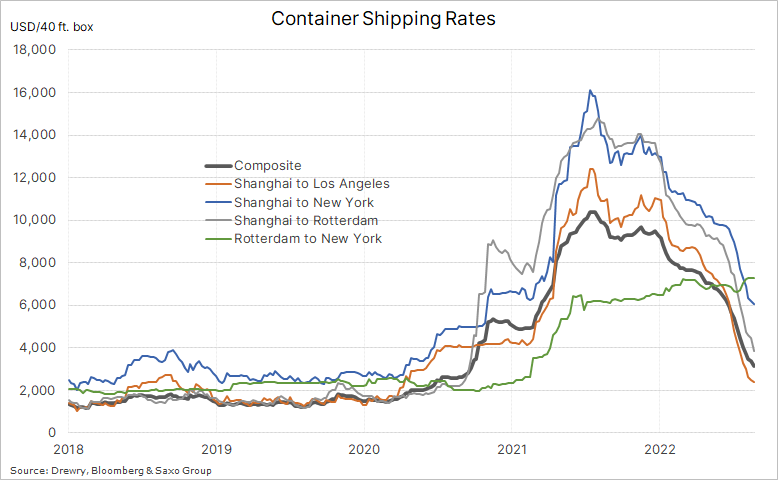

Asia +9.5% year on year. Amazing figures, the strongest quarter in the entire history of observations, is largely due to the removal of covid restrictions in Asia as well as the declining price for freight from the region. Below is a table on freight, which has returned to the levels of 3 years ago.

Africa +18.1% processing of cocoa products in Ivory Coast according to Gepex, the total volume increased to 171,540 tons in the quarter. On the one hand, the figures are very strong, but, on the other hand, resulting from the increasing number of cocoa processors in Ivory Coast, most likely these figures will only grow, though at the same time they steal processing in the USA, where they switch to purchasing ready-made cocoa products instead of their own processing.

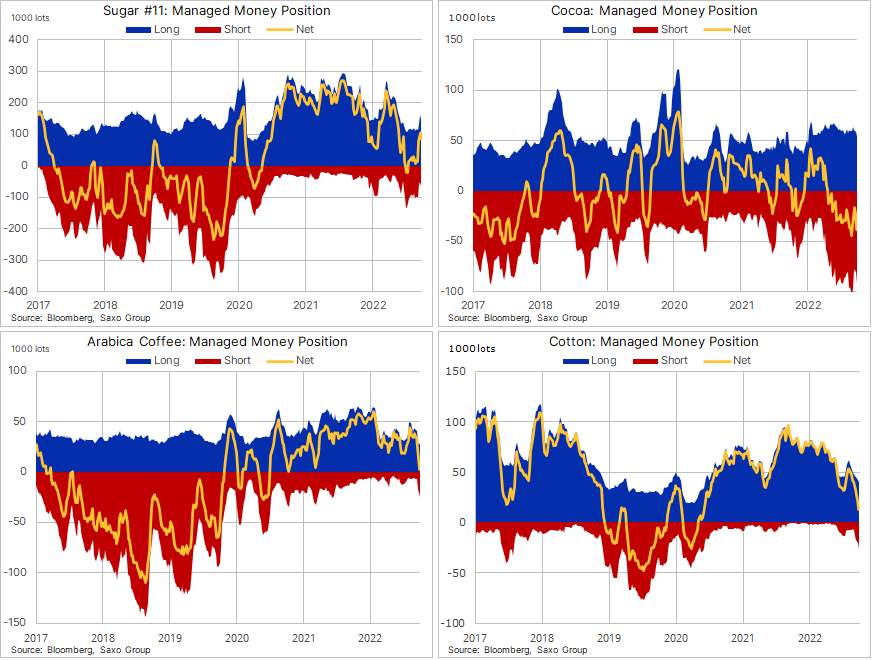

Technically, from the point of view of hedge funds and their participation in the cocoa market, we saw a large reduction in short positions in the US and UK markets in the middle of the month, but at 29.10 the number of new positions on sale increased almost to the lows of this year. While the market cannot decide whether it is ready for growth, rather no than yes, at least from the point of view of hedge funds.

- Technical analysis

As predicted in the previous report, the price at the American Stock Exchange continues its downward movement, but the wave theory shows that by the end of the year we can see a price increase of 10 to 20%.

Most likely, from September 26 to October 27, we saw the formation of the first wave of growth, the graph shows distinct 5 waves of growth, from where, after correction, it is quite possible that growth will occur to values of 2600-2700 per ton on the New York stock Exchange.

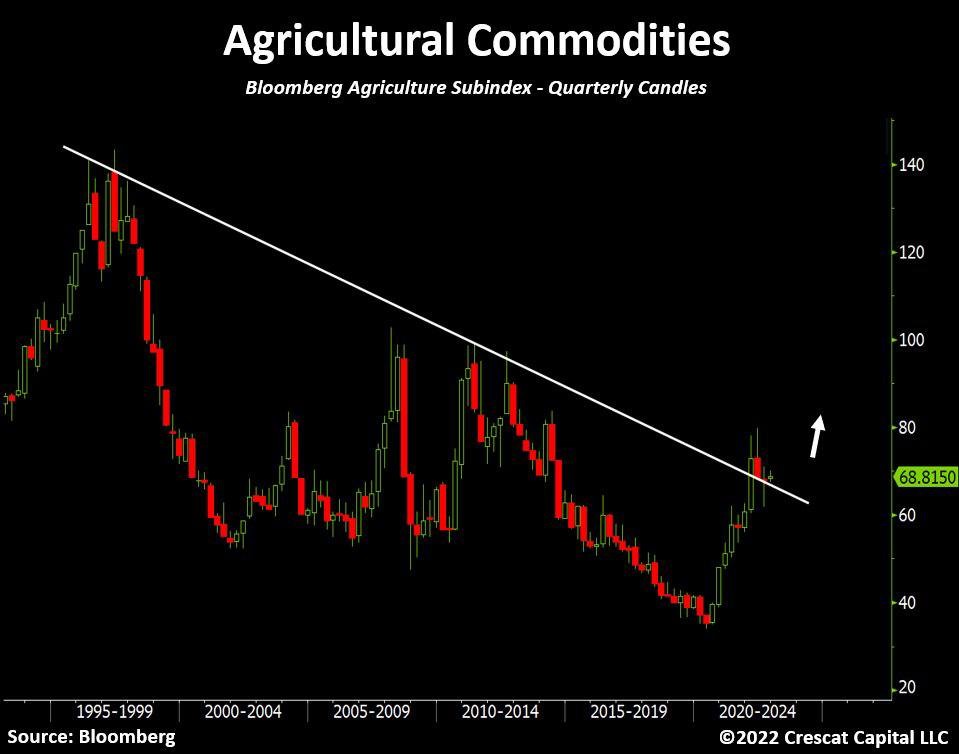

In many ways, the beginning of this movement will be tied to the dollar index, while we see a weakening of the index, if the dollar loses another 2-3% in value, this will most likely serve as a catalyst for an increase in prices for agricultural products. Below is a long chart of prices for the main commodity markets, at this moment we are trading above the trend, that dates to 1995, and it is quite possible that prices will remain at a high level for a long time.

WEATHER

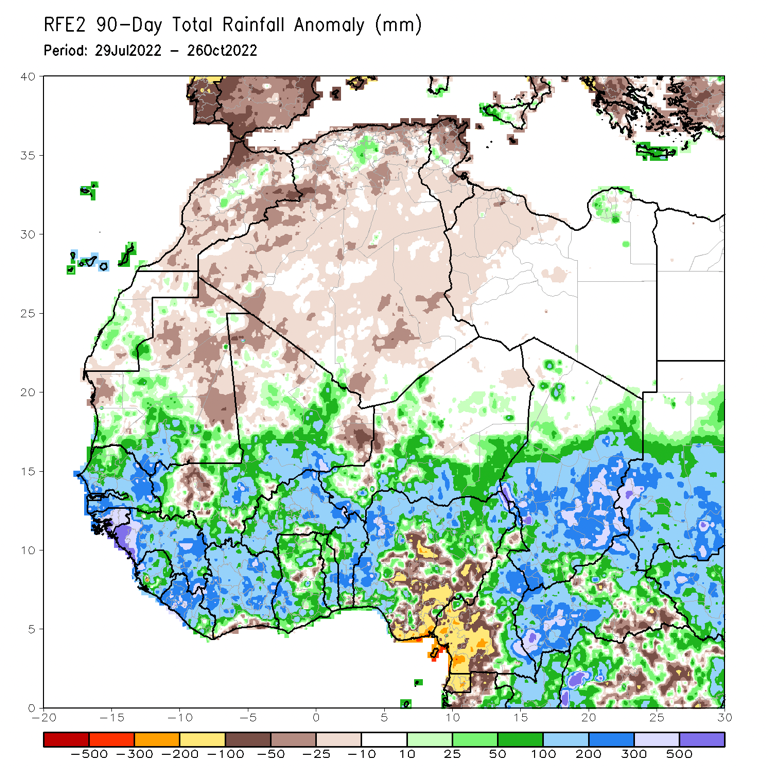

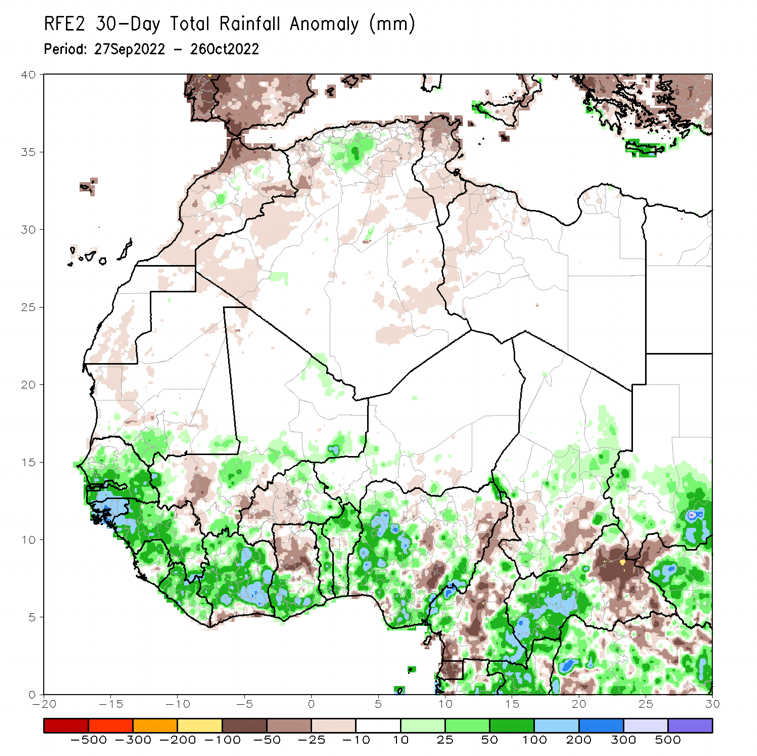

Weather conditions in West Africa are favourable, for comparison we have 2 schedules of 90 days and 30 days with deviation from the norm. The amount of precipitation shows that there were much more rains in the summer/autumn months than normal in most cocoa growing regions.

Also, we are still in the La Nina stage, highly likely, this promises favourable weather in the future for the growth of cocoa.

The only negative information regarding the weather is the black pod tree disease, which greatly accelerates along with an excessive amount of moisture. But on October 27, there were no anomalies in the development of this disease in trees, but it should be borne in mind that if the rains continue beyond the norm, it means that part of the crop will die from black pod.