Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET March 2024

Is cocoa more expensive than copper?

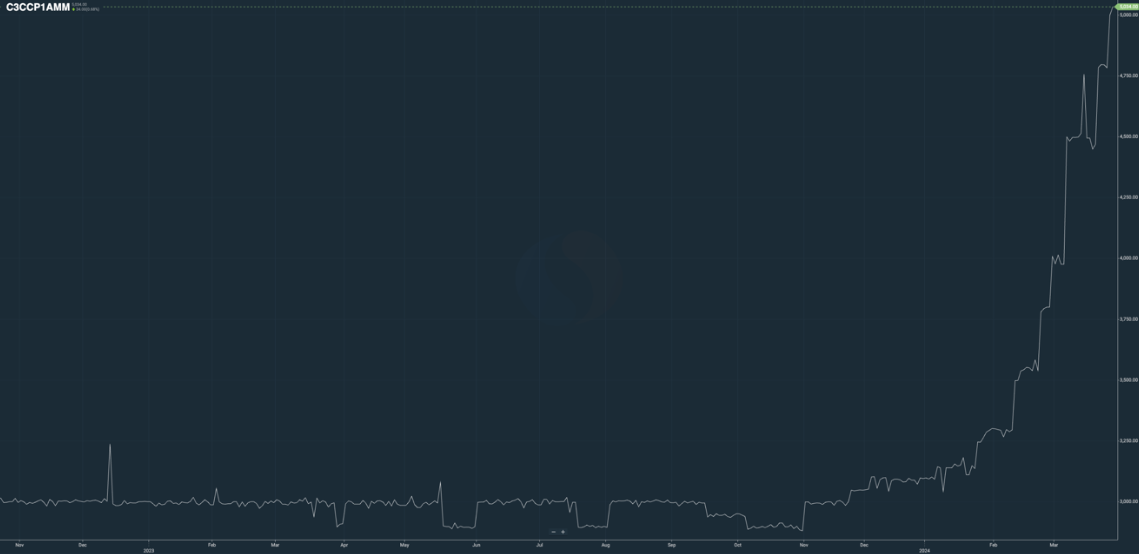

Cocoa bean futures on the New York Cocoa Exchange are now more expensive than copper futures for the first time in the last 20 years. Is it cheaper to produce electrical appliances than chocolate bars now?

In March alone, cocoa has increased in value by more than 50%. News of crop failures, bad weather in West Africa, and tree diseases have raised cocoa futures to unprecedented levels.

It’s important not to forget that the situation could only worsen, especially considering the new EUDR laws in the EU with their coming in force scheduled for 2025. It’s worth reminding that without an EUDR certificate (which tracks cocoa bean origin zones and deforestation), it will become nearly impossible to import cocoa beans into the EU. There’s also a risk that existing exchange stocks without this certification can be destroyed.

1. Season 2023/2024

As of March 26, 2024 port arrivals in Côte d’Ivoire are less compared to the previous year. This decrease has been consistent since the beginning of the season, but the gap has slightly decreased. If we started with a decrease of less than 30% and reached 36%, we are currently at a level of 26%. Following the most negative forecasts we will see a number exceeding 40% decrease at the end of the season. On the other hand, positive forecasts suggest that the deficit will not exceed 25%.

A total of 1,280,000.00 tons have been delivered to the ports. These data are more or less final, as we only need to obtain data for the last week of March, and we won’t see much of a difference. It will be good news if the figure is above 1,300,000.00 tons.

According to reports from Ghana as of March 26, it has been announced that the harvest will be the lowest in 22 last years, estimated at a level between 422,500.00 and 425,000.00 tons.

FOB West Africa ratios have stabilized at the following levels for March 2024 deliveries.

Cocoa mass

2.05 and demonstrating a stable trend towards 2.15 from the 3rd to the 4th quarter of 2024. At the current level on the exchange, the price will be about 19,000.00 euros/t spot.

Natural cocoa butter

3.05 for natural cocoa butter and an uptrend for the next 4 quarters that may bring it to 3.50. The price at the current levels of the exchange will be about 29,500.00 euros/t spot.

Cocoa powder

The ratio for cocoa powder has decreased since the last month. The ratio is at the level of 0.56 compared to the stock price. As of today, the exchange price in euros comprises 9,600.00 euros/t.

Natural cocoa powder is at 5,200.00 euros/t.

Alkalized cocoa powder is at 5,600.00 euros/t.

Please find below the graph of Ratio for cocoa powder.

2. Technical analysis

Automatic purchases by hedge funds and exchange resellers have, unfortunately, completely disrupted the entire cocoa futures trading landscape. Let’s recollect the following important events in the cocoa market:

– March 31st – end of the main harvest.

– April 4th – May options expired on the New York Mercantile Exchange.

– April 18th – release of statistics covering cocoa processing data worldwide.

Below on the Elliott Wave analysis chart, we can see level forecasts on the New York Stock Exchange ranging from $10,000.00 to $11,000.00 per ton, where a turnaround can theoretically occur.

However, we are not likely to see low prices in the near future, even considering a possibility of price reversal.

More likely, prices will stabilize around the 10-50 day moving average in the market for the second trading month (July), which is approximately 5,200.00-6,000.00 pounds per ton. The current level is 7,500.00.

According to data from the tradingeconomics.com website, we can expect a decrease in prices from current levels to $9,000.00 per ton on the New York Stock Exchange on average over the next 365 days.

According to GOV Capital’s forecasts, the average price for the nearest year will comprise $11,809.00 per ton, and for the next 5 years it can reach an average price of $22,682.00 per ton.

None of the forecasters expect prices to drop below $8,400.00 per ton in the upcoming year (currently, as of 28 March, 2024 the price is $9,950.00 per ton).

WEATHER

Some positive news: according to available forecasts, the weather will remain favorable for cocoa bean growth in the near future.

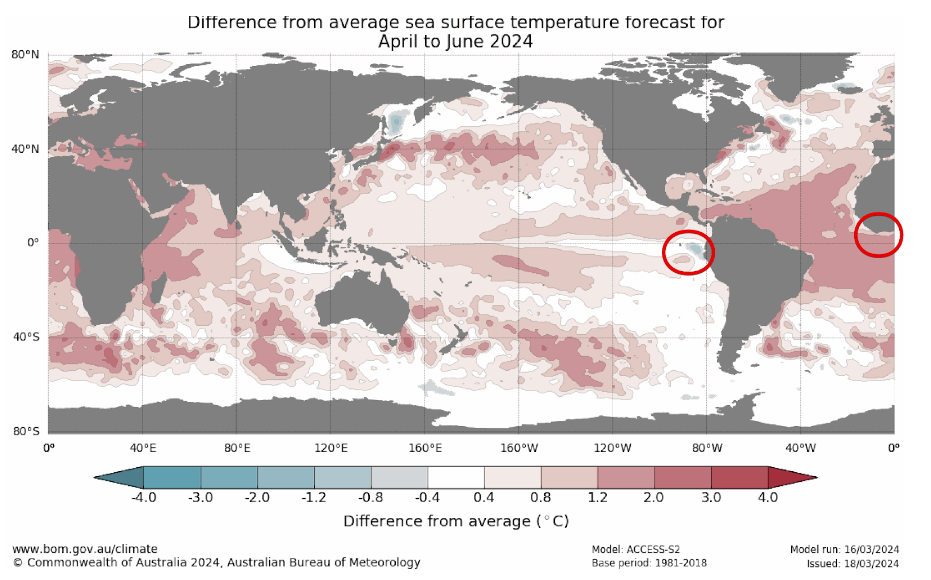

On the map of undercurrents, we can observe the formation of a cold blue spot off the coast of South America, where heavy rainfall has predominated recently. This has been detrimental to the cocoa crop in Ecuador. Now, however, the rainfall will be moderate, which will favor the cocoa crops in South American countries.

Besides, on the right edge of the map, we can see a large red spot off the coast of West Africa, which will evaporate and fall down as rain over the territories of cocoa-producing countries.

Based on this preliminary data, our forecast is that the next cocoa bean harvest will be significantly better than the current one.

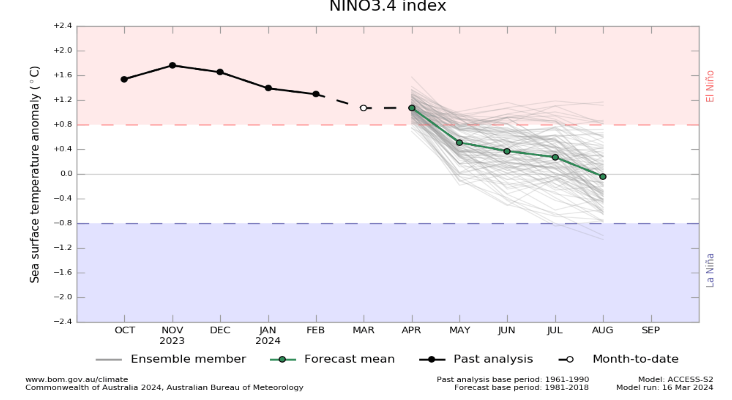

We also see a forecast of weakening El Niño effects in the graphs below, which will change weather conditions to be more favorable for cocoa and numerous other agricultural crops.