Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET – NOVEMBER 2024

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2024/2025

The cocoa harvest season in Côte d’Ivoire is ongoing, and we have excellent data on bean arrivals at the port. As of 21st of November 643,000.00 tons have been delivered to the ports, surpassing all previous harvest seasons at this stage. These are record-breaking figures, with a 34% increase compared to the same period last season.

Initially, many anticipated that the 2024/2025 harvest in Côte d’Ivoire would yield at least 2 million tons. However, after two months of harvesting, this forecast has been adjusted down to 1.85–1.9 million tons. The update is due to heavy rains from August through late October.

Such heavy rainfalls prevent new pods from forming, hinder flowering, and disrupt proper pollination.

As a result, it is expected that port arrivals in Côte d’Ivoire will be significantly weaker by late February/early March, and the main harvest season will conclude earlier than usual.

Therefore, making conclusions about total yields, despite current record arrivals, is premature. While a stronger harvest than last year is anticipated, the yield is still expected to be less than the average of the previous three years.

The market continues to face a physical shortage of cocoa beans.

Certified stocks in U.S. warehouses declined in November, hitting a minimum not seen in at least 10 years. As of November 27, the stock count is 1,585,000.00 bags, amounting to less than 100,000.00 tons.

EU Certified stocks declined to less than 20,000.00 tons.

Lumpsum it is less than 2 weeks of global grinding if we do not take in account the fresh arrivals from origin, that start to arrive now in European ports, at least for next couple of month physical shortage is not an issue, but could be a topic again next autumn.

In the third quarter Cameroon exported only 6,276.00 tons, which is a 71% less compared to the previous year.

As of November 27, the export price in Cameroon stood at 5,656.00 CFA, or approximately $9,000.00 per ton of cocoa beans.

Ghana raised its price to farmers for the third time this year, now the price is at 49,600.00 CEDI (previous price was 48,000.00), equivalent to $3,150.00 per ton.

In Côte d’Ivoire, the price for farmers comprises 1,800.00 CFA, or about $2,900.00 per ton.

Due to the prices increase for farmers, Ghana’s harvest is projected at around 650,000.00 tons, significantly higher than the 450,000.00 tons recorded in the 2023/2024 season but well below the initial forecast of 800,000.00 tons.

Ecuador’s harvest is expected to decline to 440,000.00 tons, which represents a 5% drop compared to the previous year.

The cocoa butter ratio currently stands at 3.1, marking a substantial correction from peak levels of over 4 points during the summer of 2024.

The cocoa liquor ratio is at 2.10, with a slight downward adjustment expected throughout 2025.

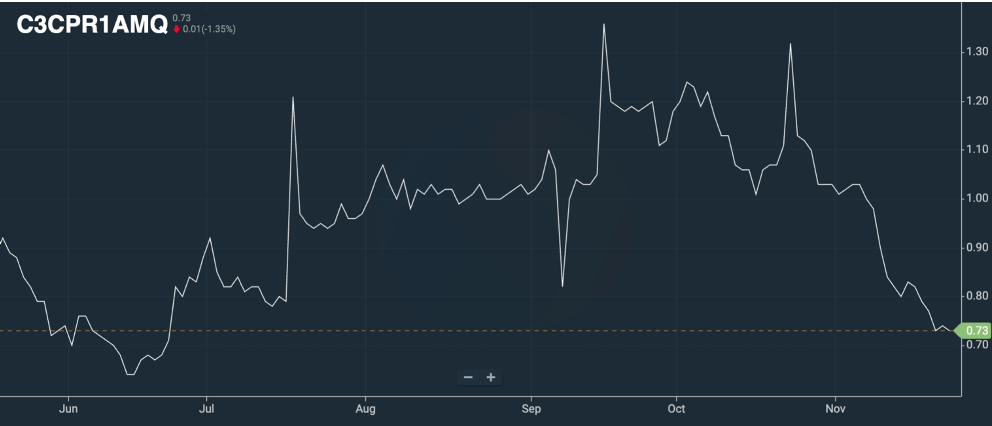

The cocoa powder ratio is at 0.73, showing a significant decline; however, the final product price remains unchanged compared to the previous month.

The ratios for FOB West Africa terms are as follows for December 2024 deliveries:

Cocoa Liquor:

2.10, with a steady downward trend expected to reach 1.95 by 1–2 quarters of 2025. At current market levels, the price is projected to be around €19,300.00 per ton in the fourth quarter.

Natural Cocoa Butter:

3.10 for natural cocoa butter with a declining trend over the next four quarters down to 2.85. At current market levels, the price is expected to be approximately €28,500.00 per ton in the first/second quarters.

Cocoa Powder:

The ratio for cocoa powder is almost unchanged from last month. The ratio stands at 0.73 compared to the Exchange. The exchange price currently stands at €9,250.00 per ton.

Natural Cocoa Powder starts from €6,750.00 per ton.

Alkalized Cocoa Powder starts from €7,000.00 per ton.

2. Technical Analysis

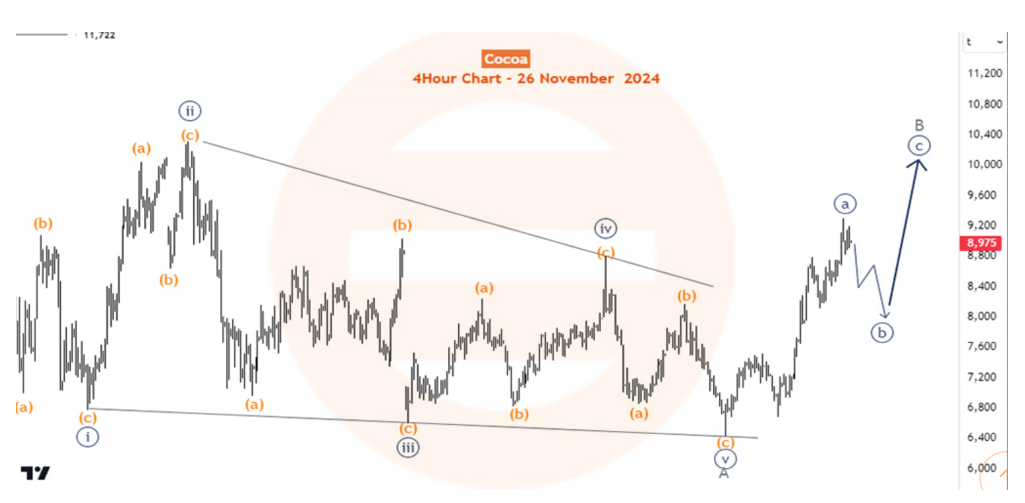

In November, prices were influenced by speculative purchasing and the rollover of hedge positions from December to March. Our advice to clients remains the same: buy any price correction, as it may be short-lived. With current market volatility, daily price swings exceeding $500 are possible.

The New York market shifted its direction, experiencing explosive growth without any fundamental justification. For now, it will likely trade within the $8,000–$10,000 per ton range for March 2025 contracts.

It is likely that the end of October marked the bottom of the short-term correction. Currently, the market appears to be in a zigzag growth pattern (a-b-c). We believe that the peak of wave “a” will occur at the end of November. This will be followed by a 10–15% correction from the final price.

Subsequently, prices will rise toward $10,000 per ton, potentially even higher.

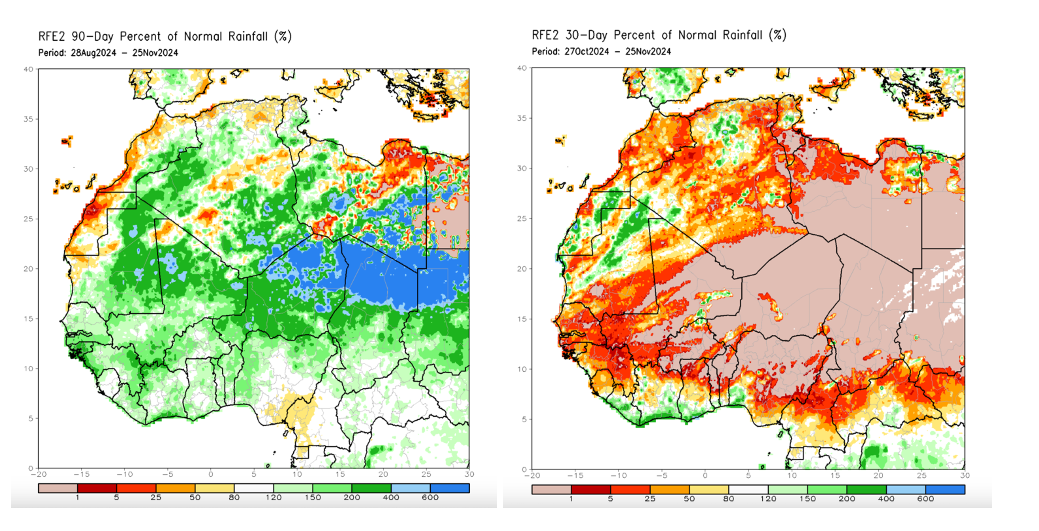

Weather

Rainfall levels in West Africa over the past 90 and 30 days are close to normal. However, in the past month, drier weather has been observed north of the coast, particularly in cocoa-growing regions. However, taking into account the 90-day table, soil moisture levels are still sufficient to sustain the trees. For now, this weather pattern contributes to harvesting activity, as reflected in cocoa bean arrivals at the ports. Nevertheless, we remain cautious about expecting a good harvest, as we have previously explained.