Cocoa Market Report

Market Reports

COCOA MARKET TRENDS – APRIL 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2024/2025

The main cocoa harvest season in Côte d’Ivoire has come to an end. We are seeing increasingly weaker data on cocoa bean deliveries to ports — the trend line suggests that by the end of the mid-crop (summer harvest), we will likely drop to last year’s levels. As of April 21, 1,480,000.00 tons have been delivered to the ports, which means we are ahead of last year’s harvest figures by 10.7%. However, this is still 11.5% lower than the five-year average.

The main crop was better than the previous year, but still not good enough — it is likely that we will see a fourth consecutive year of deficit.

Côte d’Ivoire has raised the farmgate price of cocoa beans from 1,800.00 CFA to a likely 2,200.00 CFA, the increase comprised 22%.

As a result, Côte d’Ivoire will be restricting cocoa bean exports to ensure sufficient raw material for local processing.

Rumors suggest that by 2030, the government’s plan is for the entire cocoa harvest to be processed domestically. While this is a good plan in theory, we believe it is unrealistic within the next five years.

Ghana last released last data on February 26, 2025, showing port arrivals and total harvest volume at 560,250.00 tons which is 2.8% higher than the five-year average.

The market continues to experience a physical shortage of cocoa beans.

Certified stock in U.S. warehouses increased slightly in March. As of April 30, the number of bags stands at just over 1,900,000.00 which corresponds to approximately 120,000.00 tons.

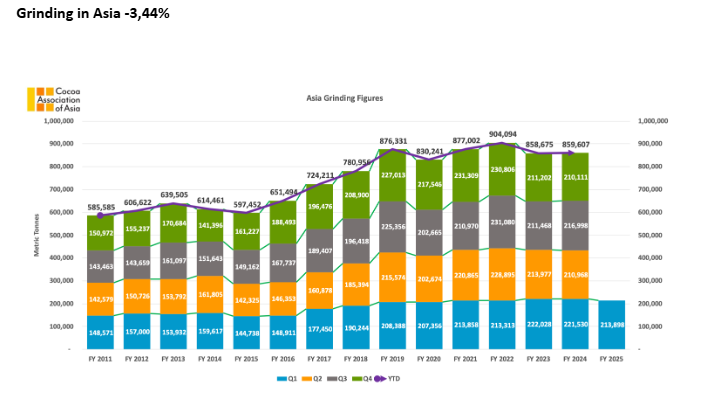

Global cocoa processing in the first quarter exceeded expectations. The total decline in processing was less than 25,000.00 tons, which is a very minor figure. Expectations had been for a decline of 6–7%, or around 50,000.00 tons.

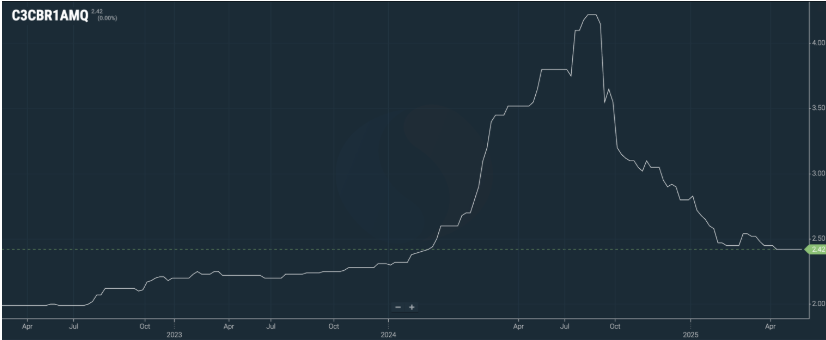

The cocoa butter ratio is currently at 2.42, following a significant correction from the peak levels of over 4 ratio points during the summer of 2025. The actual price is stable, with a slight possible increase expected over the next two quarters.

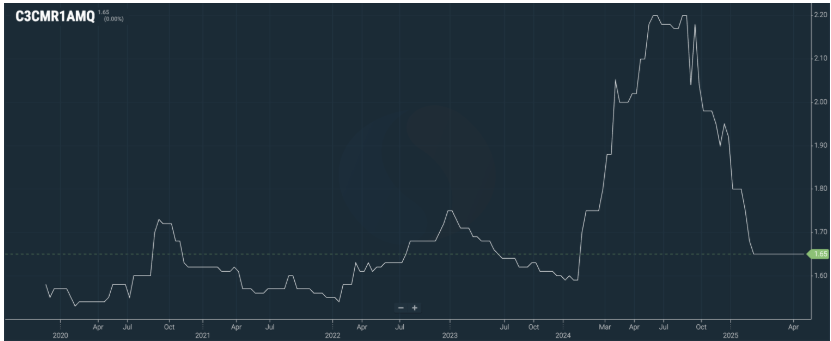

The cocoa liquor ratio is at 1.65, showing a slight upward trend throughout 2025.

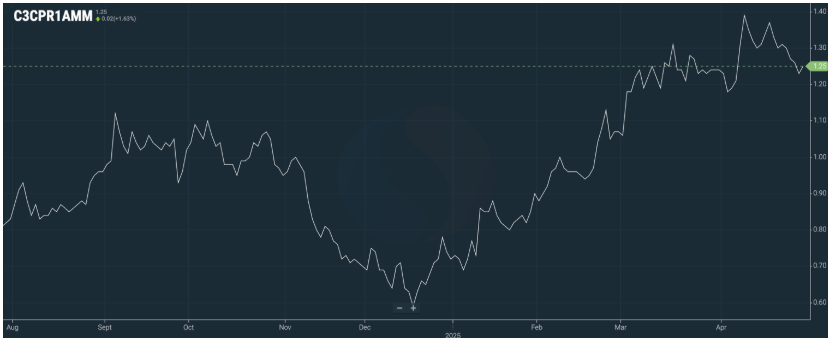

The cocoa powder ratio is at 1.25, virtually unchanged compared to the previous month; the final product price has not changed.

As of today, the exchange price in euros is €7,400.00 per ton.

The FOB West Africa ratio levels spot deliveries are as follows:

Cocoa Liquor

1.65 with a steadily rising trend toward 1.8 by 4th quarter of 2025. At the current exchange level, the price for the 2nd quarter is expected to be around €12,200.00 per ton.

Natural Cocoa Butter

2.42 for natural cocoa butter, with a stable upward trend over the next four quarters, reaching 2.9. At the current exchange level, the price for the 2nd quarter would be approximately €18,000.00 per ton.

Cocoa Powder

The cocoa powder ratio has remained nearly unchanged since last month. The ratio stands at 1.25 relative to the exchange price.

Natural cocoa powder from €9,400.00 per ton

Alkalized cocoa powder from €9,650.00 per ton

2. Technical Analysis

In mid-April, the markets reached their lowest level in the past 12 months. Having completed a deeper correction than expected, the previous forecast for a price increase remains valid.

It is likely that we reached the bottom of the correction in mid-April in the short term.

Our advice to clients remains the same: buy any price correction. As it may be short-lived, with the current market volatility, we could see movements exceeding $1,000.00 per day.

The number of long positions (expecting price increases) has been growing for the third consecutive week.

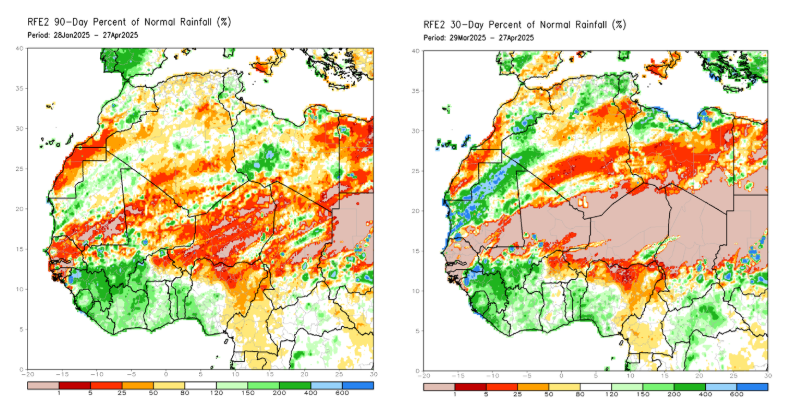

Weather

Rainfall in West Africa over the past 30 and 90 days has been above average. For the past three months, we have seen heavy rains, which will likely support good harvest figures by late July/August and lay a solid foundation for the formation of the next main crop. However, in the short term, this is causing damage to the mid-crop of the 2024/2025 season.