Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET February 2024

1. Season 2023/2024

As of February 26, 2024 the port arrivals in Côte d’Ivoire are less compared to the previous year. This decrease has been consistently present since the beginning of the season, but the gap has slightly decreased. Starting with the decrease trend being less than 30%, it reached 36%, and now we are at the level of 30%. Following the most negative forecasts we will see a number exceeding 40% decrease at the end of the season. On the other hand, positive forecasts suggest that the deficit will not exceed 25%. 1,163,000.00 tons have been delivered to the ports. If we transfer the decrease into numbers, a year ago on same dates, 1,680,000.00 tons were delivered to the ports; so the decrease is of 520,000 tons, and most likely, this figure will not change by the end of the year. The harvest is expected to be within the range of 1,700,000.00 to 1,800,000.00 tons.

In Ghana, a harvest of 492,000.00 tons is forecasted, which is 189,000.00 tons less than in the previous season when 683,000.00 tons were harvested, and 330,000.00 tons less than Ghana planned to harvest this year.

In Nigeria, there is also a 25% decrease. In terms of tons, this will amount to approximately 50,000.00 tons.

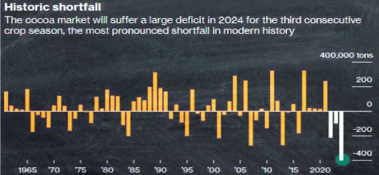

The total deficit in West Africa will comprise about 900,000.00 tons. This figure represents approximately 2 months of global cocoa bean consumption. Global reserves normally allow 4-5 months of ongoing processing; however, in October 2024, we will see that the global reserves will decrease to 2-3 months. Considering the fact that cocoa does not immediately reach processors after the start of the harvest, we can very well forecast a situation where on December 1, 2024, there will be no cocoa beans stock available to most processors.

These data are available not only to us. In February 2024, the main three processors: Barry Callebaut, OFI (Olam), and Cargill announced that they were not accepting new orders for cocoa butter, thereby causing a shortage of cocoa butter and cocoa powder. Cocoa powder prices have skyrocketed by more than $1000 per ton.

Below is the graph showing the strongest deficit in the industry history and the third consecutive deficit plagued year that awaits us.

The capital stocks of major chocolate processors or manufacturers are experiencing strong pressure from the market.

For example, within one calendar year, the price of cocoa beans has increased by £3000 per ton, i.e. by 157%.

Nestle stocks are decreasing by 11%.

Barry Callebaut stocks are decreasing by 34%.

OLAM stocks are decreasing by 38%.

Hershey stocks are decreasing by 21%.

FOB West Africa ratios have stabilized at the following levels for March 2024 deliveries. Ratios stopped decreasing and is increasing due to the news about the current shortfall together with the exchange price.

Cocoa mass

1.65 and demonstrating a stable trend towards 1.8 from the 2nd to the 4th quarter of 2024. At the current level on the exchange, the price will be about 11,100.00 euros/t in the 1st quarter.

Natural cocoa butter

2.45 for natural cocoa butter and an uptrend for the next 4 quarters that may bring it to 2.85. The price at the current levels of the exchange will be about 16,500.00 euros/t in the 1st quarter.

Cocoa powder

The ratio for cocoa powder has decreased since the last month. The ratio is at the level of 0.60 compared to the stock price. As of today, the exchange price in euros comprises 6,750.00 euros/t.

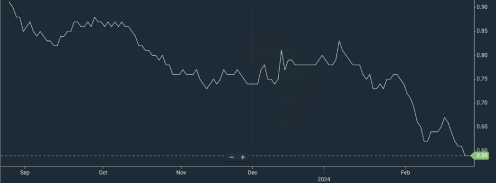

The diagram demonstrates a descend that is proportional to the prices increase on the cocoa bean stock exchange. Therefore, we will not see changes in the price for cocoa powders and ratio sudden changes in the next 3-4 quarters.

Natural cocoa powder is at 4,100.00 euros/t.

Alkalized cocoa powder is at 4,400.00 euros/t.

Please find below the graph of Ratio for natural cocoa powder.

2. Technical analysis

The price diagram for cocoa beans continues to move in an ascending channel, which began more than a year ago. The price has increased by more than £2500 per ton in the past 2 months, and we continue to move within the channel. Since the channel is ascending, each new day sets new upper limits.

The market has broken the previous wave counting model and is in the ascending 5th wave of growth. It is entirely possible that the level will be limited by Fibonacci projection at $7,000 per ton on the New York Mercantile Exchange.

The following important dates for the cocoa bean market may lead to the closing of long positions (in growth) by hedge funds on one of these dates. In the last 3 weeks, we have noticed a gradual reduction in long positions. The market has always lived according to the principle “Buy the rumor, sell the fact” so March 31 seems like a good date to sell the fact of a crop failure.

1st of March – expiration of options on the London Commodity Exchange

15th of March – expiration of March futures

31st of March – end of the main harvest

4th of April – expiration of May options on the New York Mercantile Exchange.

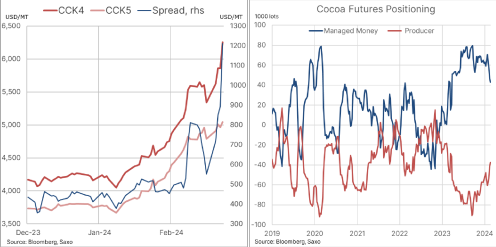

Below, on the first graph on the left, is the spread (price difference) between May 2024 and May 2025. In principle, a structure where the next month is cheaper than the previous one is a signal for growth, but in our case, growth is more likely to occur in the following month.

On the second graph, the blue line represents hedge fund positions on cocoa bean prices increase. We observe a decrease in positions, indicating a correction in the nearest future if the news background

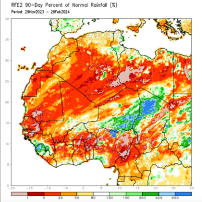

WEATHER

Weather conditions in West Africa are not stable. If 5 weeks ago we saw a fairly good picture in terms of precipitation for 30 and 90 days, then the last 5 weeks have been extremely dry. We have entered the season of Harmattan, a hot wind from the Sahara. And most likely, El Nino also contributes to the situation. Should the rains not start soon, the chances of a good harvest in 2024/2025 season are diminishing before our eyes. We shall closely monitor the weather news, since another poor harvest year could throw the entire cocoa industry into depression.