TRENDS AND MAIN EVENTS IN THE COCOA MARKET

Market Reports

COCOA MARKET TRENDS – AUGUST 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Hedgepoint

1.Season 2024/2025

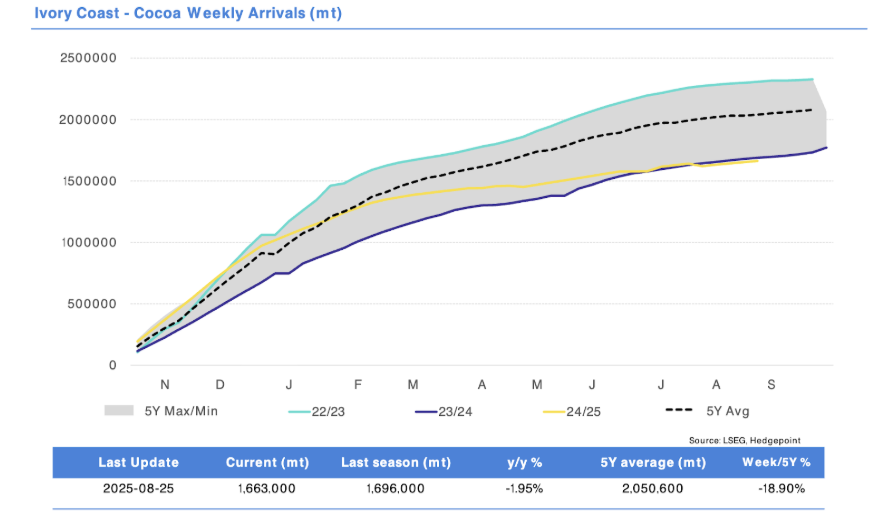

The harvest in Côte d’Ivoire is running slightly behind last year’s extremely deficit crop. Most likely, we are facing the fourth consecutive deficit year.The market continues to closely monitor fundamental supply data, especially the progress of the 24/25 harvest in West Africa, which remains a key factor in price formation. For now, the outlook is moderately positive regarding the upcoming crop. However, the market continues to experience a physical shortage of cocoa beans despite the decline in processing.

Certified stock in U.S. warehouses slightly decreased in August. As of August 28, the number of bags amounts to just over 2,164,000.00 which is about 135,000.00 tons.

Cocoa bean differentials remain at high levels compared to previous years.

Mostly due to these high differentials, Ghana plans to pay farmers up to 70% of the world price for cocoa beans on the futures market. However, the calculation method for these prices—given the country’s long-standing financial issues—raises many questions. There is no clear formula.

The ratio for cocoa butter is currently at 2.17, unchanged over the month, but it appears that the price decline has stopped. The actual price is stable, with a possible slight increase over the next two quarters.

The ratio for cocoa liquor is at 1.59, showing a slight upward trend throughout 2025.

The ratio for cocoa powder is at 1.45, with the final product price unchanged.

As of today, the exchange price in euros stands at €6,300.00/ton.

FOB West Africa Ratios for spot deliveries:

Cocoa Liquor

1.59, with a steady upward trend toward 1.72 by the 1st quarter of 2026. At the current exchange level, the price for the 3rd quarter will be around €10,100.00/ton.

Natural Cocoa Butter

2.17, with a stable upward trend over the next 4 quarters, reaching 2.55. At current exchange levels, the price in the 2nd quarter will be about €13,700.00/ton.

Cocoa Powder

The ratio has barely changed since last month, remaining at 1.45 relative to the exchange market.

Natural cocoa powder: starting from €9,100.00/ton

Alkalized cocoa powder: starting from €9,200.00/ton

2.Technical Analysis

In August, markets fluctuated on news of yet another poor harvest as well as declining demand. The market broke through several support levels, and we have redrawn new support and resistance levels.

At the moment, we are finishing the 4th corrective growth wave, from which we will most likely see another downward wave, followed by the start of the next growth wave.

If the New York exchange price holds below $7,300.00/ton over the next 5–10 trading sessions, we will enter a period of lower prices.

Our advice to clients remains unchanged: buy into any price correction, as it may be short-lived. With current market volatility, we can see daily moves of more than $1,000.00.

However, it is important not to forget that funds, which dictate market price direction, may start buying on weather-related news. We will elaborate on this below. This risk factor should not be underestimated: if it materializes, by year-end we may see prices on the New York exchange reaching $10,000.00/ton and above, as we still see an unfinished wave 5 heading towards 12 000+ USD/t on the daily chart.

Despite weaker demand, we are living in a period of shortage of quality cocoa beans.

WEATHER

Rainfall in West Africa over the past 90 days has been normal. For the past three months, we have seen stable precipitation, which will likely support a good harvest in September/November and lay a strong foundation for the next main crop.

However, over the past 30 and 60 days, there has been a dry spell. On the weather map, we see a large red zone in Côte d’Ivoire and nearby western countries, which will undoubtedly affect export data in February–March 2026.

Therefore, we would recommend shipping cocoa beans to Europe no later than the end of January 2026.