TRENDS AND MAIN EVENTS IN THE COCOA MARKET

Market Reports

NOVEMBERCOCOA MARKET TRENDS – DECEMBER 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Hedgepoint

1.Season 2025/2026

Cocoa in Côte d’Ivoire:

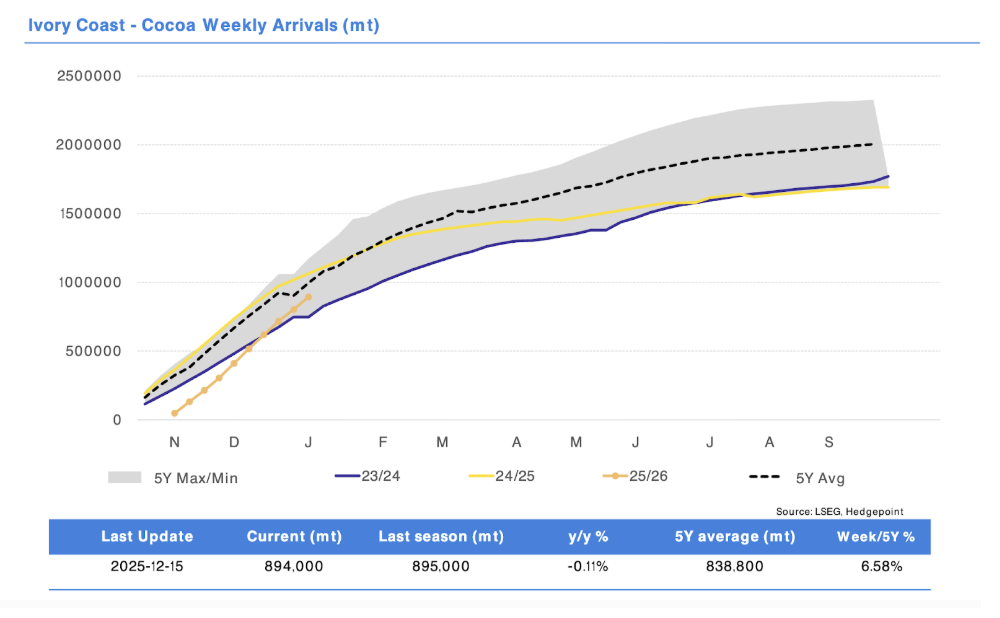

The forecast for this year’s cocoa harvest in Côte d’Ivoire remains more or less optimistic. Port arrival figures have improved over the past month, although last week data showed us quite a low number, raising concerns, and let to rapid price growth. Port arrivals reaching 1 002,000.00 tons delivered to ports, compared with 1 027,000.00 tons a year earlier. However, these figures are worse than the average of the past five years.

Barry Callebaut is exploring the possibility of separating its cocoa business from its overall chocolate business due to the volatility of cocoa bean prices. The market reacted positively to this news, with the company’s shares rising by up to 10% at one point.

The cocoa surplus for the 2025/2026 season was reduced by the ICCO from 142,000.00 tons to 49,000.00 tons. Rabobank also lowered its estimate from 328,000.00 to 250,000.00 tons, while Citigroup cut its surplus forecast from 134,000.00 to 79,000.00 tons.

As a reminder, cocoa futures were added to the Bloomberg Commodity Index, and it is expected that this could attract up to USD 2 billion in additional investment into cocoa market. We are not confident that this will drive prices higher, but price volatility is certain to remain high.

The EUDR has officially been postponed for the second time, with a new effective date of 1 January 2027 for medium and large companies.

Certified stocks in U.S. warehouses declined by 4% in December. As of 22 December, the number of bags stands at just over 1,625,000,00 which is less than 100,000.00 tons.

Differentials on cocoa beans have been pushing product differentials higher in recent weeks. This is already being reflected in ratio prices, and we are seeing a reversal trend of ratios for cocoa products.

The cocoa butter ratio is currently at a level of 1.95. The outright price has also fallen along with cocoa bean prices, although a modest increase may be possible over the next two quarters.

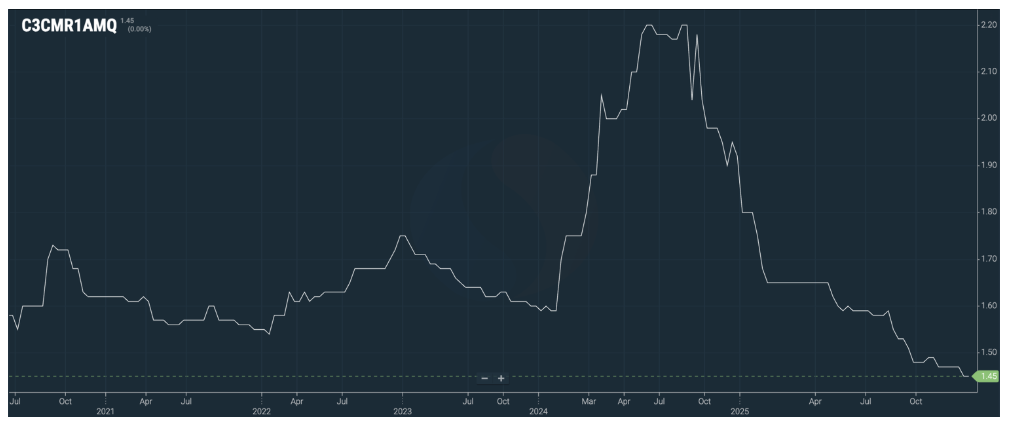

The ratio for cocoa liquor is at 1.45, with an upward trend expected throughout 2026.

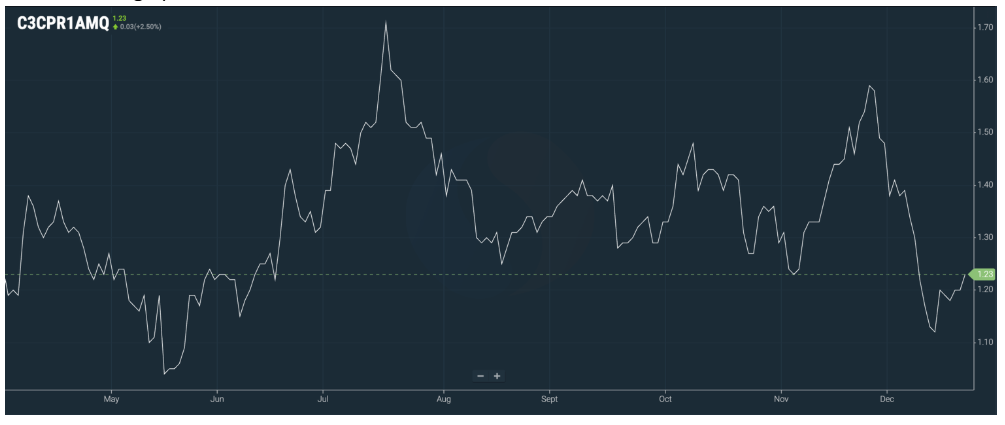

The ratio for cocoa powder is 1.23; the final product price has slightly decreased due to changes in cocoa exchange prices.

As of today, the exchange price in euros is EUR 5,175.00 per ton.

FOB West Africa ratios for spot deliveries are at the following levels:

Cocoa liquor

Ratio: 1.45, with a steady upward trend toward 1.55 by the 3rd quarter of 2026.

At the current exchange level, the price for the 1st quarter is expected to be around EUR 7,500.00 per ton.

Natural cocoa butter

Ratio: 1.95, with a stable upward trend over the next four quarters, reaching 2.15.

At current exchange levels, the price for the 2nd quarter is expected to be around EUR 10,100.00 per ton.

Cocoa powder

The cocoa powder ratio has increased slightly compared with last month and currently stands at 1.23 relative to the exchange.

Natural cocoa powder: from EUR 6,300.00 per ton

Alkalized cocoa powder: from EUR 6,400.00 per ton

2.Technical Analysis

Markets showed a technical upward correction in December.

At the moment, we are likely completing, or have already completed, the second wave of decline on the short 30-minute chart. Given the strong impulse that drove prices higher at the beginning of December, it is most likely that short term we are trading higher than November lows, but this scenario leaves us a possibility still to see lower prices , if the level 6475 on NY stands.

Our advice to clients remains unchanged: buy any price corrections. The market has significant upside potential, although some year-end correction to the downside is possible.

It should not be forgotten that funds, which largely dictate market price direction, may begin buying on news of poor weather conditions or weak cocoa bean arrivals at ports, or may start interpreting positive news in a negative light.

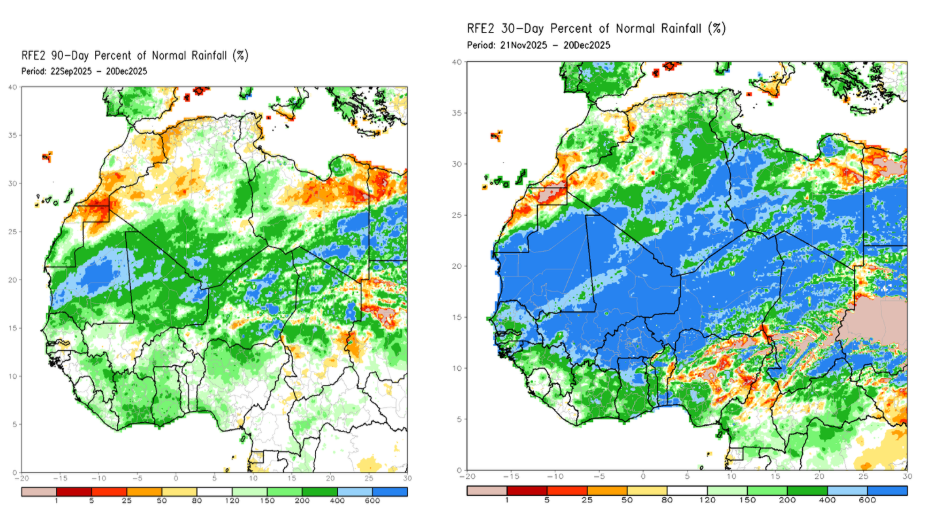

WEATHER

Rainfall in West Africa over the past 30 and 90 days has been significantly above normal; such charts are rare. This should have an impact on pod development during the May–June 2026 harvest period, provided that no flooding of trees and no development of fungal diseases affecting cocoa trees happens.