Cocoa Market Report

Market Reports

COCOA MARKET TRENDS – JULY 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1.Season 2024/2025

Cocoa prices were under pressure in July, mainly due to second-quarter processing results published by the world’s major industry associations: ECA (-7.2%), CAA (-16.3%), NCA (-2.8%). Nevertheless, the RSI (Relative Strength Index) signaled a technical rebound on Friday, July 25, after exiting oversold zone, reflecting a price relief at the end of the week.

This movement occurs against a backdrop of mixed signals in global demand.

While net imports into the EU remain 7.2% below last year’s level, indicating a potential decline in processing activity in Europe, the USA recorded a 46% increase year-to-date, which may have limited the drop in USA processing.

In addition to supply and demand dynamics, the market was also affected by new tariffs announced by the USA on products from countries such as Brazil, Indonesia, and Malaysia, which are major suppliers of cocoa products. This measure increases the perception of domestic inflation risk and could affect both raw material demand and the potential for further interest rate cuts in the U.S., adding uncertainty to the macroeconomic outlook.

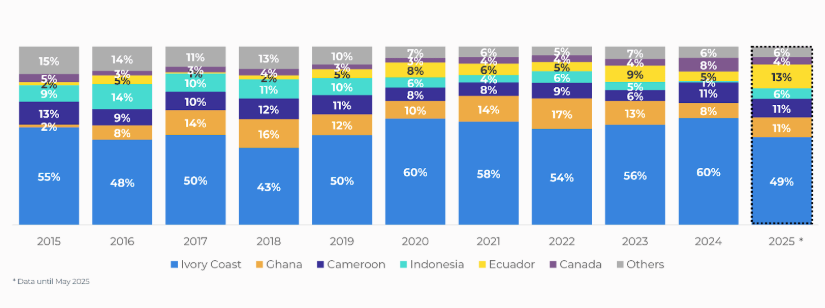

USA imports of cocoa liquor by country.

USA imports of cocoa butter by country.

USA imports of cocoa powder by country.

Given the new tariff agreements between the EU and the USA as of July 27, 2025, importing cocoa products from the EU will be more cost-effective than doing it from Asia. This could significantly impact global processing figures as early as the 4th quarter of 2025.

The market continues to closely monitor supply fundamentals, particularly the progress of the 2024/25 harvesting in West Africa, which remains a key factor of price formation. So far, the forecast is moderately positive for the upcoming crop. However, the market still faces a physical shortage of cocoa beans, despite the decline in processing.

The certified stock in USA warehouses remained unchanged in July. As of July 28, 2025 the number of bags totals just over 2,359,000.00 units, equivalent to about 150,000.00 tons.

The cocoa butter ratio currently stands at 2.17, marking a notable correction from peak levels above 4 ratio points. The actual price remains stable, with a slight increase possible over the next two quarters.

The ratio for cocoa liquor is at 1.59, with a slightly upward trend throughout 2025.

The ratio for cocoa powder stands at 1,52, with no changes to the product final price.

As of today, the exchange price in euros is at € 6,400.00 per ton.

FOB West Africa ratios for spot deliveries are at the following levels:

Cocoa Liquor

Ratio is at 1.59, with a stable upward trend toward 1.75 by the 1st quarter of 2026.

At the current exchange market levels, the price for the 3rd quarter would be approximately € 10,200.00 per ton.

Natural Cocoa Butter

Ratio is at 2.17, with a steady upward trend over the next four quarters, reaching 2.55.

At current exchange market levels, the price for the 2nd quarter would be approximately €13,900.00 per ton.

Cocoa Powder

The ratio for cocoa powder has remained nearly unchanged from last month.

Current ratio stands at 1.52 relative to the exchange price.

Natural cocoa powder price starts at €9,450.00 per ton

Alkalized cocoa powder price starts at €9,650.00 per ton

2.Technical Analysis

In June, markets fluctuated on news of yet another poor harvest as well as declining demand. The market broke through several support levels, prompting a re-drawing of new support and resistance zones.

We are currently completing the 4th corrective wave of the uptrend, from which we will most likely see another downward wave, followed by the next upward impulse.

Our advice to clients remains unchanged: buy any price correction, as it may be short-lived. Given the current volatility, we are seeing daily price swings of over $1,000.00.

WEATHER

Rainfall levels in West Africa over the past 90 days have been within normal ranges.

For the last three months, we’ve seen consistent rainfall, which will likely support good harvest figures in September and lay a solid foundation for the formation of the next main crop.

However, in the past 30 days, a dry spell has been observed.