Cocoa Market Report

Market Reports

COCOA MARKET TRENDS – JUNE 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2024/2025

The mid-crop harvest season in Côte d’Ivoire continues with varying degrees of success.

We are seeing increasingly weak data regarding cocoa bean arrivals at ports. The trend line suggests that by the end of the mid (summer) harvest, we are likely to drop down to last year’s figures.

As of June 29, 1,613,000.00 tons have been delivered to ports, and based on this data, we are still ahead of last year’s harvest season, ahead by 1.1% compared to the previous season.

There is a high probability that we will see the fourth consecutive year of deficit. Additionally, cocoa bean processing in Côte d’Ivoire declined by 8.5% in May, which certainly raises concerns about the availability of cocoa beans in the country.

Côte d’Ivoire plans to process up to 50% of its harvest domestically by 2027.

What results will this lead to?

Most likely, to higher domestic taxes and restrictions on cocoa bean exports.

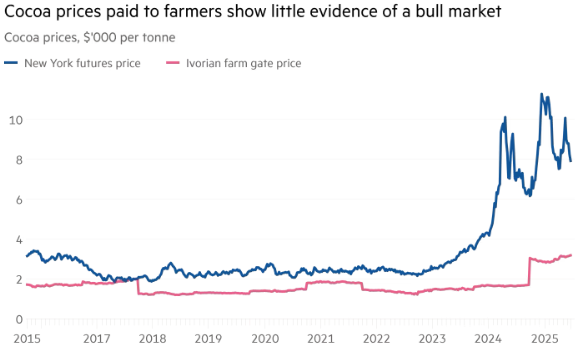

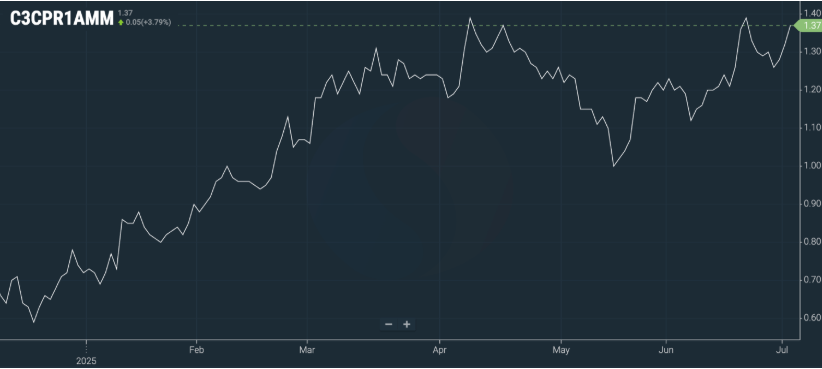

Below is a chart in US dollars showing the price paid to farmers compared to the market exchange price.

According to farmers, production costs are higher than what the government pays.

![]()

The chart above shows cocoa yield compared to other crops.

It clearly demonstrates a lag behind other crops. This reflects soil fatigue and the age of the cocoa trees.

Higher cocoa prices may potentially encourage new cocoa tree plantings.

The market continues to experience a physical shortage of cocoa beans.

The certified stock in U.S. warehouses slightly increased in March. As of June 30, the number of bags stands at just over 2,320,000.00 pieces, which equals approximately 145,000.00 tons.

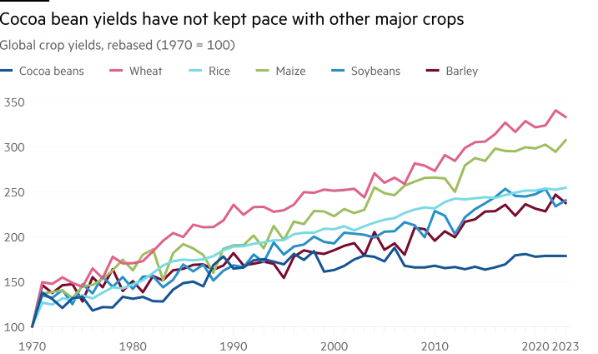

The ratio for cocoa butter is currently at 2.15, following a significant correction from peak levels of over 4 ratio points. Despite this, the actual price remains stable, with a slight potential increase over the next two quarters.

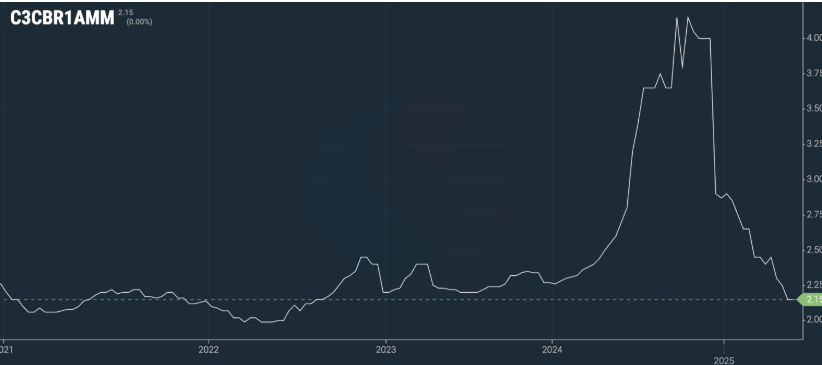

Cocoa liquor ratio comprises 1.59, with a slightly upward trend throughout 2025 year.

Cocoa powder ratio comprises 1.37, with no change in the final product price.

As of today, the exchange price in euros comprises €7,000.00 per ton.

FOB West Africa spot shipment ratios are at the following levels:

Cocoa Liquor

Ratio is at 1.59, with a steady upward trend toward 1.75 by the 1st quarter of 2026 year.

At current market levels, the price in the third quarter is expected to be around €11,100.00/ton.

Natural Cocoa Butter

Ratio is at 2.15, with a stable upward trend for the next 4 quarters, expected to reach 2.65.

At current exchange levels, the price for the second quarter would be approximately €15,500.00/ton.

Cocoa Powder

The ratio has remained virtually unchanged from last month, currently it is at 1.37 relative to the exchange.

Natural cocoa powder price starts from €9,450.00/ton

Alkalized cocoa powder price starts from €9,650.00/ton

2. Technical Analysis

Markets in June fluctuated based on news of yet another poor harvest, as well as reports about declining demand. The market broke through several support levels, and we have redefined new support and resistance levels.

It is likely that during the summer we will reach (if we haven’t already) the bottom of the correction in the short term, from which a new wave of growth may begin.

Our advice to clients remains the same: buy into any price correction, as it may be short-lived.

Given the current market volatility, we may see daily price moves exceeding $1,000.00.

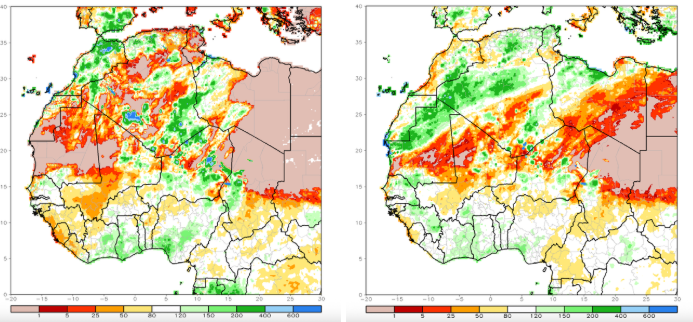

Weather

Rainfall levels in West Africa over the past 30 and 90 days have been within normal ranges.

Over the last 3 months, we’ve seen a good amount of rain, which should help us see better harvest figures in August and will likely lay a solid foundation for the development of the next main crop.

Source: Refinitiv, Hedgepoint