Cocoa Market Report

Market Reports

COCOA MARKET TRENDS – MAY 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Rabobank

1. Season 2024/2025

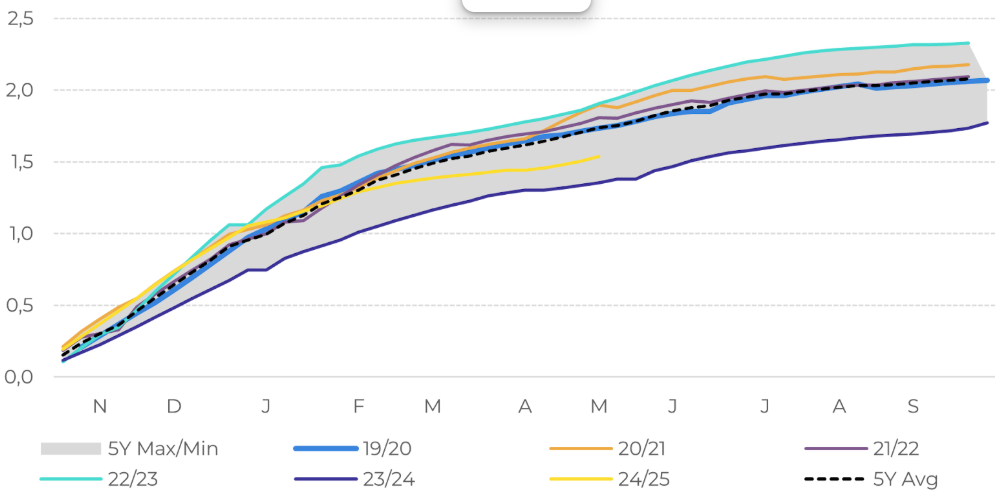

The mid-crop season in Côte d’Ivoire continues with variable success. We are observing increasingly weak data on cocoa bean arrivals at the ports. The trend line suggests that by the end of the mid (summer) harvest, we will likely return to last year’s levels. As of May 26, 1,590,000.00 tons have been delivered to the ports. Based on this data, we are ahead of last year’s harvest by 9.1%.

The main crop was better than the previous year, but not good enough and, as a result, we are very likely to see a fourth consecutive year of deficit.

![]()

Ghana is also unlikely to meet its original target of 650,000.00 tons.

Currently, it is expected that port arrivals by the end of the season will total 600,000.00 tons.

The market continues to experience a physical shortage of cocoa beans.

Certified stock in USA warehouses slightly increased in March. As of May 30, the number of bags stands at just over 2,180,000 pcs. which amounts to around 140,000.00 tons.

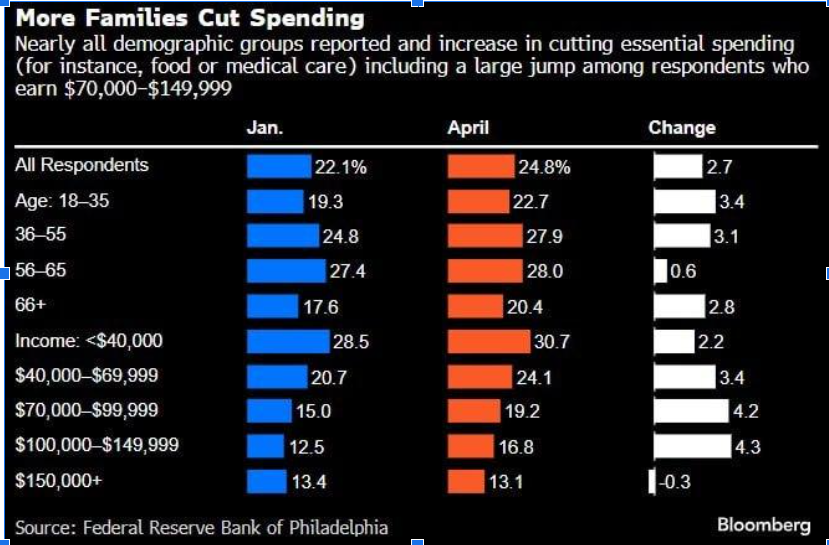

Global purchasing power is declining in the first quarter of 2025.

The most interesting part is that the purchasing power of the upper-middle class is dropping by up to 4.5%.

This directly affects global chocolate consumption.

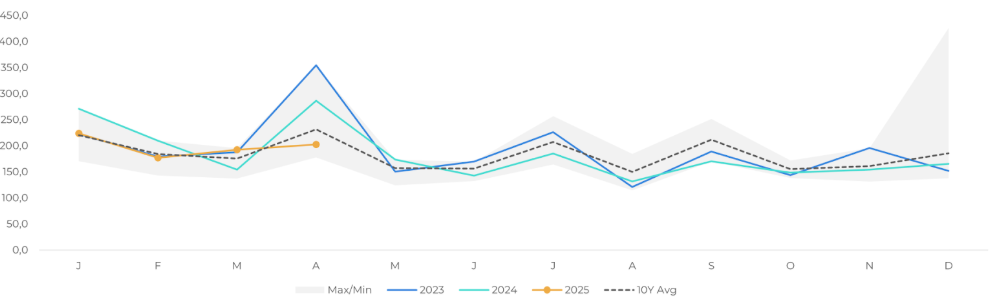

Cocoa bean imports into the EU have also declined, most likely due to poor harvests.

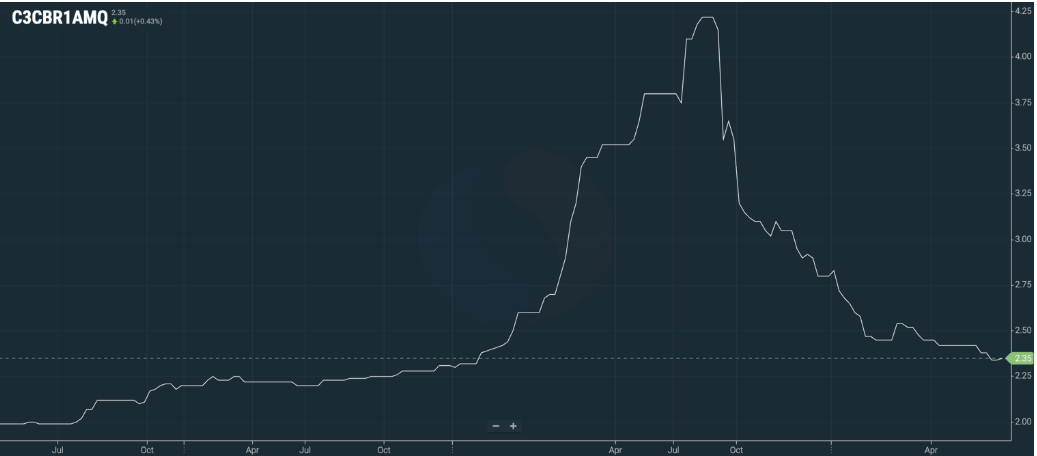

The ratio for cocoa butter is currently at 2.35, showing a significant correction from peak levels of over 4 ratio points. The actual price remains stable, with a possible slight increase expected over the next two quarters.

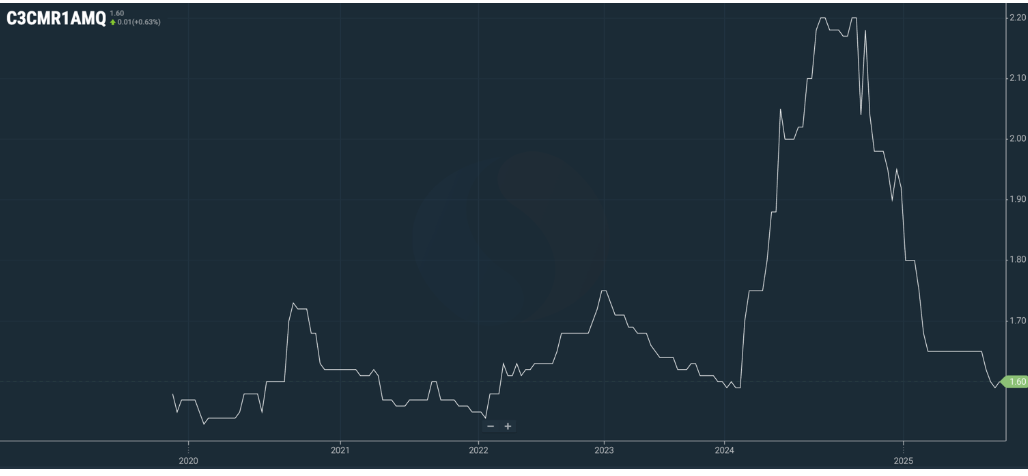

The ratio for cocoa liquor is at 1.60, with a slight upward trend continuing throughout 2025 year.

The ratio for cocoa powder stands at 1.18, virtually unchanged from the previous month, and the final product price has remained the same.

As of today, the exchange price in euros stands at €8,000.00 per ton.

The FOB West Africa ratios for spot deliveries are at the following levels:

Cocoa Liquor:

Ratio of 1.60, with a steady upward trend towards 1.8 by the 1-st quarter of 2026.

At the current exchange level, the price in the 2-nd quarter is expected to be approximately €12,800.00 per ton.

Natural Cocoa Butter:

Ratio of 2.35, with a stable upward trend projected over the next four quarters, reaching 2.85.

At the current exchange price, the 2nd quarter price is expected to be around €18,800.00 per ton.

Cocoa Powder:

The cocoa powder ratio has remained almost unchanged from the previous month, currently at 1.18 against the exchange.

Natural cocoa powder price starts from €9,450.00 per ton

Alkalized cocoa powder price starts from €9,650.00 per ton.

2. Technical Analysis

Markets activity rose in May based on news of yet another poor harvest, which is three months after this scenario had already begun to unfold. In our view, it’s rather strange to see markets buying into outdated news; once again, we warned about this trend three months ago. After completing Wave 2 correction lower than expected, our previous forecast for a price increase remains valid. According to all technical indicators, we should see the price exceed $12,931.00 per ton on the New York exchange.

Most likely, the market reached its short-term correction lowest point in mid-April.

Our advice to clients remains unchanged: buy any price corrections, as they may be short-lived. With current market volatility, we could see price swings exceeding $1,000.00 per day.

The number of long positions (bets on rising prices) has been increasing for seven consecutive weeks.

Weather

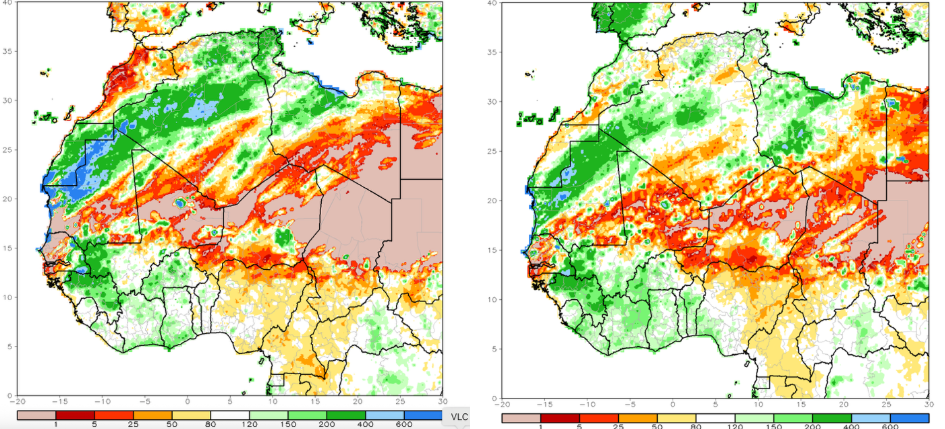

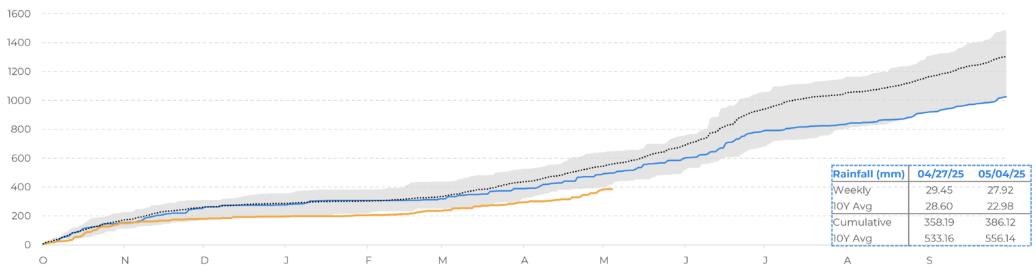

Rainfall levels in West Africa over the past 30 and 90 days have been above average. In the last three months, we’ve seen heavy rains, which should help produce good harvest figures by late July/August and will likely lay a solid foundation for the next main crop. However, in the short term, these rains are causing damage to the current mid-crop of the 2024/2025 season.

Overall, rainfall data for the 2024/2025 season remains below the 5-year average as well as lower than the same period last year.

Source: Refinitiv, Hedgepoint