TRENDS AND MAIN EVENTS IN THE COCOA MARKET

Market Reports

NOVEMBERCOCOA MARKET TRENDS – NOVEMBER 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Hedgepoint

1.Season 2025/2026

Cocoa in Côte d’Ivoire:

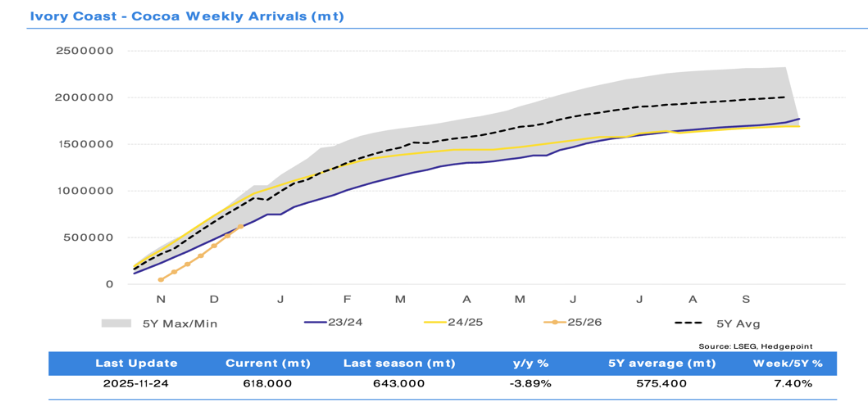

The forecast for this year’s cocoa harvest in Côte d’Ivoire remains more or less optimistic. Port arrivals have improved over the past month, reaching up to 100,000.00 tons per week. A total of 618,000.00 tons has been delivered to ports, compared to 643,000.00 tons a year earlier. So far, this is approximately 4% less than the average of the past five years.

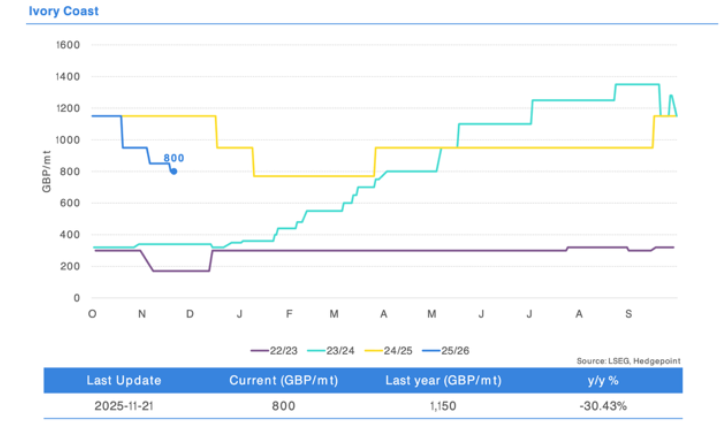

In Côte d’Ivoire, despite the decline in exchange prices, the country is paying farmers the highest price per ton of cocoa beans in its history. At current exchange price levels, the country is losing money on every ton and is not collecting enough taxes.

In October, cocoa bean processing into cocoa products in Côte d’Ivoire fell by 25.4% year-on-year.

Ghana has lowered its harvest expectations, reducing its original target of 650,000.00 tons.

The United States has removed the 15% tariff on Ghana cocoa products.

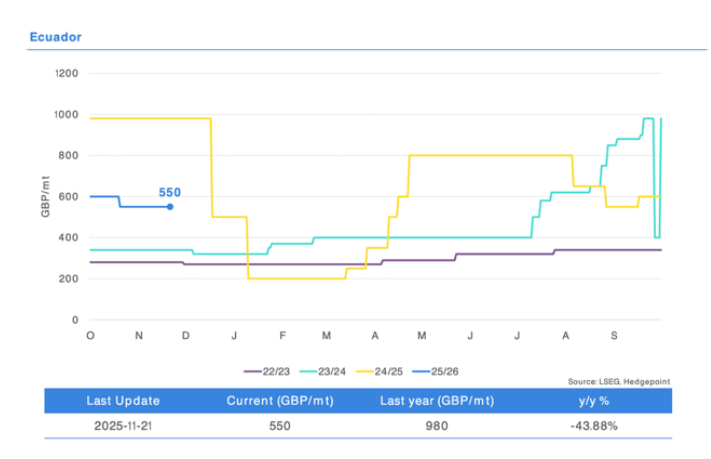

In Ecuador, which initially announced a forthcoming record harvest of 650,000.00 tons, there is also a slowdown in cocoa-bean arrivals at ports. At the moment, this is leading to a sharp increase in differentials in that country.

Additional pressure on cocoa prices is coming from compliance requirements under the EUDR, which has been officially postponed for the second time. The new enforcement date is January 1, 2027, for medium and large-size companies.

Certified warehouse stocks in the United States decreased by 6% in November. As of November 28, the number of bags stands at just over 1,700,000.00 units, which is about 100,000.00 tons.

Cocoa-bean differentials have been declining over the past two months with the start of the new crop; however, the weak port arrivals in recent days are more likely to cause differentials to rise by 10–20% in the coming weeks rather than fall. This is already reflected in the ratio values — we are seeing a shift in the trend for cocoa-product ratios.

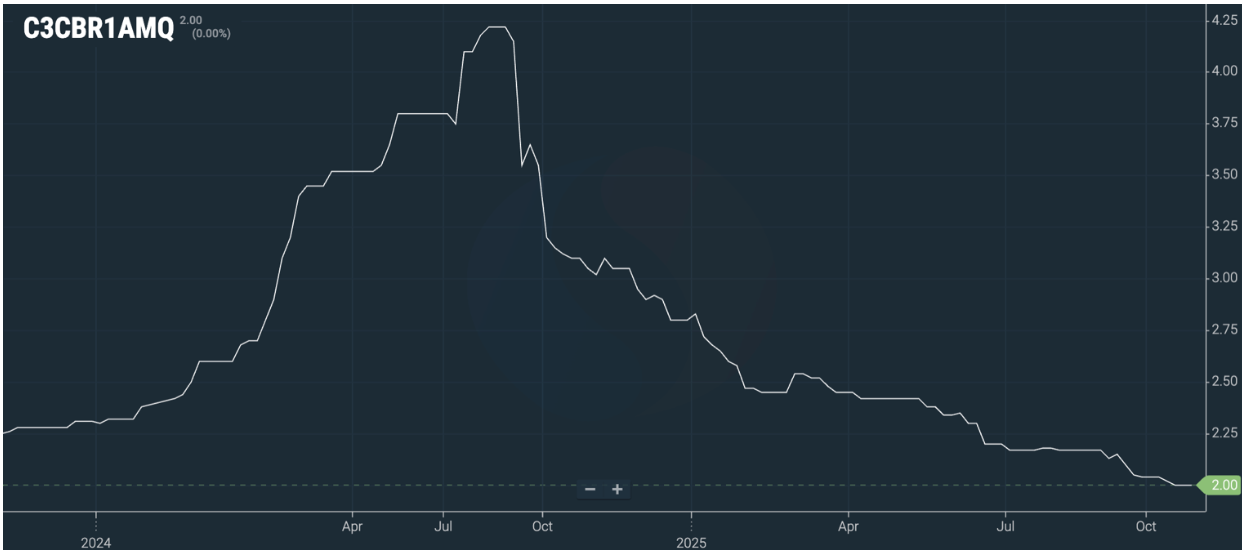

The ratio for cocoa butter is currently at 2.00. The actual price has also fallen along with cocoa-bean prices, and a slight increase is possible over the next two quarters.

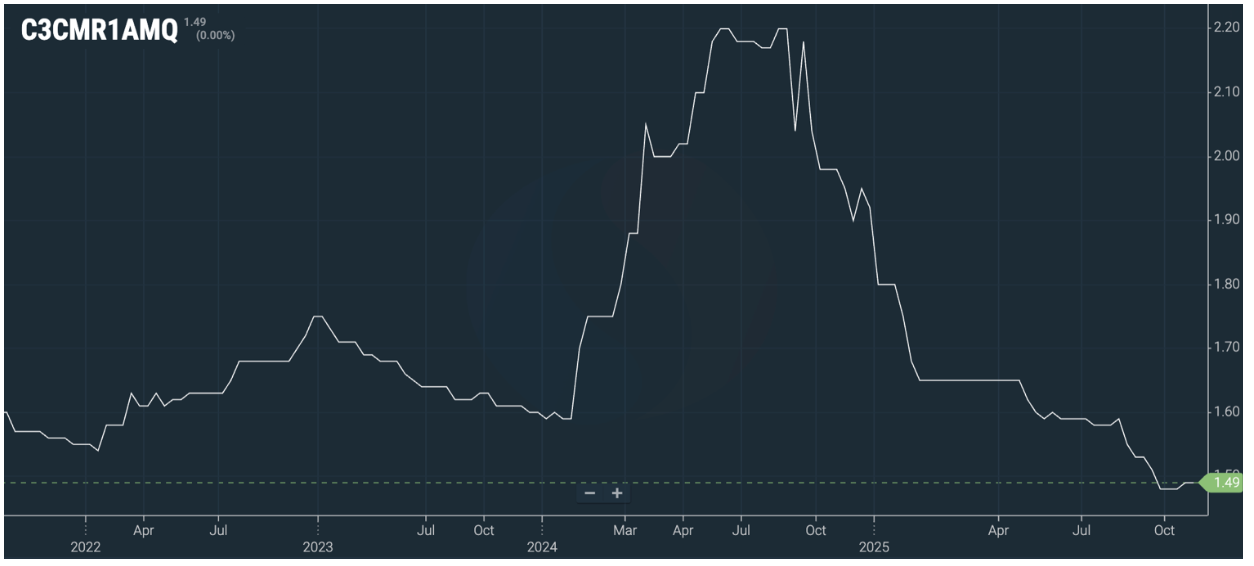

The ratio for cocoa liquor is 1.49, with a slight upward trend throughout 2026.

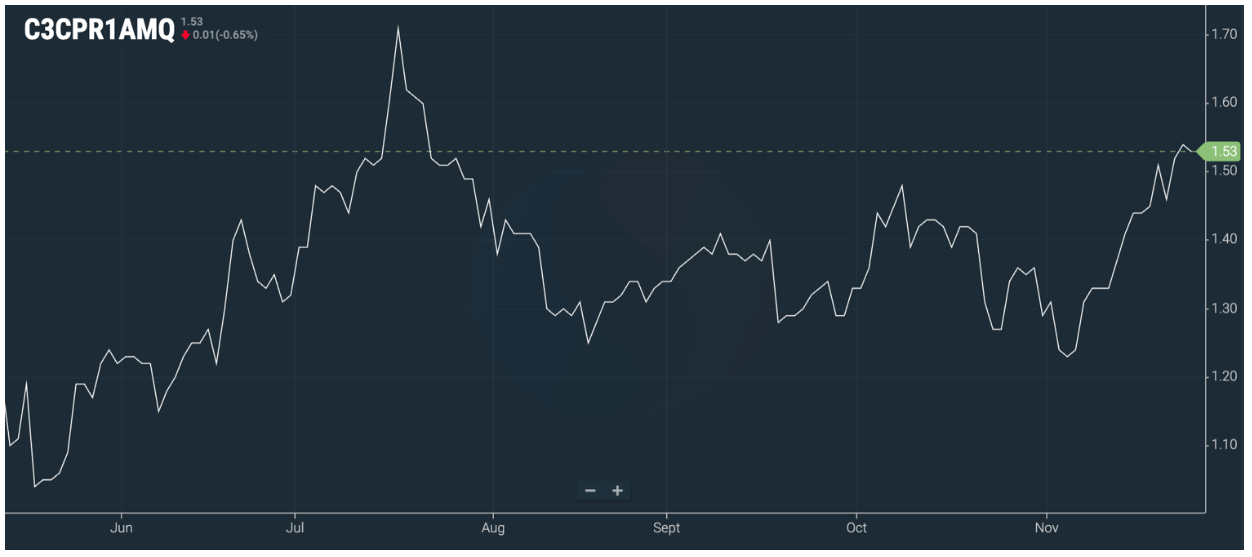

The ratio for cocoa powder is 1.53; the final product price has slightly decreased due to changes in cocoa exchange prices.

As of today, the exchange stock price in euros is €4,600.00 per ton.

FOB West Africa ratios for spot deliveries are at the following levels:

Cocoa Liquor

Ratio is at 1.49, with a steady upward trend toward 1.6 by the 3rd quarter of 2026.

At the current exchange price, the price for the first quarter will be around €7,000 per ton.

Natural Cocoa Butter

Ratio is at 2.00 for natural cocoa butter, with a stable upward trend over the next four quarters toward 2.25.

At current exchange levels, the price for the second quarter will be around €9,200.00 per ton.

Cocoa Powder

The ratio for cocoa powder has slightly increased compared to last month.

The ratio stands at 1.53 relative to the stock exchange.

Natural cocoa powder price starts from €6,500.00 per ton

Alkalized cocoa powder price starts from €6,700.00 per ton

2.Technical Analysis

Markets declined in November on news of reduced consumption, strong port arrivals, and technical sell signals.

At the moment, we are likely completing/completed the 5th wave of the decline on the 4-hour chart, from which we should see an upward reversal in the next 1–2 months.

Taking in account the imlosive impulse of growth on Friday, most probably we will start foramtion of ABC correction upwards in coming weeks before Dec expiry.

Our advice to clients remains the same: buy any price corrections. The market is technically oversold.

It is important to remember that the funds that dictate market price direction may start buying on news of bad weather conditions or weak cocoa-bean arrivals at ports, or begin interpreting positive news in a negative way.

Cocoa also entered the Bloomberg Commodity Index in November, which will add trading volume. Given how oversold the market is, the upward move could be explosive, as we saw in the end of last week, and we could see prices rise from $5,000.00 to $7,000.00 within 2–4 weeks during the next trading period before the expiration of the March Contract.

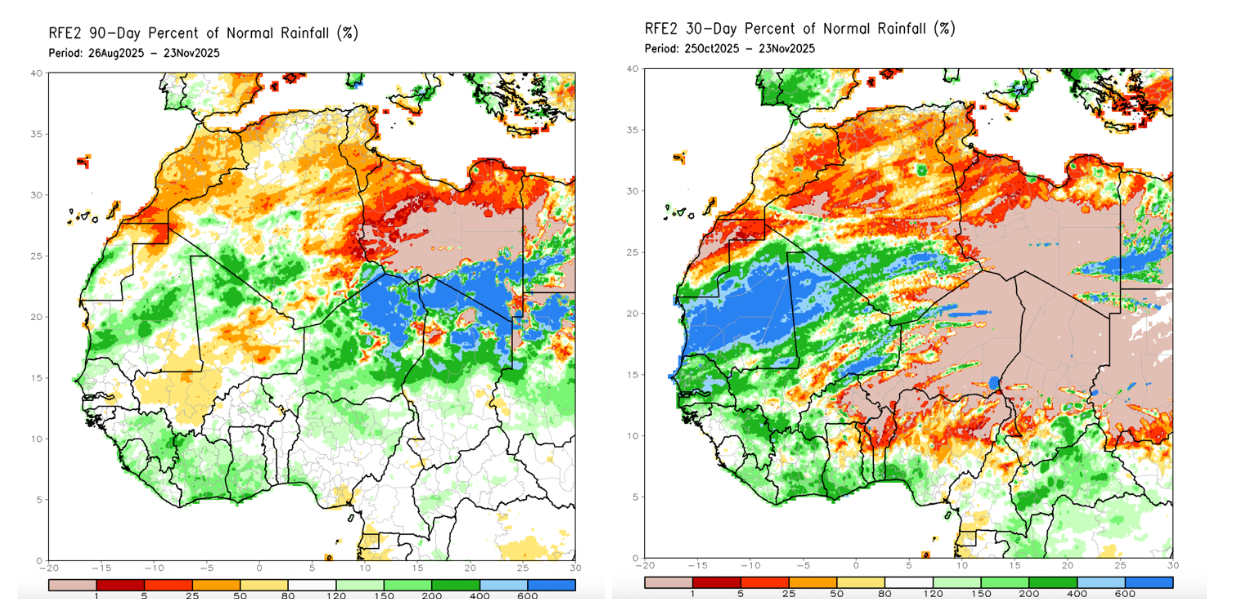

WEATHER

Rainfall levels in West Africa over the past 30 and 90 days have been above normal. It is worth recalling that in July and August precipitations were significantly below normal, which should have affected pod development for the January–February 2026 harvest period.

The current heavy rains, on the one hand, provide good conditions for pod development for next year’s mid-crop, but on the other hand, they significantly hinder fermentation and may contribute to the development of fungal diseases in cocoa trees.