Market report

TRENDS AND KEY EVENTS IN THE COCOA MARKET

June 2022

Season 2021/2022

TRENDS AND MAIN EVENTS IN THE COCOA MARKET

- Season 2021/2022

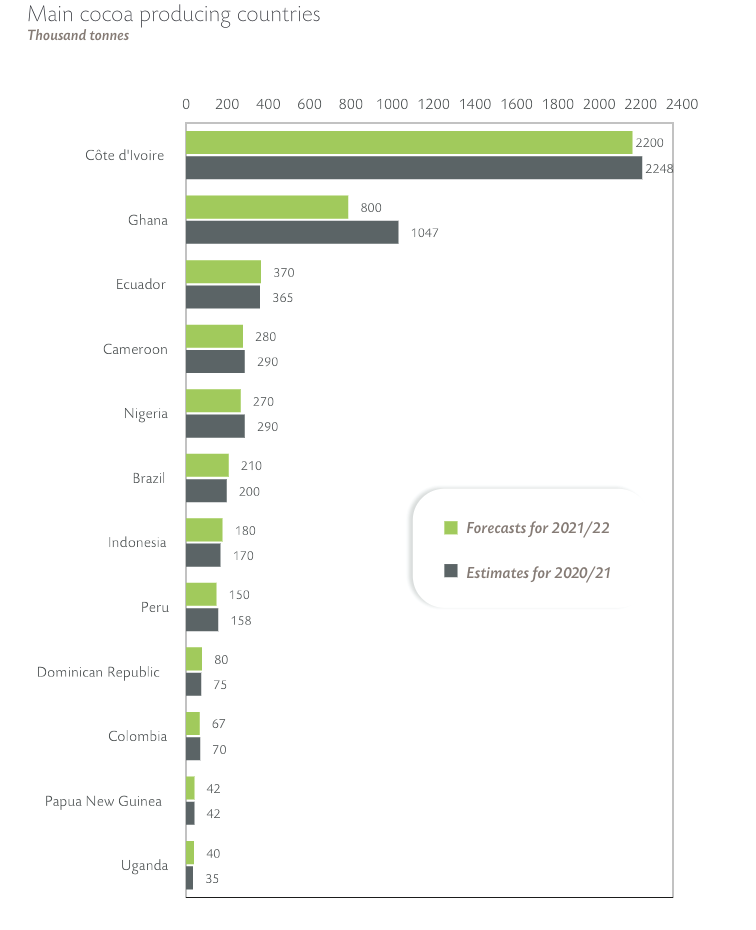

The main harvest of 2021/2022 is over. The average (summer) harvest continues around the world, which will end on September 30. The main forecast is a shortage of cocoa beans in the world by an average of 4% year-on-year.

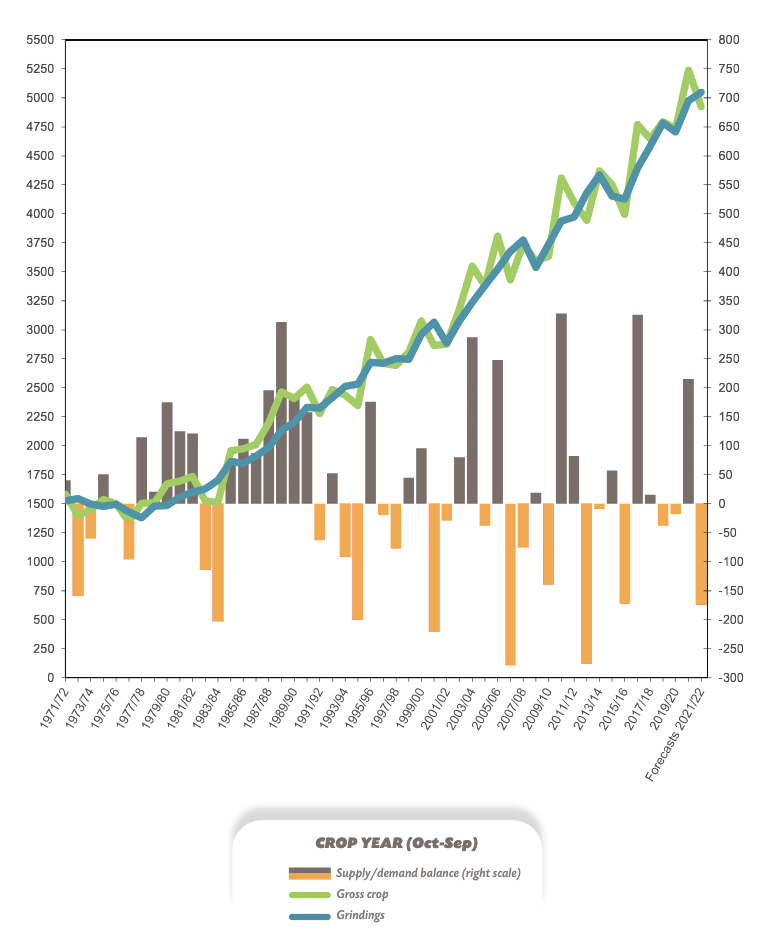

In this graph, we can see that processing has overtaken the production of cocoa beans, this is not the most frequent scenario. Normally, production prevails over consumption. At the moment, the stocks of cocoa beans in certified warehouses will remain at the end of the season in the amount of 1,754,000 tons, which means – for a little more than 4 months of consumption. Usually, 4 months is a kind of limit, if it falls below this figure, it means that there is a shortage of cocoa in the world. I think that many of you have recently encountered this problem, we declare a problem – cocoa beans have become more difficult to buy.

Similarly, ambiguous data come from Nigeria, on rumors of a shortage of fertilizers, April exports fell by 61% year-on-year. But still, it seems to us that this is an exaggerated fact, since if a crisis in the fertilizer world happens, it can in no way affect the production in African countries in the spring of 2022. Maybe, in the fall of 2022 and in the winter 2023 it is quite possible. But that will be another story. Our opinion was described in previous reports where a potential shortage of fertilizers was mentioned, and this is a very important factor for cocoa trees. Without fertilizers, the cocoa tree yields up to 20-30% less yield. If this happens globally, and we sadly consider Africa to be a third world, where ordinary farmers do not have fertilizers in stock for the year ahead, or money to buy fertilizers which are getting more expensive, then the yield of the next season will be up to 10-20% lower. Now let’s have a look at coffee, where a similar story happened due to frosts a year ago, which led to a price increase of 100%, we draw conclusions and take this risk factor into account when forming the average purchase price of the factory for 2023. Since, if suddenly this risk factor is justified, the factory will need much more funds for the purchase of cocoa beans and products.

- Processing and consumption

In Ivory Coast, from the beginning of the season to 31.05, the export of cocoa products amounted to minus 0.3% of last year data, thus it can be concluded that production in other countries works better. Since globally we see an increase in processing for the first quarter.

- Other factors

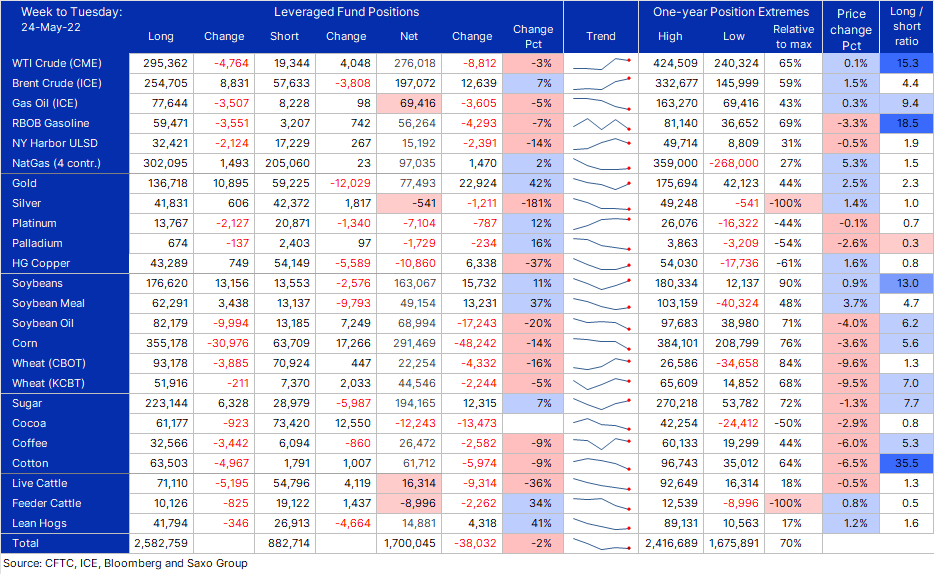

Regarding the positions of hedge funds, we saw in the last week of May one of the strongest outflows from long positions (responsible for price growth), for a long history of observations. The number of closed positions has reached 14,000 lots.

For the first time in quite a long time, we have a negative position, that is, more people bet on falling prices than on rising prices. But sometimes these data are deceptive. The table above shows the number of open positions as of 24.05

What did we observe on the market on 05/24/2022?

We are seeing, of course, a couple of days later, a strong rebound in prices from the intersection of support lines. There is a clear manifestation of the descending Elliott waves and the formation of a bullish flag, which will lead to a breakthrough of the upper line at about 2580 on the New York Stock Exchange and the subsequent growth is likely to prices of 2800-2900 dollars a ton, which in the London market is equivalent to about 1900-2050 pounds per ton of goods.

WEATHER

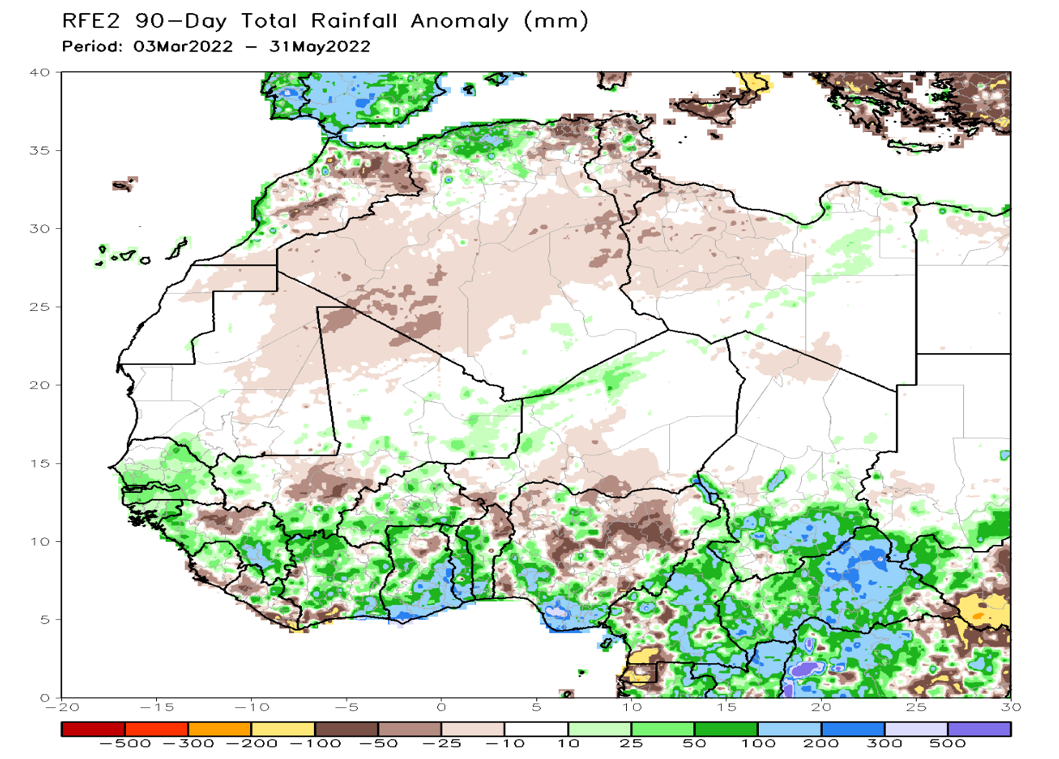

Weather conditions in West Africa have become favorable over the spring months for the development of the main crop of 2022/2023.

The precipitation chart for the last 90 days shows excessive rains in green and blue, compared to the precipitation norm in this region. This fact is slightly offset by concerns about the lack of fertilizers in the region.