Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET August 2022

Season 2021/2022

TRENDS AND MAIN EVENTS IN THE COCOA MARKET

- Season 2021/2022

The summer continues to be poor for events. The cocoa world seems to have gone on vacation!

The average-result harvesting of 2021/2022 that is supposed to finish on the 30th of September continues.

As of 26.07 in Côte d’Ivoire the harvest decrease constitutes 4,1% on a year-to-year basis. 2, 013, 000.00 tons were delivered to the ports against 2, 098, 000.00 tons delivered in the previous year.

Preliminary harvest data from Ghana demonstrate 35% decrease!!! To a great extent it is preconditioned by the fact that the Ministry of Agriculture underwent a range of reforms. The Сocoa Board that used to be an independent body previously, became a subsidiary of the Ministry of Agriculture which in its turn used the cocoa budget for other needs leaving the cocoa transporters and other local expenses without sufficient financing. Currently, we expect protests of the drivers who bring cocoa from distant regions to the port.

The general data indicates 685, 000.00 tons of harvested cocoa this year, compared to approximately one million tons in the previous year. 850, 000.00 tons are forecasted for the next season.

One shall understand that the cocoa was cultivated but transported to Côte d’Ivoire in order to get profit for the harvest. At this point, it comes to think that the harvest failure in Côte d’Ivoire is much worse than the indicated 4%.

For now we are just reading news about a possible economic recession in USA and EU at the background of the energy crisis which in its turn may influence the market of cocoa, bringing prices for the cocoa-based products to new lows.

One of the important events in July is the conclusion of an agreement between Côte d’Ivoire and Ghana to set target price for cocoa beans to the level of 2,600.00 USD per ton on conditions FOB Africa. Nigeria is expected to join this agreement in the autumn. Will it create any fluctuations at the exchange market? Unlikely, we have witnessed the prices decrease to the level of 2,200.00 USD per ton whilst the price level was established at the level of 2,400.00 USD per ton of goods. In case of short-term trading, it will provoke serious changes at the London exchange market since the three countries will control more than 70% of the existing cocoa stock. Should they officially announce to have finished hedging (sales at futures market) of their seasonal yield, it will cause a strong growth for the market prices. At the end of the day, it means appearance of a new major operator on the market. If they act unprofessionally or pursuing a certain target, their trading volume can either cause the market price drop to the level of 1,500.00 USD per ton or increase the market price to the level of 6,000 USD per ton in the nearest time, depending on the targets they pursue.

- Cocoa processing. 2Q data.

6,29% decrease in USA on a year-to-year basis.

3,64% increase in Asia on a year-to-year basis.

2,03% increase in EU on a year-to-year basis.

+ 3,69% in Germany

USA demonstrated the expected decrease in processing scopes, last year the 2Q was anomalous when the numbers were far from normal, while all the experts came to the conclusion that 2022 year was supposed to be worse. Moreover, the reporting was provided by 15 factories instead of 16 factories and 17 factories in the previous years. USA starts to be a country consuming ready cocoa products. Raw material processing level decreases on a year-to-year basis.

Interesting data was provided by a major operator on the American market – Hershey, their retail sales decreased by 2% in the second quarter, however, this data might perfectly well correlate with the dollar index strengthening. This data shall be analyzed within a whole calendar year.

EU demonstrated very good indices taking into account the military and energy crisis; we believe that they proceed perfectly well!

Lindt & Sprüngli, one of the major manufacturers in EU, shows sales doubling especially in the developing regions.

Asia demonstrated the strongest quarter in all the market history, which is very important. With the background of expensive freight prices from the Asia region, all the countries of the region continue to be isolated within their consumption region. Taking into account the population increase and aggressive promotional campaigns of the confectionaries, the processing increase took a good pace.

China, leaving behind the COVID-related restrictions, also starts increasing the processing rate.

If we consider the global processing numbers, in the second quarter the consumption increased by 5,96% on a year-to-year basis. At that, let’s not forget that the harvest decreased by more than 5%. The difference comprising 10 and more % between the cultivation and consumption will be viewed as a bullish signal on the market at a certain point, provoking prices increase.

- Technical analysis

So far we still see the cocoa in the descending corridor at the New-York and London Stocks Exchanges despite all the fundamental data. After all, hedge funds moving the market are afraid too much of the recession, and as we know chocolate is one of the raw materials that suffers market drops more than others in case of an economic recession.

The price at the London Stock Exchange remains at the level of 1,700.00 – 1,750.00 pounds for the last 4 years. This price is quite comfortable both for the processing industry and the final manufacturers of chocolate.

The Dollar hit resistance and moves upwards, now the currency is outbid but there is a real probability that the currency still has the resource for increase since EU lives an internal military and energy-related crisis, in such conditions even 0.5% stakes rising does not allow EURO increase and enhances the further growth of Dollar value. That could well be the case, and we will see EURO-USD exchange rate at the level 0.95-0.98 in the nearest time.

The schedule below shows the downward corridor of prices at the American stock exchange, the trend started on the 1st of February, a certain consolidation was observed at the level of 2,250.00 dollars per ton, where we crossed the support line that was preserved for many years. We expect a further retest of the lower market boundaries. Should we make a forecast till the end of the calendar year, the price with a high probability may be traded within a narrow range.

However, there’s one hitch: on 28.07 Côte d’Ivoire announced to have sold 1, 500, 000.00 tons from the volume of season 2022/2023, which means one seller less on the cocoa market at least till the winter of 2022 year. What is it supposed to bring to the market? Historically, usually a month after the announcement, the price tended to boom, so we do not exclude that the price will try to get out of the descending corridor.

WEATHER

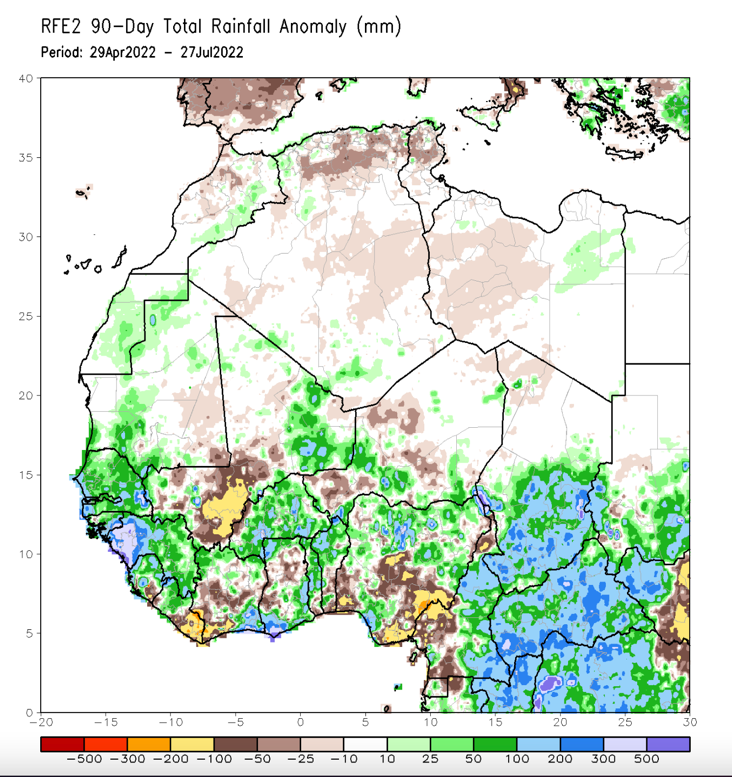

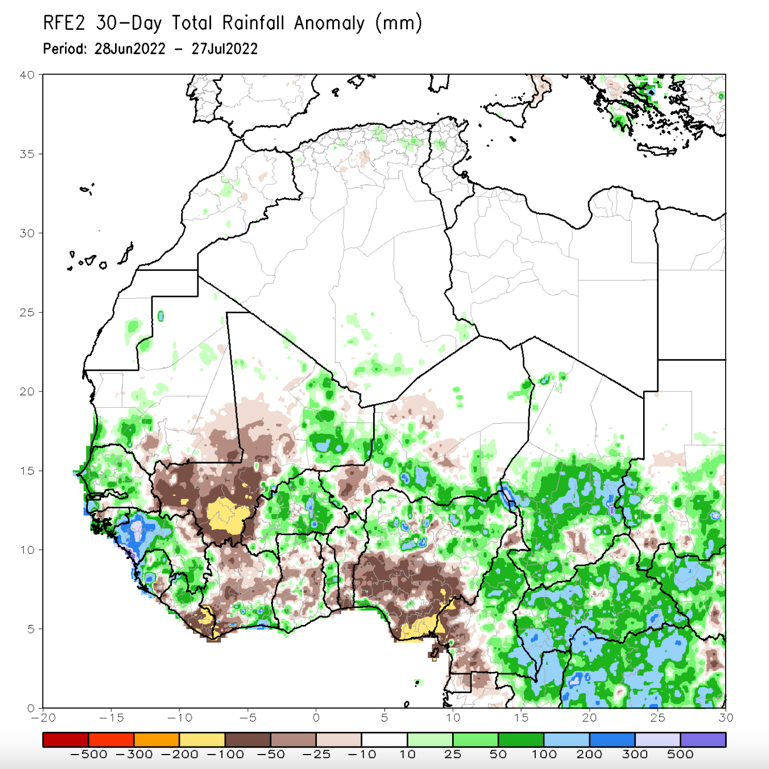

Weather conditions in the Western Africa tend to be less favorable especially it is noticeable in the last 30 days. For comparison we provide 2 schedules: for 90 days and 30 days with deviations from the norm. The quantity of rainfall shows that the rainfalls were below the standard in the summer months in the most regions of cocoa cultivation.

The rainfalls schedule for 90 days indicates excessive quantities with green and blue color compared to the precipitation norm in the indicated region, whilst the brown color shows the deficiency of rain. However, we do not observe critical numbers therefore the forecast for the harvest of 2022/2023 remains positively neutral. Besides, we are still at the stage La Nina, which most probably will ensure favorable weather conditions for cocoa cultivation in the future periods.