Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET December 2023

1. Season 2023/2024

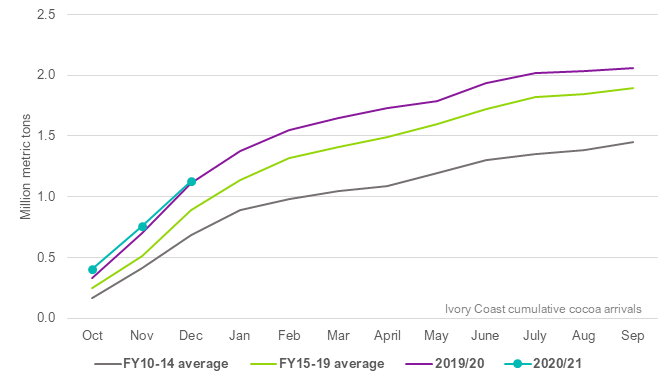

Arrivals at ports in Ivory Coast, according to data on November 26, are 33% lower than a year earlier. 481,000 tons were delivered to the ports, however, if we look at the data in comparison with the average amount in the context of 13 years, almost half the amount of cocoa beans was exported in the same time period. 481,000 tons in 2023 against 1,000,000 tons on average by the end of December 2010-2022.

The question is, who will not have enough cocoa beans in the next calendar year? Will there be enough world reserves to ensure consumption?

In many ways, weak arrivals at ports are due to heavy rains in Ivory Coast, which is an unusual phenomenon for the El Nino season. Beans do not have time to dry and ferment properly, respectively, they are not delivered to ports. Those cocoa beans that are delivered to ports do not always have sufficient quality for supplies to chocolate factories.

Whether this is a consequence of the policy of producer states, which, due to low prices over the past 7 years, have not invested in cocoa infrastructure, or it is a combination of circumstances related mainly to the weather – we will most likely see in the next season.

The Hershey Company (HSY)

NYSE – NYSE Delayed Price. Currency in USD

Shares of many chocolate manufacturers are starting to decline, so Hershey is revising its forecasts for the next financial year and making disappointing forecasts about lower profits and sales. It also follows from their report that with an average production coverage of 12-24 months with purchase contracts over the past couple of years, this year the figure has been reduced to 6 months.

The same trend is observed in the EU, many factories are increasingly switching to spot purchases 1-3 months in advance, moving away from long-term planning.

The FOB ratio of West Africa stabilized at the following levels for shipments in November.

The ratio is decreasing, but the exchange price is rising, which causes an increase in the prices of cocoa products.

Cocoa mass

1.60 with a steadily growing trend to 1.65 from Q1 to Q4 of 2024. At the current exchange level, the price for Q1 will be about 6,500 euros/t.

Natural cocoa butter

2.25 natural cocoa butter and a growing trend for the next 4 quarters to 2.35. The price at current exchange levels will be about 9200 euros/t.

Cocoa powder

The ratio for cocoa powder has decreased since last month. The ratio is at 0.76 to the exchange. To date, the exchange price in euros is 4080 euros/t.

The graph falls proportionally to the increase in prices on the cocoa bean exchange. Therefore, we do not see any changes in the price of cocoa powders and sharp changes in the ratio in the next 3-4 quarters.

Natural cocoa powder is 3,150 euro/t.

Alkalized cocoa powder is 3,500 euro-ton with a stable trend without strong signs of an increase or decrease.

2. Technical analysis

The price chart of cocoa beans continues to move in an ascending channel, which originates a year ago, the price has doubled exactly, we continue to follow the upper boundary of the channel, which we most likely will not break through, but periodically the market tests with false breakouts, however, this does not mean that prices will not continue to rise, since the channel ascending, each new day sets new upper limits, and the price can continue its ascent at 10-30 pounds per day for an indefinite amount of time, as it has been going on for more than 12 months with minor corrections.

If we evaluate the American market, then we are moving along the border of the ascending channel, and if we imagine that we showed a peak in prices at December 1st, 2023, then it is quite possible that we will see a correction to the channel line at about 4000 per ton and then after an upward movement by March we can reach the level of 3750 dollars per ton.

However, the question is in the air, what will be the reason for the correction? From a technical point of view, the market is overbought, but in fact hedge funds are not reducing their position.

There are gaps in the market (price positions not covered by the market on the chart at levels 3830, 3460 and 3357). It is quite possible that the market engines, hedge funds will want to close these levels before further growth. However, in the current realities, this is most likely a long-term prospect.

WEATHER

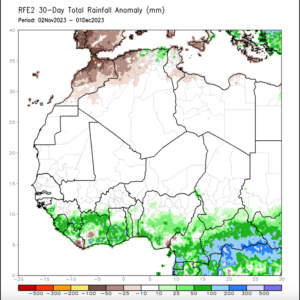

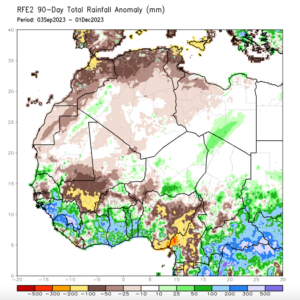

Weather conditions in West Africa have been better than normal in the last 3 months, as evidenced by the green-blue spots in the left image, for comparison of 2 graphs of 90 days and 30 days with deviation from the norm. There are many times more rains than there should be, unfortunately, this has a very detrimental effect on the harvest of 2023/2024, we are already seeing the consequences in port arrival figures we wrote above. The cocoa beans that come to the ports have very high humidity and a very high level of defects. However, in March/April 2024, it is quite possible that we will have good arrivals at ports at the end of the main season. If only the trees can withstand the abundance of rains and there will be no spread of fungal diseases of the trees.

Now we are expecting the start of the season of winds from the Sahara, the so-called Harmattan, which should help fermentation and drying of cocoa.