Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET February 2023

1. Season 2022/2023

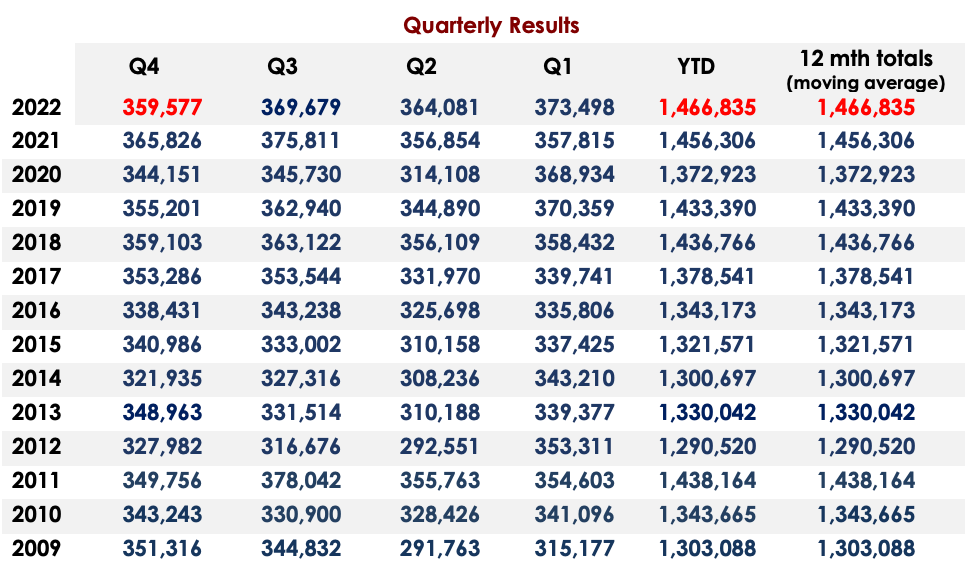

As of January 29, 2023 Ivory Coast’s cocoa port arrivals reached +5.7% on a year-to-year basis. 1, 544, 000 tons were delivered to the ports. As of the end of December port arrivals in Ghana substantially increased compared to the last year: 350, 000.00 tons versus 199, 000.00 tons. Nigeria demonstrates a rather serious downturn, export decreased by 70% in December compared to the last year. Grinding in EU decreased by 1,7% in the Q4, general increase in 2022 year comprised 0,7% which complies with the analysts’ forecasts.

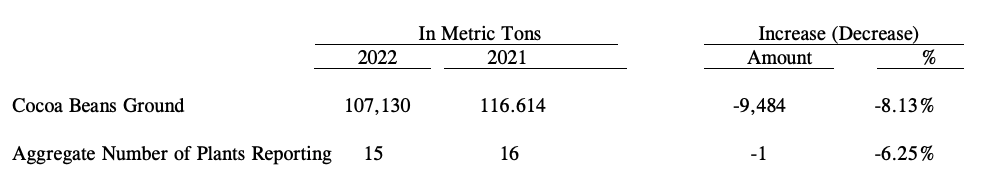

Grinding in USA decreased by 8,13% compared to the 4Q of 2021 year. These data are worse than forecasted by analysts.

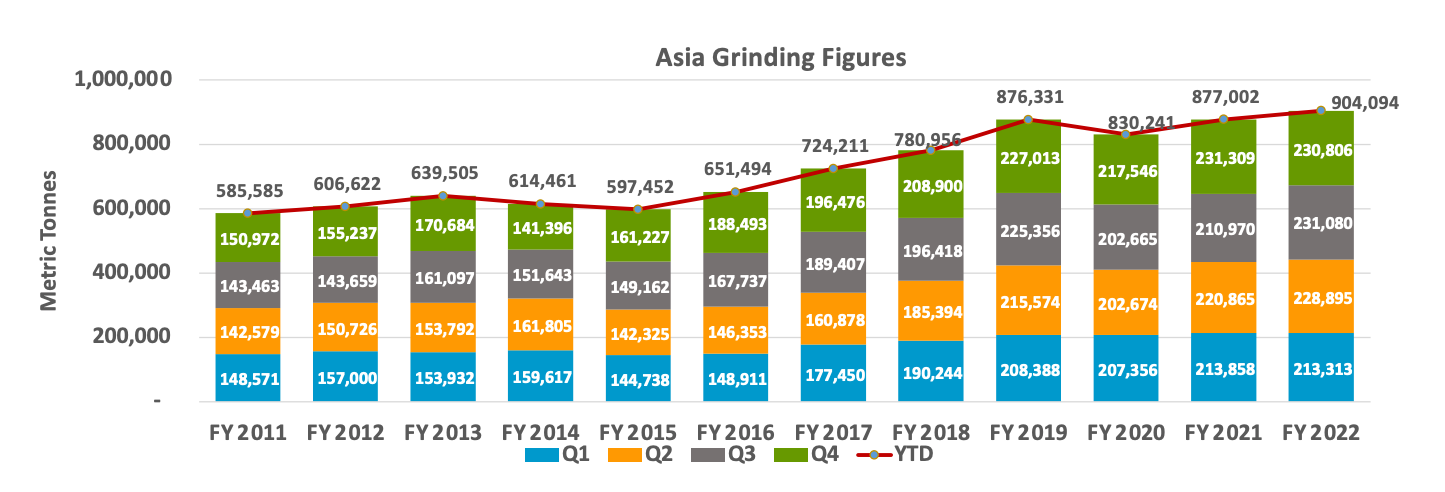

Rather surprising data arrive from Asia: with the expected growth the data for the Q4 demonstrate a decrease of 0,22% with the total yearly increase in 2022 being at the level of 3%, which is slightly worse result than forecasted by analysts.

Taking into account all the data, we see that grinding in USA was substituted by grinding in the African countries where the increase comprises approximately 5% on a year-to-year basis.

The final results of 22/23 season will demonstrate deficit or proficit which depends on the summer harvest of 2023.

2. Technical analysis

Fundamental and technical analysis clearly state that the market is sufficiently outbid; as forecasted in the previous report for December we demonstrated the increasing quotes at the New York Exchange reaching almost 2,700 US dollars per ton, however, the increase occurred without whatsoever correction in 2022 year, same as no correction occurred in January 2023.

Due to the weakness of GB pound we saw unprecedented prices at the London Exchange that reached 2,150 GB pounds per ton in the mid December; the prices remained at the same level in January demonstrating low volatility.

Currently the New York Exchange demonstrates an upward wedge as well as distinct waves picture composed of 5 waves which, as we believe, shaped the first long upward wave with a probable correction wave to fol ow due to a possible dollar strengthening which we will describe below; however, there are a few preconditions allowing to make such assumptions besides long positions decrease on the growth by hedge funds. So far the countries of origin sell the future harvest unwillingly, probably expecting higher prices at the Stock Exchange; as of the data for mid-January 118, 000.00 tons of 2023/24 harvest are sold, with the expected harvest comprising 2, 000, 000.00 tons. As long as these numbers do not grow, probably, we will not see a strong price correction.

Nevertheless, last week hedge funds decreased the long position for cocoa prices growth by 12, 000 lots, currently long (growth) positions by reference to short positions are prevailing by 7 % only, whilst just the week before the relevant number comprised 24.7%. Perhaps this phenomena is due to the expiration of options in the New York market in early February, which may add some volatility to prices.

Also, we should not forget about the dollar index, according to the Elliot wave theory, we observe obvious 5 downward waves, after which a correction occurs or has occurred. We expect the dollar to strengthen against major currencies. This may leave unchanged the prices on the London Cocoa Exchange, but act as a catalyst for lower prices on the New York Cocoa Exchange.

WEATHER

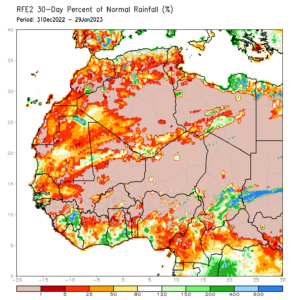

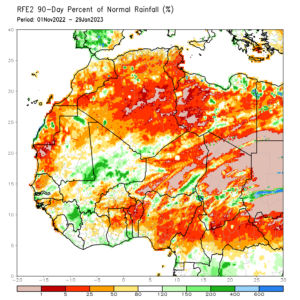

Weather conditions in West Africa almost did not change, below please see two maps: for 90 days and for 30 days with deviations from standard conditions. Quantity of precipitations demonstrates that rainfalls in the autumn period were missing in the most regions that grow cocoa in Ghana and Nigeria.

However, while these data do not have a strong impact on the main harvest, they may affect the average (summer) harvest, which may cause a shortage in May-August 2023.