Market report

TRENDS AND KEY EVENTS IN THE COCOA MARKET

March 2022

Season 2021/2022

TRENDS AND MAIN EVENTS IN THE COCOA MARKET

The harvest of 2021/2022 continues with some changes. In Ivory Coast, this season, arrivals at the port are 3% better than a year earlier, according to data from March 6, 2022. Now more than 1,740,000 tons have been delivered. If at the beginning of the season we saw a lag of up to 9%, then 6 months later we can see that the export of cocoa beans is ahead of last year.

Consumption is not lagging behind, African producers Gepex reported an increase in the production of cocoa intermediates +8.7% year-on-year.

The EU countries, the USA and the Russian Federation have completely or partially lifted all restrictions related to COVID-19. This gives optimism in cocoa prices, though some scepticism at the moment has been added by the conflict and the closure of air transportation between Russia and Europe.

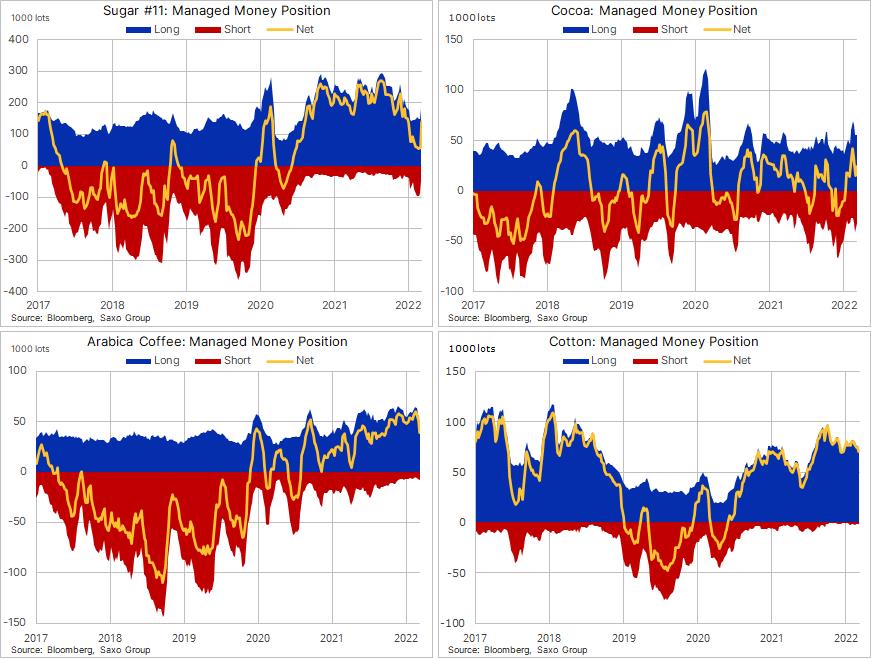

Funds have greatly increased long positions in sugar and cocoa. And slightly reduced in the coffee which is due to the influence of the conflict in Ukraine.

WEATHER

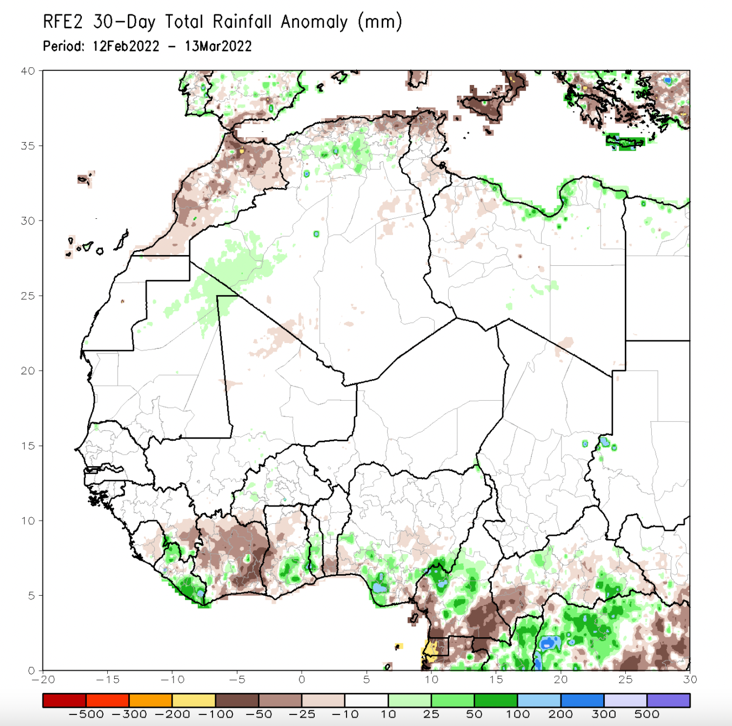

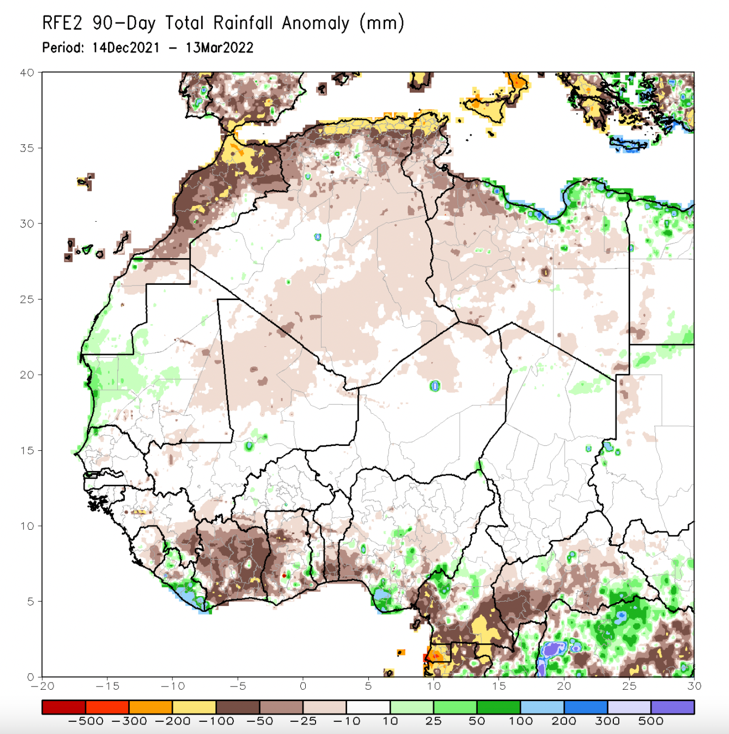

Weather conditions in West Africa are unfavorable.

There have been no regular rains in West Africa for more than 8 weeks. Although some newspapers report good conditions for the development of the crop and favorable weather. The graphs (below) show a different picture,

both for 30 and for 90 days, we are lagging behind the norm. Perhaps the news in the leading newspapers is beneficial to someone?

Brown spots show a lack of millimeters of precipitation from the norm.

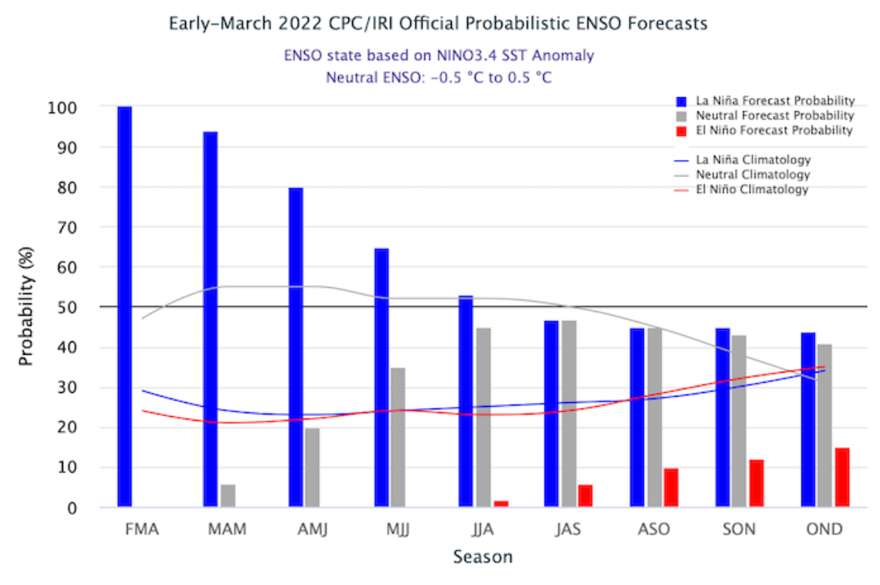

The red shows the chance of drought in West Africa (El Nino), where we can see the chances growing by December 2022.

If we superimpose these data on a possible crisis in the fertilizer market, again caused by the ongoing conflict in Ukraine, then the prospect of future harvests looks very uncertain.

TECHNICAL ANALYSIS OF THE MARKET

From a technical point of view, the uptrend of the market has been going on for quite a long time, and at the moment, there are no prerequisites for breaking the trend. Given the strong fundamental news and the long position of hedge funds from a technical point of view, we will see the market only going up in the medium term. However, this does not mean that in the next 1-2 weeks we can see how the market is declining. In many ways, it may also be due to the closing of trading by March 2022.

We should also bear in mind that New York opened with gaps which will definitely be closed in the near future, the highest of which is at the level of 2760 USD, it is quite possible that this will happen under the closure of May options on April 1st, 2022.

Cocoa beans from Ghana

Deliveries 2nd quarter of 2022

Exchange K2 (May2022) +500 GBP/mt

Price FCA Tallinn 3010 USD/mt

Cocoa beans from Ivory Coast

Deliveries 2nd quarter of 2022

Exchange K2 (May2022) +385 GBP/mt

Price FCA Tallinn 2840 USD/mt

Wishing You Good Health & Happiness

Panamir OÜ is carrying out an investment project aimed at launching a cocoa powder production line. This project is within the framework of the investment support for the processing and marketing of agricultural products of micro and small enterprises (ERDP 2014-2020 measure 4.2.1), the amount of the support is 175,120.80 euros.