Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET May 2023

1. Season 2022/2023

Taking into account the results of April 2023 port arrivals to Côte d’Ivoire as of April 23, 2023 comprise -7.4% on a year-to-year basis. 1, 859, 000 tons were delivered to the ports.

As of mid-March port arrivals to Ghana are much more compared to the previous year: 566, 000.00 tons against 481, 000.00 tons in the previous year. However, the final results of the season will be 10-15% less when compared to the results of the average crop of previous 4 years.

Exporters in Côte d’Ivoire are having difficulty complying with their contracts, many exporters have not fulfilled their obligations to supply cocoa beans, at the moment they say that the debt is about 200,000.00 tons in the market.

Ratio for cocoa products in Africa on FOB West Africa conditions have stabilized at the following levels

Cocoa mass

1.75 and demonstrating a stable trend, showing no signs of increase or decrease for the next 4 quarters. At the current level on the exchange, the price will be about 4,400.00 euros/t.

Natural cocoa butter

2.37 for natural cocoa butter and an uptrend for the next 4 quarters. The price at the current levels of the exchange will be about 6,000.00 euros/t.

Cocoa powder

Natural cocoa powder – 3,050.00 euros/t .

Alkalized cocoa powder is at the level of 3,300.00 euros/t and demonstrates a stable trend without particular signs of increase or decrease.

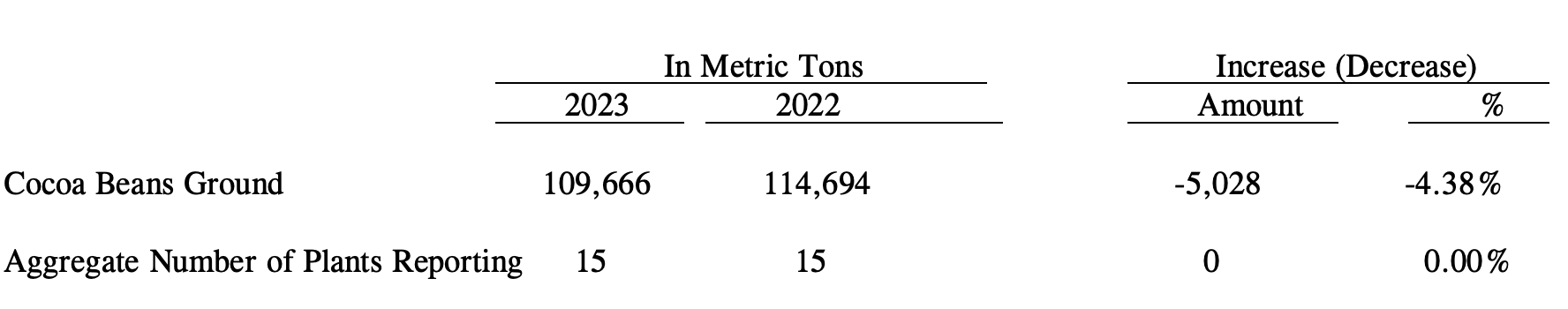

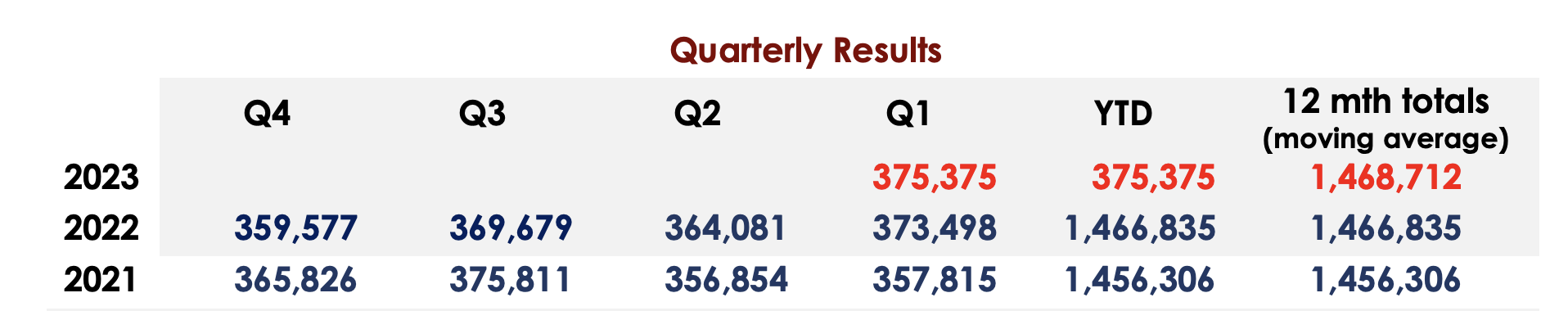

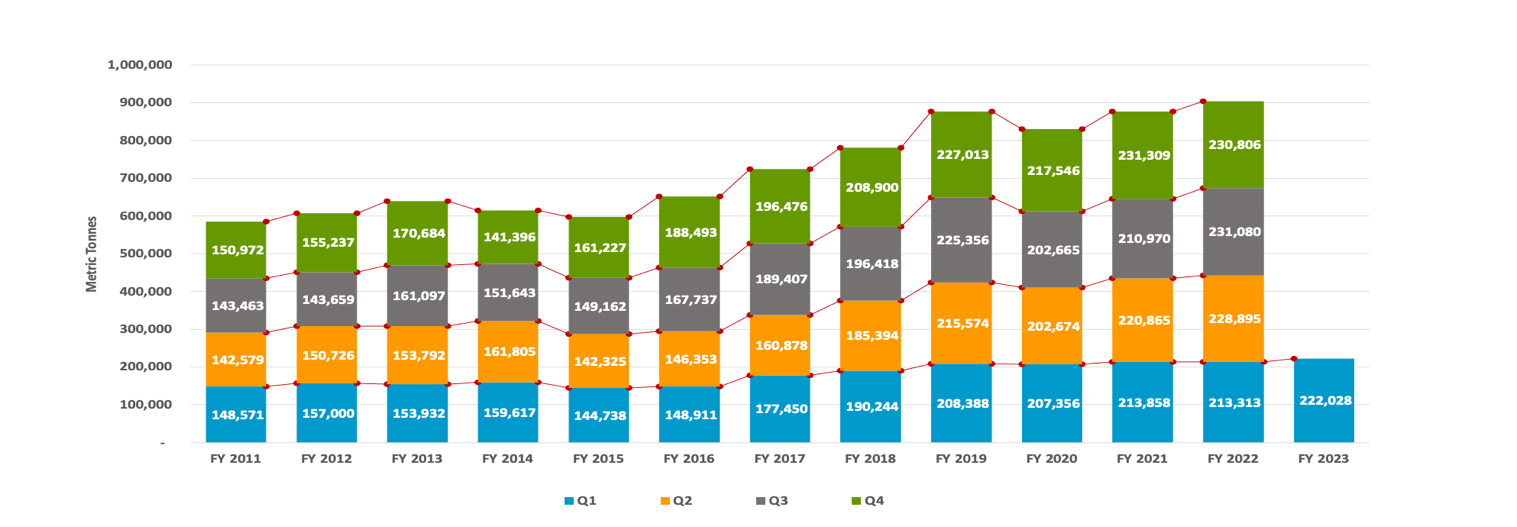

Cocoa processing globally in the 1st Q 2023

Stable growth and record-level first quarter on record in EU.

Expected drop of 4% in US; more and more products are being imported from Africa and the US is phasing out its own processing

Another record quarter on record in Asia with an increase of 4%

Africa and South America also demonstrate a growth trend, but the data is not available in the public domain. The grinding increase in Africa in the first quarter is estimated to be about 10% increase, Brazil is also not far behind, and according to the manufacturers the growth in the first quarter was up to 14%.

Given these data, the processing growth in the first quarter globally is about 25,000.00 tons or about 0.5%; the annual expected processing growth is stable and remains at the level of 2-3%, however, the harvest is poor and we witness already the second deficit year in a row. It is quite possible that the next season will not be good in terms of yield either. In this case harvest will depend on the weather that we will discuss below.

2. Technical analysis

Fundamental and technical analysis clearly state that the market is sufficiently outbid as we also made relevant forecasts in the previous reports; however, due to strong fundamental news, the market tries to keep the pace from the technical viewpoint and does not leave a chance to strong correction waves.

We have seen the last correction at the beginning of February.

The countries of origin have been hedging the future harvest in the last couple of weeks (sold on the market); theoretically we should have seen prices’ decrease, but there was no correction. The funds are in the largest long position in the last couple of years. This may cause a stronger prices decrease when the funds begin to close their positions.

The market is still in backwardation (every next month is cheaper than the previous one), which spurs prices’ increase from a technical viewpoint.

The first price support levels which we can reach during the next correction.

London Exchange CN3 (July Contract) 2,090.00, 2,010.00 and 1,930.00 onwards.

NYSE CCN3 (July contract) 2,750.00, 2,675.00 and 2,500.00 onwards.

WEATHER

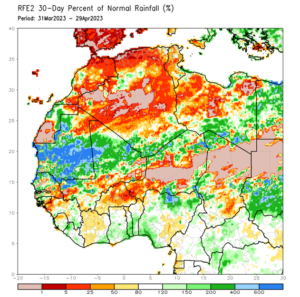

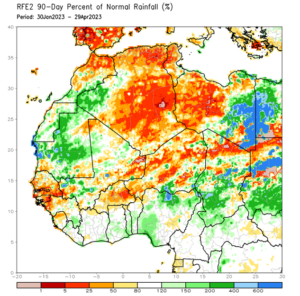

The weather conditions in West Africa have not changed much, below please see two maps: for 90 days and for 30 days with deviations from standard conditions. Quantity of precipitations demonstrates that rainfalls in the winter period were missing in the most regions that grow cocoa in Ghana and Côte d’Ivoire.

However, while these data did not have a strong impact on the main harvest before February, we have repeatedly indicated in the previous reports that the precipitations were below the norm, and now we see the consequences of the lack of rain in autumn, the data in the charts below may already affect the middle (summer) harvest, which may cause a deficit exceeding even the forecasted 150,000.00 tons in May-August of 2023.

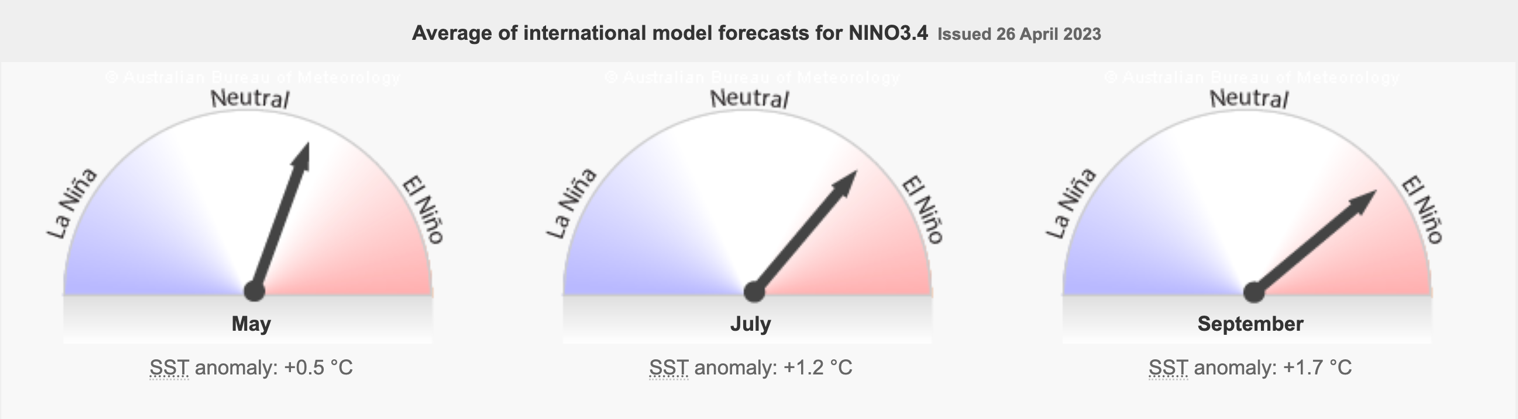

Besides, according to the latest data provided by the Australian Research Center, with a probability of more than 50% we will enter the El Nino season in August, which can bring drought to West Africa countries, where more than 70% of the world’s cocoa beans are being grown.

If this forecast is confirmed, then in January-February 2024 we will see very scarce port arrivals of cocoa beans in the countries of origin.