Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET November 2023

1. Season 2023/2024

Arrivals to ports in Ivory Coast, according to data at 24.10, are lower than a year earlier by 16.3%. 170,000 tons were delivered to the ports, but if we look at the data on October 22, 2022, 26% more were delivered to the ports than in 2021. And in 2021, compared to 2020, 15.3% less was delivered. In total, comparing the data in the context of 3 years, two times less amounts of cocoa beans were exported in the same period. 170,000 tons in 2023 versus 327,000 tons in 2020. Impressive, isn’t it?

In many ways, weak arrivals to ports are due to heavy rains in Ivory Coast, which is an unusual phenomenon for the El Nino season. Beans do not have time to dry and ferment properly, respectively, they are not delivered to ports.

Expectations about the current harvest are also not rosy, according to data at 25.10, Ivory Coast made a statement that the harvest is expected to fall by 25% in the 2023/2024 season. The figure is shocking, though, in our opinion, it is greatly exaggerated.

However, a day earlier, Ghana also made a similar statement that they expect a drop in the harvest due to adverse weather conditions and high prices for fertilizers (sanctions against Russia, after all, affected not only natural gas prices).

Ghana expects a 25% drop in harvest, coincidence? I don’t think so.

We also received news that Ghana, as we wrote in previous reports, was not allocated money and the placement of new bonds against the sale of future crops failed.

It is not surprising since Ghana is virtually de facto bankrupt, as it has not settled with the EU on previous payments and has defaulted.

Ghana cocoa board unofficially offered to buy cocoa beans directly from farmers. The question of how calculations can take place, how to pay taxes, how to export, was suspended in the air, there has not been an official announcement yet, or at least it has not reached the world news agencies.

Most factories in Ghana are idle without raw materials, some have already been closed since the end of 2022.

In the 42nd week, the CCC Ivory Coast began selling the future harvest, thereby increasing the pressure on trade against December 2024, and the price spread between months continued to increase. The spread between December 2023 and 2024 futures trading is 400 pounds.

Major exporters including Barry Callebaut, Mondelez, Cargil made an appeal to the CCC to reduce differentials for the 2024/2025 season (next year), but were ignored by Ivory Coast, which also ignored joint meetings with major buyers in the EU this month.

High prices play into the hands of Ivory Coast and Ghana, thereby they will be able to improve their financial situation at least a little. The question is whether the difference in price growth will be enough to cover the expected 25% of crop failure.

Many agree that the figure of 25% is greatly exaggerated, and as soon as the world’s main processors come to an agreement with Ivory Coast and Ghana, we will see higher harvest figures, but the fact is that there will be a shortage, the question is how strong.

COCOA PROCESSING, DATA FOR THE 3RD QUARTER

The European Union –(minus) 0.9% or 3,000 tons less

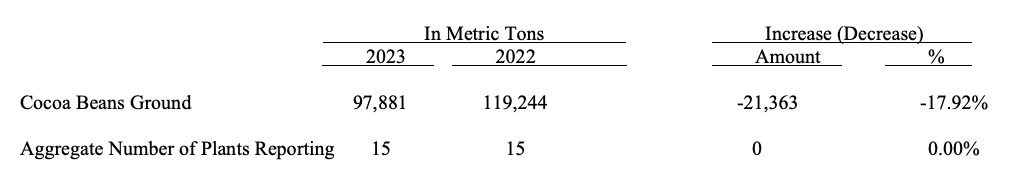

USA –(minus) 17.9% or 21,000 tons less

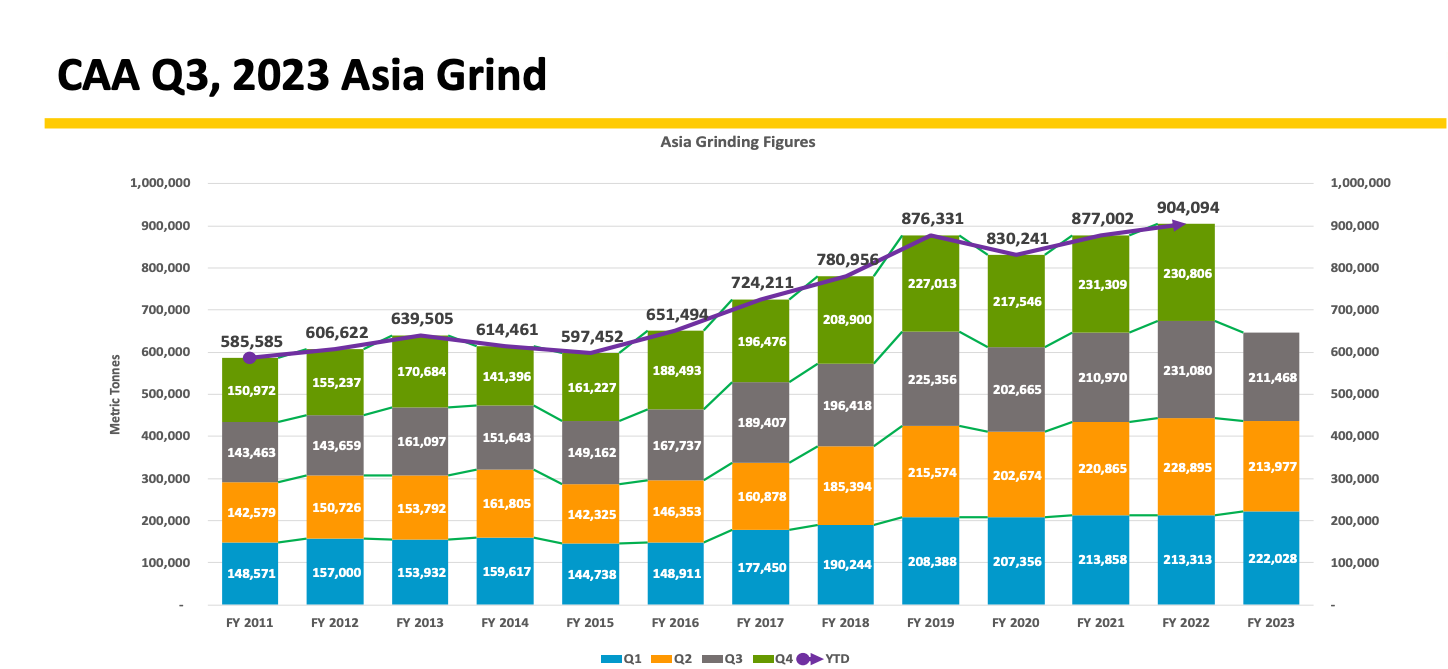

ASIA –(minus) 17.9% or 20,000 tons less

AFRICA +(plus) 7% or 12,000 tons more

In total, we factually see a drop in processing by about 30,000 tons in the third quarter if we take the data of all processors (who provide data) as a whole. In total, the global decline in processing in the third quarter is about 3%.

Given that the industry was covered for about 7 months at prices in May 2023 at the levels of 2300-2500 pounds per ton, we do not expect a strong drop in the fourth quarter, which is likely to support prices in early 2024.

The ratio on FOB terms West Africa stabilized at the following levels for deliveries in November.

The ratio is decreasing, but the exchange price is rising, which causes an increase in the prices of cocoa products.

Cocoa mass

1.61 with a stable trend, with no signs of an increase or decrease for the next 4 quarters. At the current exchange level, the price will be about 6300 euro-t

Natural cocoa butter

2.22 for natural cocoa butter and a growing trend for the next 4 quarters. The price at the current exchange levels will be about 9900 euro-t.

Cocoa powder

The ratio of cocoa powder has decreased since last month. The ratio is at 0.82 to the exchange. To date, the exchange price in euros is 3850 euros-t.

The graph falls proportionally to the growth of prices on the cocoa bean exchange. Therefore, we do not see changes in the price of cocoa powders or sharp changes in ratio in the next 3-4 quarters.

Natural cocoa powder is 3160 euro-t.

Alkalized cocoa powder is 3450 euro-t with a stable trend without strong signs to increase or decrease.

2. Technical analysis

The price chart of cocoa beans continues to move in the ascending channel, which originates a year ago, the price has doubled exactly, we continue to go along the upper border of the channel, which we most likely will not break through, the news background is not enough, but this does not mean that prices will not continue to rise, since the channel is ascending, each new day sets new upper limits, and the price can continue its ascent of 10-30 pounds per day for an indefinite amount of time, as it has been going on for more than 12 months with minor corrections.

Support lines against December 2023 at the levels of 3150 and 3000.

A possible correction during 2024 to the levels of 2750-2850 pounds per ton. Unfortunately, there are no lower prices in the 12-month perspective from a technical point of view yet.

Prices showed the highest levels in 45 years in October.

If we take into the account the pound-dollar pair, then in 1978 it was trading at 1.85, and currently at levels around 1.20. Based on these data, we see the highest prices in the entire history of observations.

The question is the value of money, $5,000 in 1978 and in 2023 are two absolutely incommensurable values.

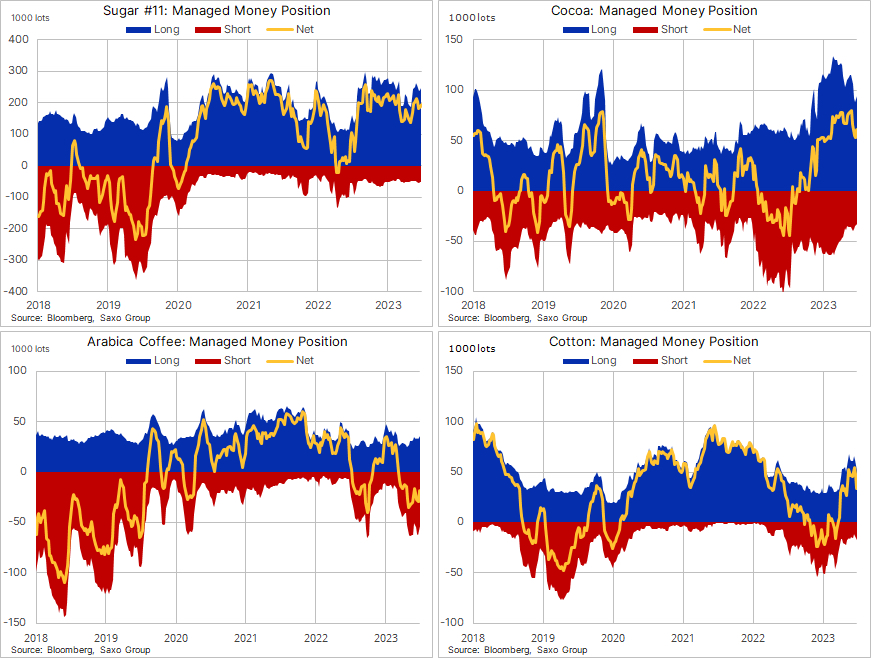

For hedge funds, we still see a large influx of long positions (yellow line) for price increases in all soft commodities, except for coffee. It is unlikely that we will see a strong price liquidation in the nearest future.

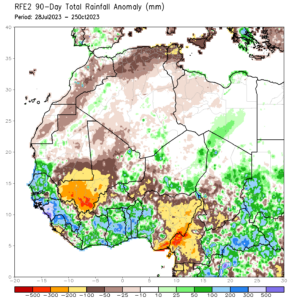

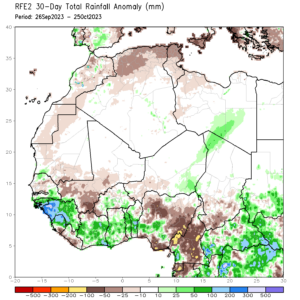

WEATHER

Weather conditions in West Africa in the last 3 months have been better than usual, as evidenced by the green-blue spots on the left image, for comparison, 2 graphs of 90 days and 30 days with a deviation from the norm. There are many times more rains than there should be, then unfortunately it has an exceptionally detrimental effect on the harvest of 2023/2024, we are already seeing the consequences. Cocoa beans that come to ports feature very high humidity and a very high level of defects. However, in March/April 2024, it is quite possible that we will have good arrivals at ports at the end of the main season. Unless, of course, the trees can withstand the abundance of rains and there will be no spread of fungal diseases of trees.