Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET October 2023

1. Season 2022/2023

According to the results of the end of season 2023, port arrivals in Côte d’Ivoire, as of September 30, remained consistent with the previous levels, 4.1% less on a year-to-year basis. 2,460,000 tons were delivered to the ports, which marks the conclusion of the season on a subdued note. Expectations for the upcoming harvest are less than optimistic, with major exporters anticipating a deficit ranging from 80,000 to 230,000 tons.

Notably, Côte d’Ivoire’s cocoa sales for the 2023/2024 season totaled 1,400,000 tons, down by 18% compared to the previous year, intensifying pressure on the market.

In September, prices reached their highest levels in 45 years, though factoring in the pound-to-US-dollar exchange rate. Considering inflation and the pound’s weakness this year, we are likely witnessing the potential for further price escalation and new record highs. This trajectory may involve a minor correction, potentially up to 10% from the peak.

Ghana has faced challenges meeting its cocoa export obligations for the second consecutive season, with estimated exports ranging from 650,000 to 700,000 tons; however, precise data on cocoa bean exports is unavailable. This represents a substantial decrease compared to previous volumes, with numerous unmet contractual obligations in Ghana’s export portfolio.

In Nigeria, cocoa bean exports have declined by an average of 15% monthly year-over-year, and prospects for improvement in the new season remain bleak, according to major exporters.

In Ghana an effort to deter illegal cocoa bean exports to neighboring countries, Côte d’Ivoire or Togo, Ghana will raise payments to cocoa farmers by 63% in the upcoming season. However, the local currency has depreciated by 12% over the year, resulting in a net increase of 50% in payments to farmers when measured in US dollars. In dollar terms, the price on October 1, 2024, will be about $1,810 per ton before export taxes.

In Côte d’Ivoire, preliminary data indicates a 150 CFA franc increase in payments to farmers, raising the price from FCFA 1,100 to FCFA 1,250(Preliminary data), which is $2,010 per ton in dollar terms. This represents an increase of approximately $350 per ton compared to the previous year, with prices specified before export taxes.

These price increases may stimulate cocoa production in Côte d’Ivoire and Ghana in the coming years, as prices have become more favorable for farmers.

Ratio on FOB West Africa conditions have stabilized at the following levels for September supplies.

Ratios are decreasing, but the stock market price is increasing, leading to higher cocoa product prices.

Cocoa mass

1.63 and demonstrating a stable trend, showing no signs of increase or decrease for the next 4 quarters. At the current level on the exchange, the price will be about 5,560 euros/t.

Natural cocoa butter

2.22 for natural cocoa butter and an uptrend for the next 4 quarters. The price at the current levels of the exchange will be about 7,570 euros/t.

Cocoa powder

The cocoa powder ratio has decreased slightly since last month. Ratio is at the level of 0.95 to the exchange. Today the exchange price in euros is 3,400 euros/t.

The graph falls proportionally to the increase in prices on the cocoa beans exchange. Therefore, we do not foresee changes in the price of cocoa powders and sharp changes in the ratios in the next 3-4 quarters.

Natural cocoa powder is priced at 3,240 euros/t.

Alkalized cocoa powder is at the level of 3,450 euros/t and demonstrates a stable trend without particular signs of increase or decrease.

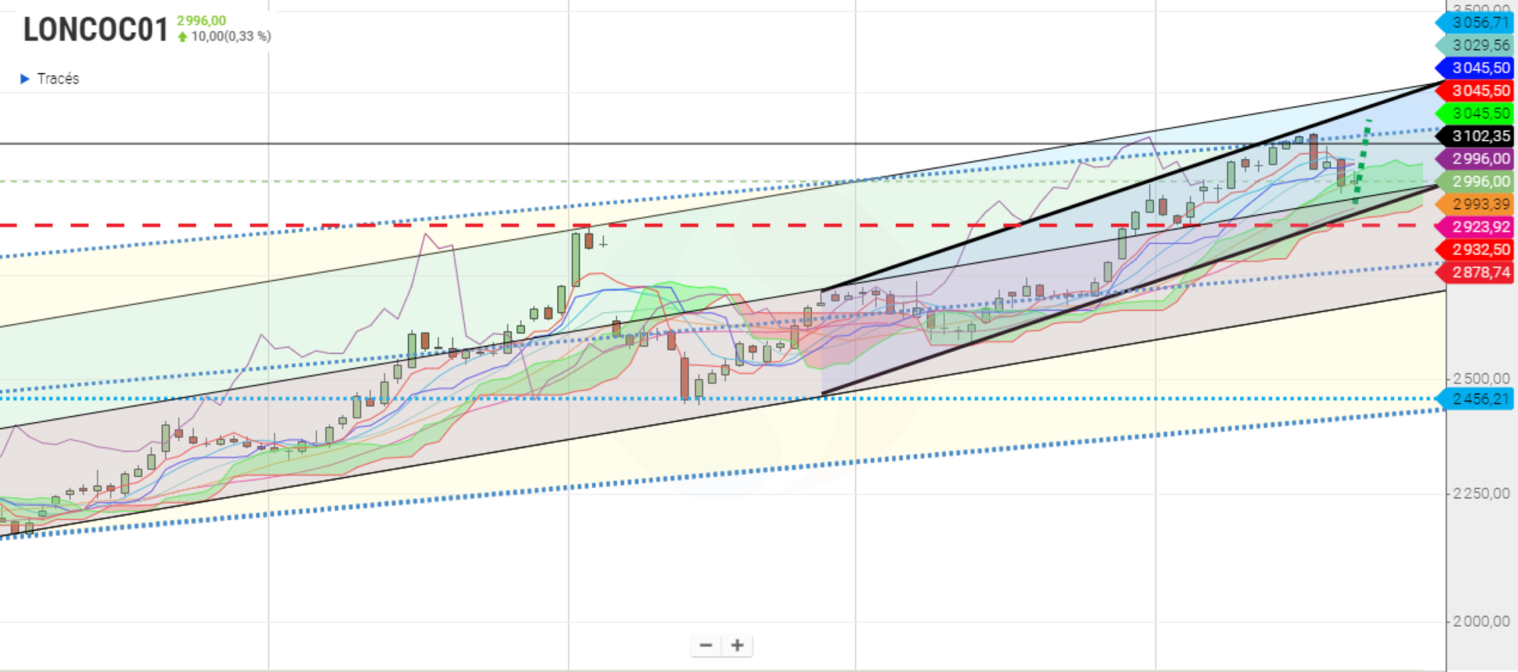

2. Technical analysis

The market exhibits strong backwardation, indicating that each successive month is notably cheaper than the preceding one, technically signaling a potential price increase. However, from the technical viewpoint, we see a price correction within the ascending channel.

On the London Stock Exchange, we observed unprecedented prices during September, reaching up to 3,130 pounds per ton in the first trading month. These levels were predictable, as they approach the upper limit of the channel.

As of the close of the session on September 29, we are trading within the middle of the ascending channel, with a lower point at 2,750 pounds per ton. There is potential for prices to reach levels between 3,200 to 3,400 pounds per ton, depending on when we return to the upper boundaries of the channel.

We emphasize the importance of utilizing any corrections to secure prices for forthcoming supply months. Global industry purchases for up to 7.5 months suggest that a substantial price drop is unlikely in the near future. The structure of the market indicates the same, as it is possible to purchase 2024 futures at more favorable prices, particularly closer to the expiration date of these trading months, where we may witness price increases to current levels.

WEATHER

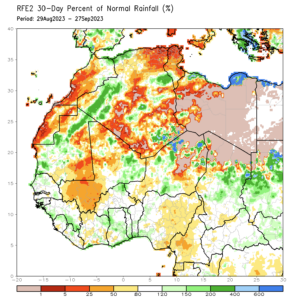

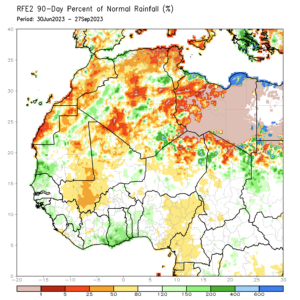

Weather conditions in West Africa have surpassed expectations over the past three months, as shown in the green areas on the right image. For comparison, we offer two accompanying charts illustrating deviations from standard conditions over 30 and 90 days. However, recent data for the past 30 days in Côte d’Ivoire reveal deviations for the worse (see the left image), as we see more and more such areas particularly in its north and west regions where cocoa trees are cultivated. A decrease in rainfall compared to the average is expected during this period. The consequences of these deviations may manifest in March 2024, potentially resulting in weaker arrivals at ports at the conclusion of the main harvest.

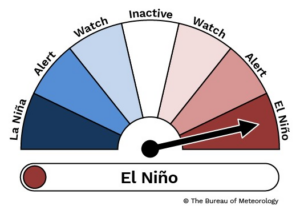

Additionally, we should remain vigilant regarding the onset of El Niño, which officially commenced in August, according to the research center specializing in this natural phenomenon. El Niño is expected to lead to dry weather conditions in West Africa during the current cocoa season.