Market report

TRENDS AND MAIN EVENTS IN THE COCOA MARKET September 2023

1. Season 2022/2023

On the basis of the results of June 2023, revenues to ports in Côte d’Ivoire, as of August 22, remain at -4.3% year to year. 2,340,000 tons were delivered to the ports and the level has been stable for a long time. We expect no changes.

Excessive rains have caused the spread of viral diseases (black pod and swollen shoot) in cocoa trees in West Africa, the trees are starting to rot, this will definitely have a negative impact on the next main crop.

Approximately 20% of trees are now infected with viral diseases to some extent, this can involve the death of fruits.

The price increases were also driven by the announcement by the Ministry responsible for cocoa production that they had stopped selling future crops. And the entire harvested crop in excess of the already sold one will go to domestic processing in the country. As we wrote earlier, many new productions of cocoa products are going to be opened in Côte d’Ivoire, and most likely the Ministry will limit the export of cocoa beans in the coming years.

By this statement, Côte d’Ivoire gave an opportunity for us to see an incredible increase in prices over the past 2 months, this occurs because hedge funds understand that no one else is pushing the market from above, no one is selling significant volumes, and accordingly, it is possible to drive the market to new heights.

Ghana is unable to fulfil its export obligations for the second consecutive season, a crop of 650,000 tons is expected, but 850,000 tons were sold, and an international loan was received for this tonnage. Clouds are gathering over the Ghana National Chamber of Commerce and Industry.

In Nigeria, exports of cocoa beans are down more than 20% year to year, according to unconfirmed reports. In July, 12% less year to year. Based on data from ports, local exporters are already paying about USD 2,900 per ton before taxes for ton of beans, which is much higher than in neighbouring countries.

Local exporters predict that the harvested crop in 2023/2024 will be even worse than this year.

In terms of market prices, the New York and London exchanges are showing record prices in spite of weak 2Q 2023 processing data.

In the main, funds buy news that the harvest will be weak – without relying on processing data.

The year will be in short supply and the same expectations for the next main crop, opinions on the deficit of the next crop vary, for instance, Marex Financial predicts a shortage of up to 279,000 tons.

This would mean stockpiles at the lowest level since 1985. Prices have already broken a 40-year record.

FOB West Africa ratios have stabilised at the following levels for September deliveries.

Ratios are decreasing, but the exchange price is rising, which causes an increase in the prices of cocoa products.

Cocoa mass

1.68 with a stable trend, no signs of up or down for the next 4 quarters. At the current exchange level, the price will be approx. 5,650 EUR/t.

Natura cocoa butter

2.22 for natural cocoa butter and a growing trend for the next 4 quarters. The price at the current exchange levels will be approx. 7,485 EUR/t.

Cocoa powder

Ratio for cocoa powder has decreased slightly since last month. The ratio is at the level of 0.95 to the exchange. At present, the exchange price is 3,200 EUR/t.

The chart falls proportionally to the price increase on the cocoa bean exchange. That is why we do not see changes in the price of cocoa powder and sharp changes in the ratio in the next 3-4 quarters.

Natural cocoa powder – 3,150 EUR/t.

Alkalised cocoa powder – 3,400 EUR/t with a stable trend without strong signs of up or down.

2. Technical analysis

Fundamental and technical analysis suggests that the market is seriously overbought, at the beginning of July we observed a correction from record price levels, but it turned out to be short-lived and, as we wrote in the previous report, we found a resistance level of approx. 2,400 pounds, but at present, due to strong fundamental news, we can see further growth.

On the London Stock Exchange, we see unprecedented prices reaching almost 3,000 pounds per ton in the moment of the first trading month on August 31, we predicted these levels a month earlier, but the forecast at that time seemed certainly very pessimistic due to the strength of the British pound. At the moment, at the close of the session on August 31, we have reached the upper technical limit of the price, whether this will mean a correction – rather yes than no. But we repeat once again that it is necessary to use any correction to fix prices for the coming months of deliveries, since the world industry has been purchased with raw materials for 6.5-7.5 months and these figures mean that we are unlikely to see a strong drop in prices in the near future.

The market is trading in a trend line, where we still see a resistance line at the level of 2,900-3,000 on the London Stock Exchange, depending on the time when we approach these levels, this line is calculated based on the two previous peaks from 2010 and 2016, and, in the next for months, we will definitely try to break through it, and 3,800, respectively, on the New York Stock Exchange.

Below, we will find support in a correction at the level of 2,600 pounds per ton in September, if we break this line, then we will probably test the level of 2,400 pounds again.

WEATHER

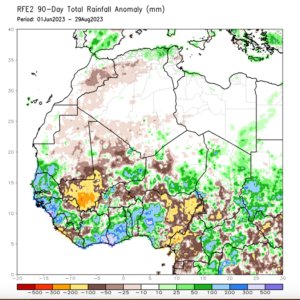

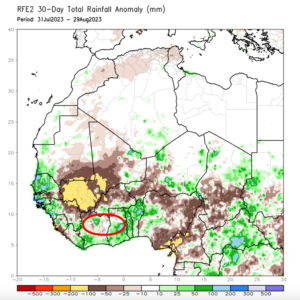

The weather conditions in West Africa have been better than usual in the last 3 months, as we wrote above in the first paragraphs there were very favourable rains which served as a catalyst for the spread of viral diseases of trees, for comparison: 2 charts showing 30 days and 90 days with deviation from the norm.

But let’s not forget about El Nino, which has already started since August. On the 30-day chart, the region circled in red is where more than 70% of all West African cocoa is grown. And according to the satellite data, there is drier than usual.

Therefore, we will probably start the season behind schedule.