TRENDS AND MAIN EVENTS IN THE COCOA MARKET

Market Reports

COCOA MARKET TRENDS – SEPTEMBER 2025

The article contains data provided by Saxobank, Reuters, ICCO, HCCO, Hedgepoint

1.Season 2025/2026

Cocoa in Côte d’Ivoire:

The cocoa harvest forecast in Côte d’Ivoire for this year has significantly improved thanks to favorable weather conditions and optimistic forecast about the crop. Côte d’Ivoire has announced an increase in its farmgate prices for the new season, which begins on October 1, and the prices going up to 2,800.00 FCFA/kg, or about 5,000.00 USD per metric ton.

Ecuador has announced an upcoming harvest of 650,000.00 tons, putting it in the second place among cocoa-producing countries and, thus, ahead of Ghana. The competition promises to be interesting!

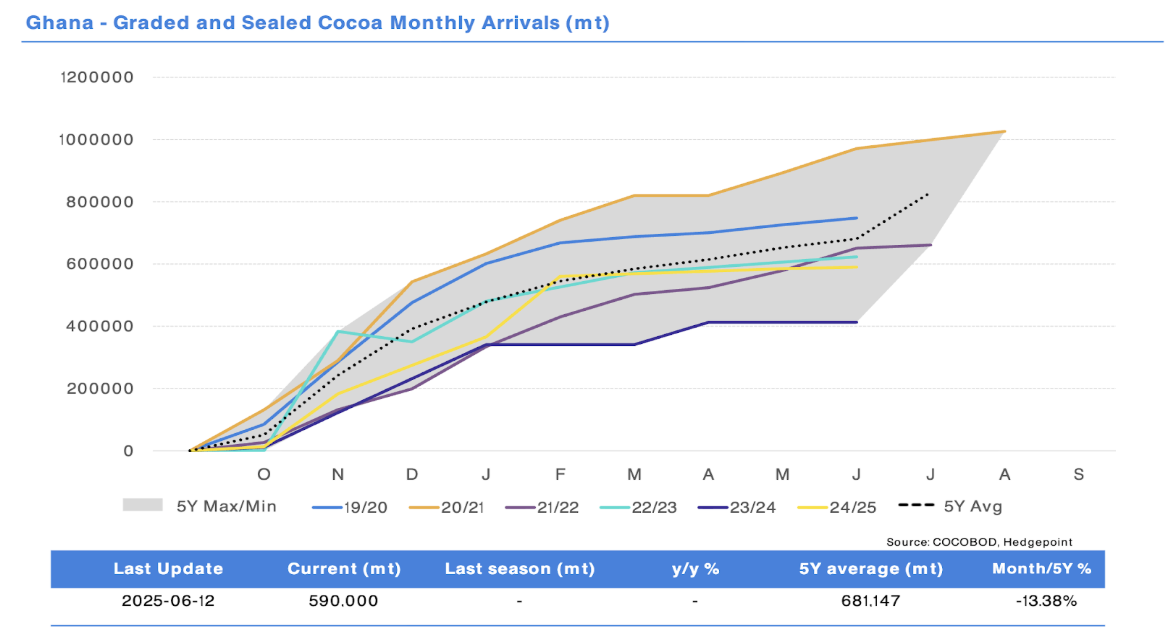

Ghana: deliveries of cocoa to warehouses in August were much higher than during the same period last year (50,440.00 MT versus 11,000.00 MT), due to the accelerated seasonal strategy with harvesting beginning on August 1, as in the previous year. This potentially may lead to a substantial increase in this season deliveries.

Authorities recorded a price increase of 4.5% (around 160 USD), to approximately 4,160.00 USD/t compared with last season, although the price in local currency has hardly changed — 49,600.00 cedis last year versus 51,660.00 cedis this season. Ghana continues to pursue goals of expanding its cocoa acreage amid growing demand for the crop. Additional upward pressure on cocoa prices also comes from compliance with EUDR requirements, which will most likely be postponed until 2027.

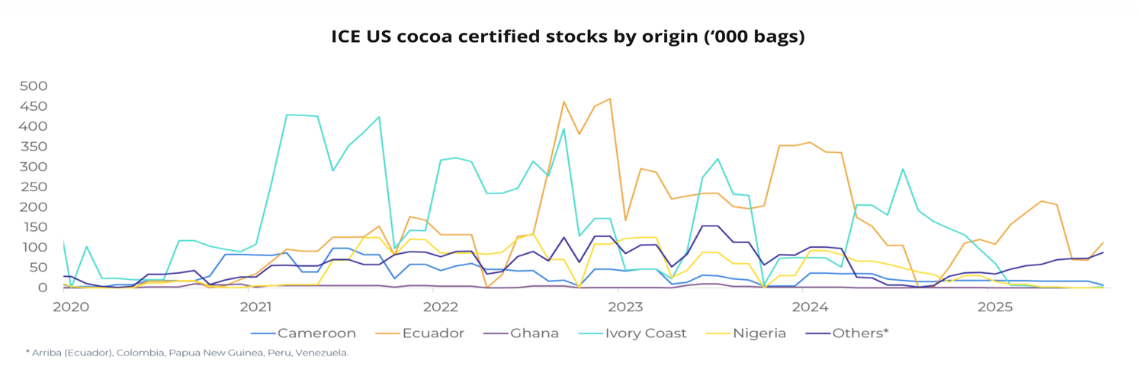

Certified cocoa stock levels in the United States fell by 7% in September. As of September 29, the number of bags stood at just over 1,972,000.00 pcs., which is equivalent to about 135,000.00 tons.

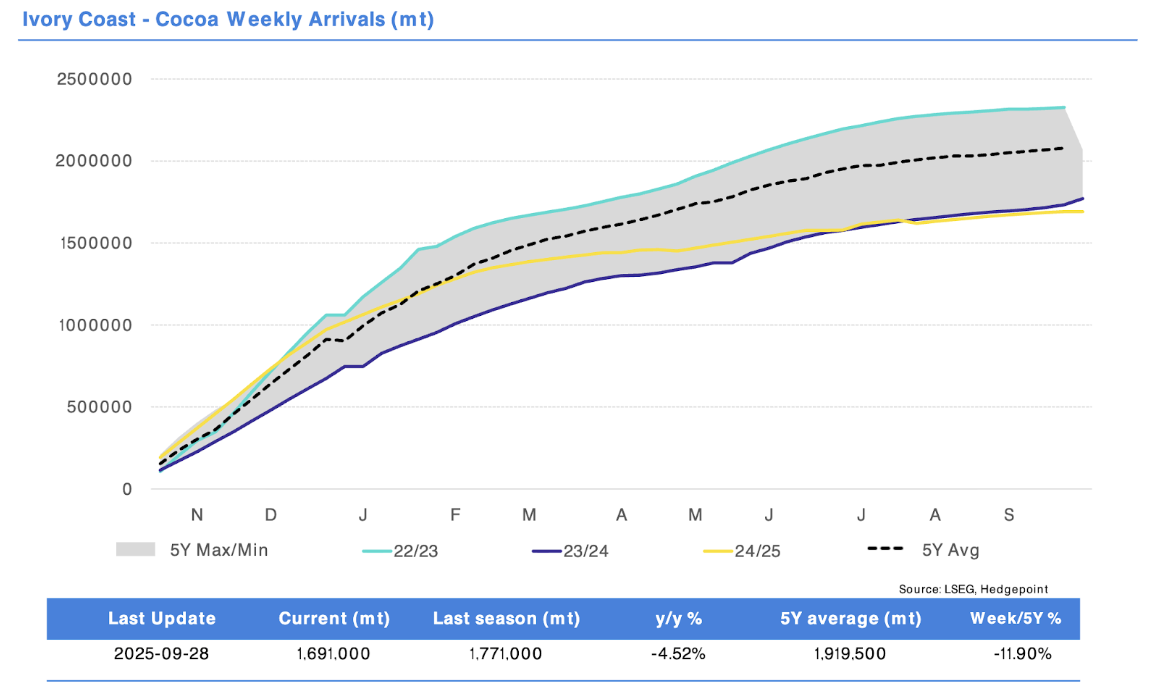

We also see that the final harvest figures for 2024/25 in Côte d’Ivoire ended up even lower than during the crisis season of 2023/24. However, the decline in demand offset these results.

Ghana looks better, and the data from the first arrivals of the 2025/26 season are encouraging, so it is possible that the country will emerge from the cocoa production crisis. However, it will still need some time to meet its accumulated shipment debts.

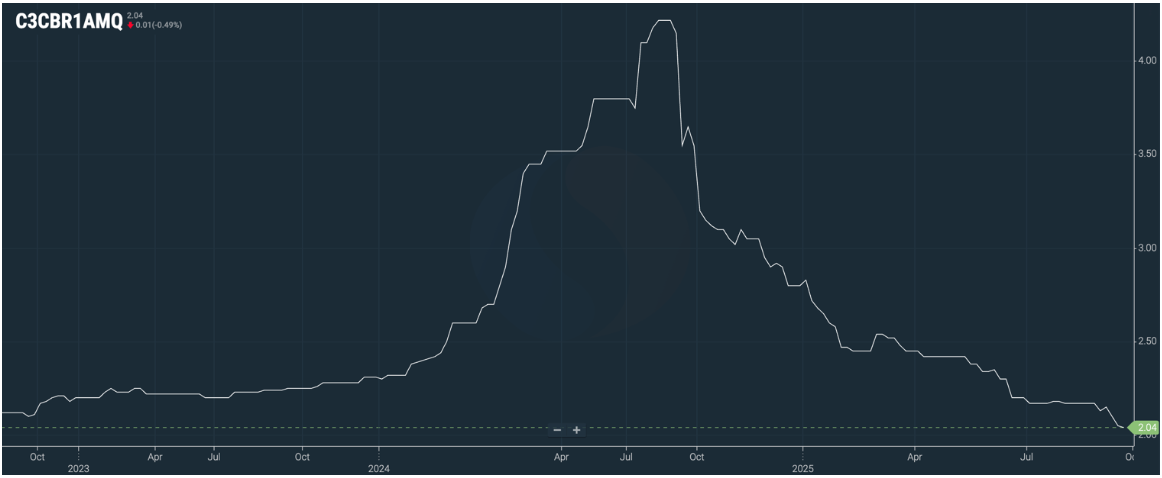

The cocoa butter ratio is currently at 2.04, having lost about 7% of its value. The actual price has also decreased along with cocoa bean prices, though a slight increase may be possible in the next two quarters.

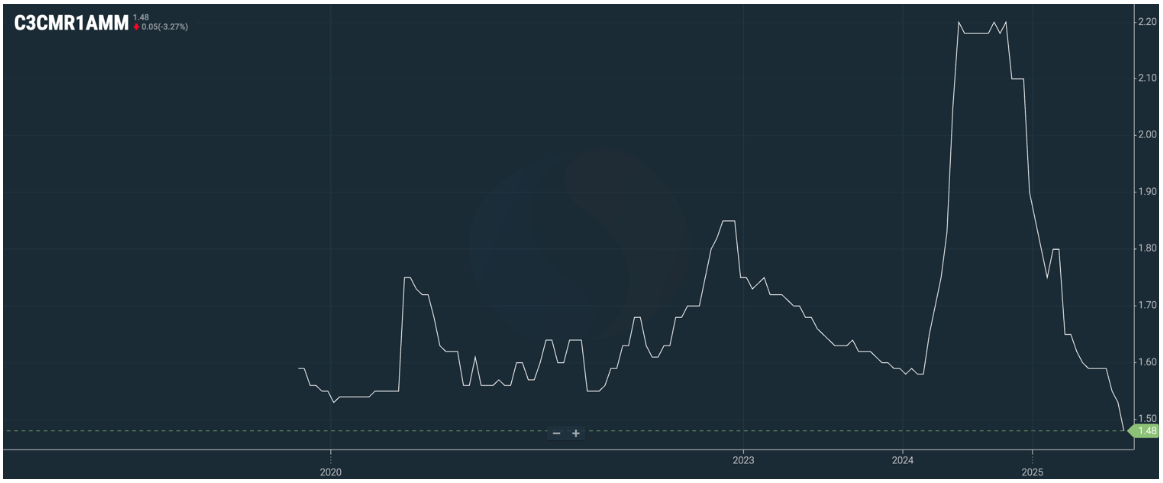

The cocoa liquor ratio is at 1.48, showing a modest upward trend throughout 2025.

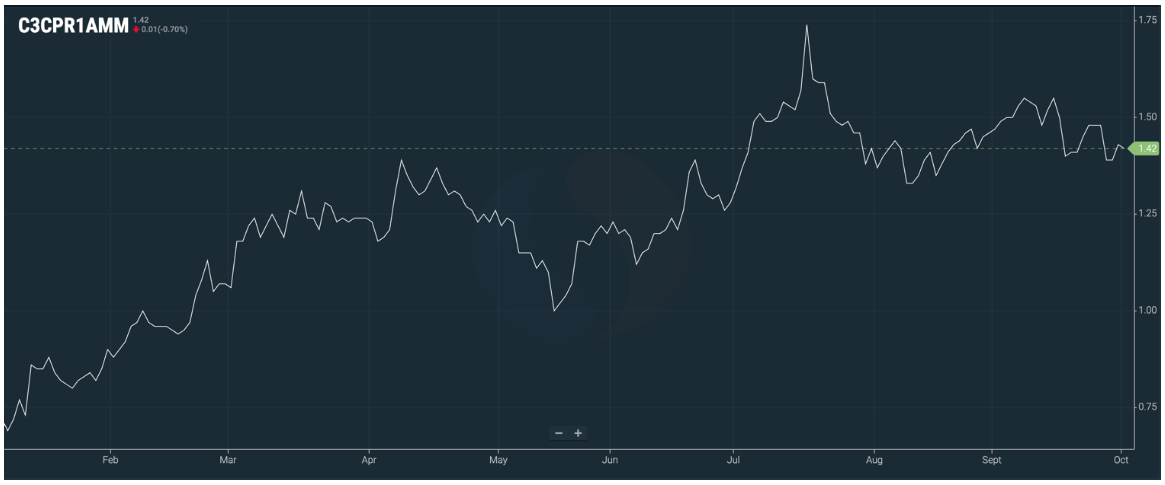

The cocoa powder ratio is at 1.42, with the final product price slightly declining due to changes in cocoa exchange prices.

As of today, the exchange price in euros stands at 5,500.00 EUR/t.

Ratios on FOB West Africa terms for spot deliveries are at the following levels:

Cocoa liquor

1.48, with a stable upward trend expected to reach 1.6 by the 2nd quarter of 2026. At the current exchange market level, the price for the 3rd quarter is projected at around 8,150.00 EUR/t.

Natural cocoa butter

2.04, with a stable upward trend over the next 4 quarters toward 2.25. At the current exchange level, the price for the 2nd quarter is projected at around 11,220.00 EUR/t.

Cocoa powder

The ratio has remained almost unchanged since last month, standing at 1.42 to the exchange market.

Natural cocoa powder price starts from 7,800.00 EUR/t

Alkalized cocoa powder price starts from 7,950.00 EUR/t

2.Technical Analysis

In September, markets declined on news of reduced consumption. The market broke through certain support levels, and we have redrawn new support and resistance levels.

At the moment, we are in the 5th wave of decline, from which we expect an upward reversal in the near future.

If the New York exchange price consolidates below 6,100.00 USD/t within the next month, we may see a period of lower prices.

Our advice to clients remains the same: buy any price correction. Such corrections may not last long, and with the current market volatility, we may see moves exceeding 1,000.00 USD per day. One can gain a few hundred dollars per ton during a correction, but risk losing thousands in the event of an explosive increase. Any even minor news could serve as a catalyst.

It is important not to forget that funds, which dictate market price direction, may start buying on news of poor weather conditions; and we will cover this issue below. This risk factor should not be underestimated. If it materializes, by the end of the year we may see prices on the New York exchange at 10,000.00 USD and above.

Despite weaker demand, we are living in a period of shortage of quality cocoa beans

WEATHER

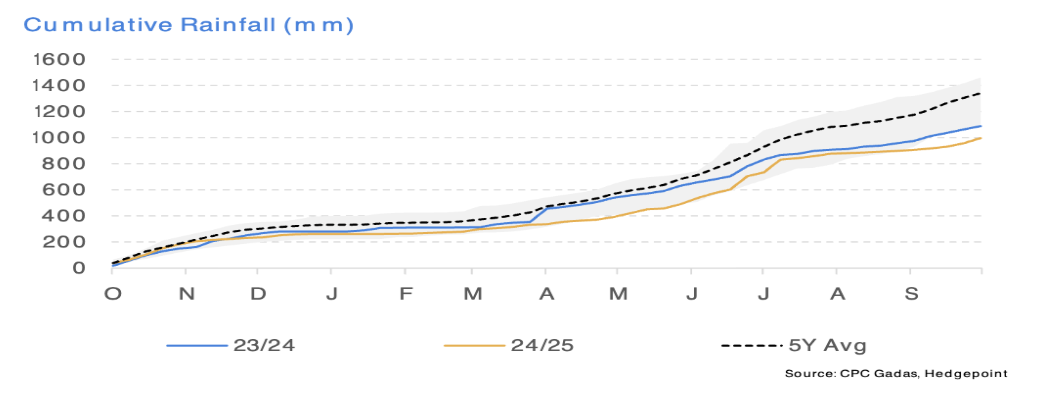

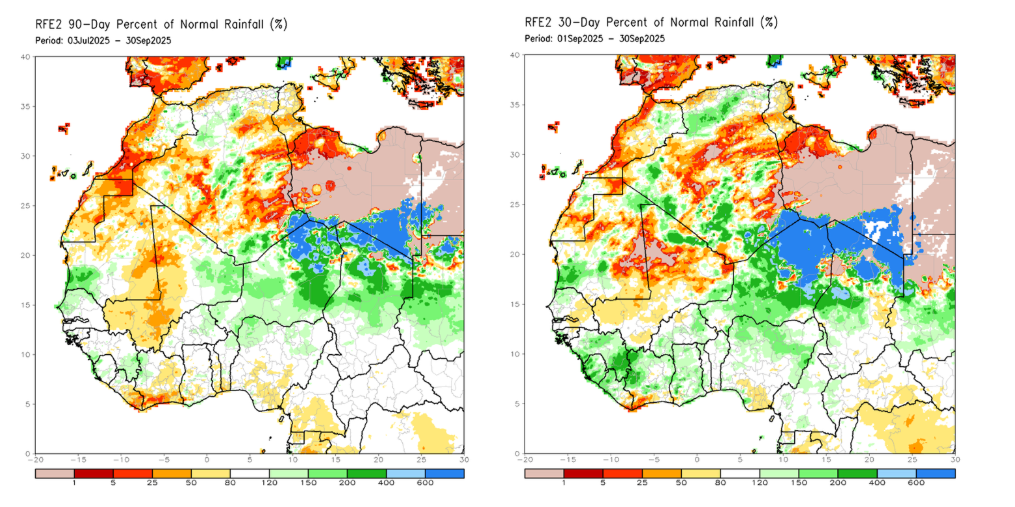

Rainfall in West Africa over the past 90 days has been below normal. For the last three months, we have seen consistently low rainfall, which is more likely to affect harvest figures in December–February. However, the data for the past 30 days will probably provide a good basis for the formation of the next mid-crop.

Overall rainfall data is concerning. We would advise paying attention to it, as the figures are significantly below recent averages. Most likely, we are facing yet another scarse season.