Market report

TRENDS AND KEY EVENTS IN THE COCOA MARKET

February 2022

Season 2021/2022

Cocoa beans processing in the 4Q 2021 globally.

EU +6.3%

USA -1.2%

Asia + 6.33%

This data that is available from the middle of January, shows that the prices at the cocoa stock exchange underwent a correction.

There is a continuing delay in shipments of the harvest 2021/2022. There is 2% decrease of shipments to Côte d’Ivoire port this season if compared with the previous year as of January 31, 2022. As of today the deliveries scope comprises more than 1, 320, 000 tons. At the season beginning we observed an underperformance of approximately 9%, however, 4 months later we see that the cocoa beans export is almost at the level of the previous year.

According to the latest updates from Barry Callebaut, the leading manufacturer of cocoa products and chocolate in the world, we see increase in sales by 8.9% during the autumn of 2021, these numbers published on 27.01.22 gave a positive momentum to the market stimulating its further growth.

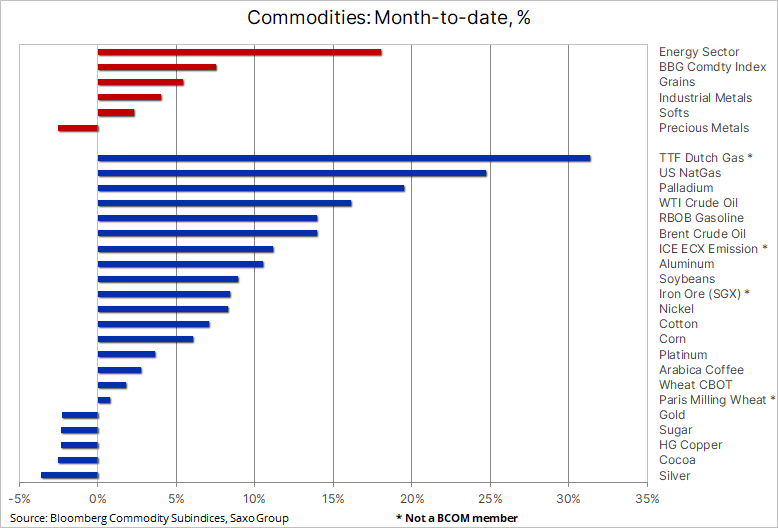

Besides, chocolate sales in USA during the 4Q 2021 demonstrated 5% annual increase. Therefore the processing data can be not completely exact, taking into account the fact that only 16 out of 17 factories provided their reports last year. We remind that cocoa is still one of the most underestimated assets in the list of raw products.

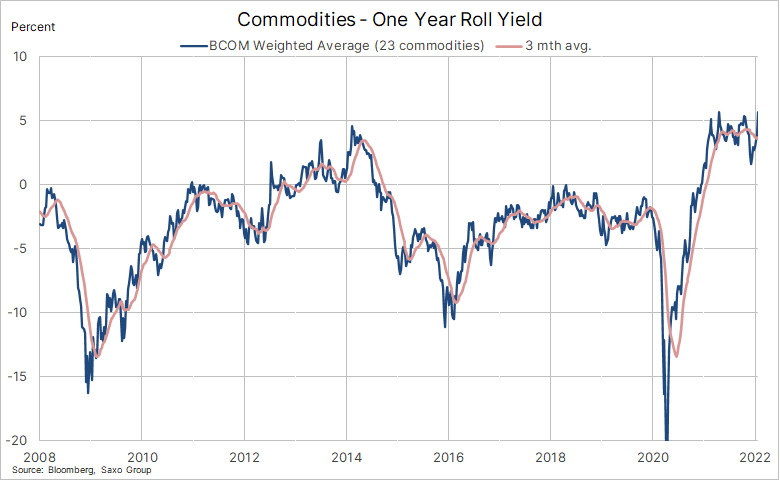

For the last decade the general trend of raw materials cost is anew at the peak.

Besides, let’s pay attention to the dollar index, the trend of the last decade that used to be a support, now is an obstacle for the further growth. Retesting of the level has happened, and the index went down to 1% which is a reliable sign of US dollar index decrease. The lower goes US dollar, the higher go the prices for raw materials sold in US dollars.

WEATHER

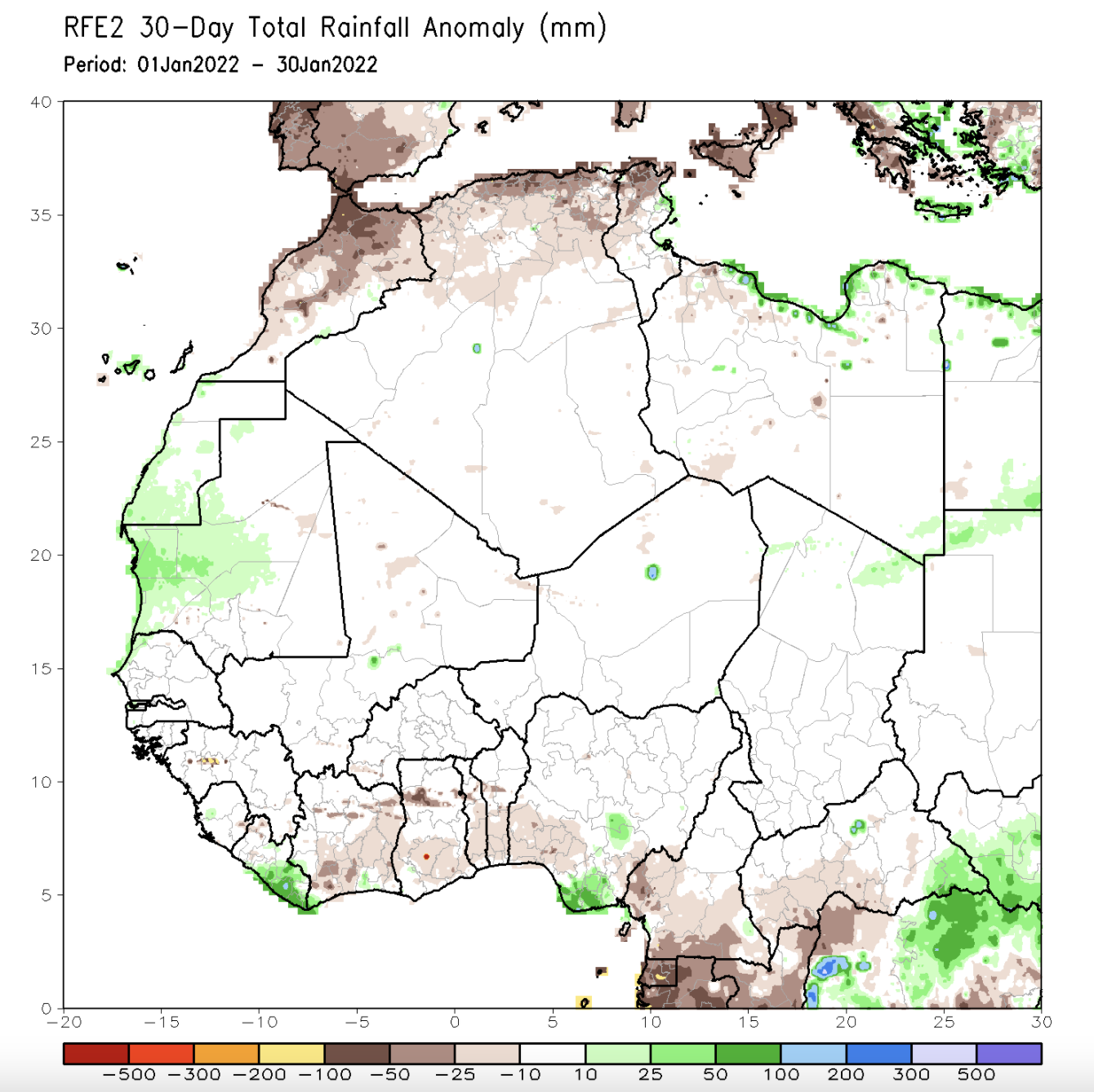

Weather conditions in West Africa ceased to be favorable.

In West Africa, no rain has been falling for more than two weeks.

Higher air temperatures stimulated the trees for an earlier average harvest; however, the same high temperatures harm the further blossoming of the trees. Therefore, the main harvest of 22/23 may not be as good as could have been.

The data is also confirmed by the observations from Ghana, where the loss of air humidity decreased the trees blossoming.

The data is confirmed by precipitations observations from satellites.

TECHNICAL ANALYSIS OF THE MARKET

From a technical point of view, the upward market trend was not ruined by the quotes decrease during the last week of January, 2022.

On London Stock Exchanges CH2 (May 2022 trading month) we continue trade above the main support points as of the 1st of February, which means that already during the next month we can see an increase in prices.

According to the Elliot Wave theory the New-York market demonstrated a decrease to the trend line in 5 waves and now we observe ABC correction. Where ABC is expected with high probability to shape the next wave of growth covering a longer time period. According to forecasts made by some analysts, it may be the third wave of growth, and the most rapid. However, the fundamental analysis does not yet give us any grounds, except for the weather conditions, to expect an explosive market growth.

But it is worth remembering that New York Stock Exchange has opened trade with gaps, which will necessarily be closed in the nearest future, the highest of which is at the level of 2645 USD, it is quite possible that it will be done with the closure of the contract on February 22, 2022.

PRICES FOR COCOA BEANS AND COCOA PRODUCTS

Cocoa mass (cocoa liquor)

Ratio spot (instant deliveries) – 1.68

Ratio for the first quarter of 2022 – 1.68

Cocoa powder (cocoa powder)

Natural powder of standard quality IC1 – 2380 EUR/mt

Premium Quality Natural Powder ICP – 2530 EUR/mt

Alkalized powder of premium quality A6 – 2630 EUR/mt the offer is limited

Alkalized powder of premium quality A8 – 2780 EUR/mt the offer is limited

Cocoa beans of Ghana

Deliveries 1 Q 2022

Stock Exchange CH2 (Mar22) +500 GBP/mt

Price FCA Tallinn 2980 USD/mt

Cocoa beans Ivory Coast

Deliveries 1 Q 2022

Stock Exchange CH2 (Mar22) +385 GBP/mt

Price FCA Tallinn 2815 USD/mt

Wishing You Good Health & Happiness

Panamir OÜ is carrying out an investment project aimed at launching a cocoa powder production line. This project is within the framework of the investment support for the processing and marketing of agricultural products of micro and small enterprises (ERDP 2014-2020 measure 4.2.1), the amount of the support is 175,120.80 euros.

Panamir OÜ publishes a monthly market report on the cocoa market.