Market report

TRENDS AND KEY EVENTS IN THE COCOA MARKET

January 2022

Season 2021/2022

The harvest of 2021/2022 continues with delays in deliveries. In Ivory Coast, this season, arrivals at the port are 6% worse than a year earlier, according to data as on January 2, 2022.

Now 1,110,000 tons have been delivered.

In Ghana, the harvest is projected to decrease to 950,000 tons from 1,060,000 MT last year, which is -5.6% compared to last year.

Pressure on prices is also exerted by a new strain of the Omicron coronavirus, with millions of cases every day in the US and the EU. It is unclear how this will affect the demand for chocolate.

GIPEX group of African cocoa processors announced an increase in cocoa processing by 6.2% according to data for November 2021.

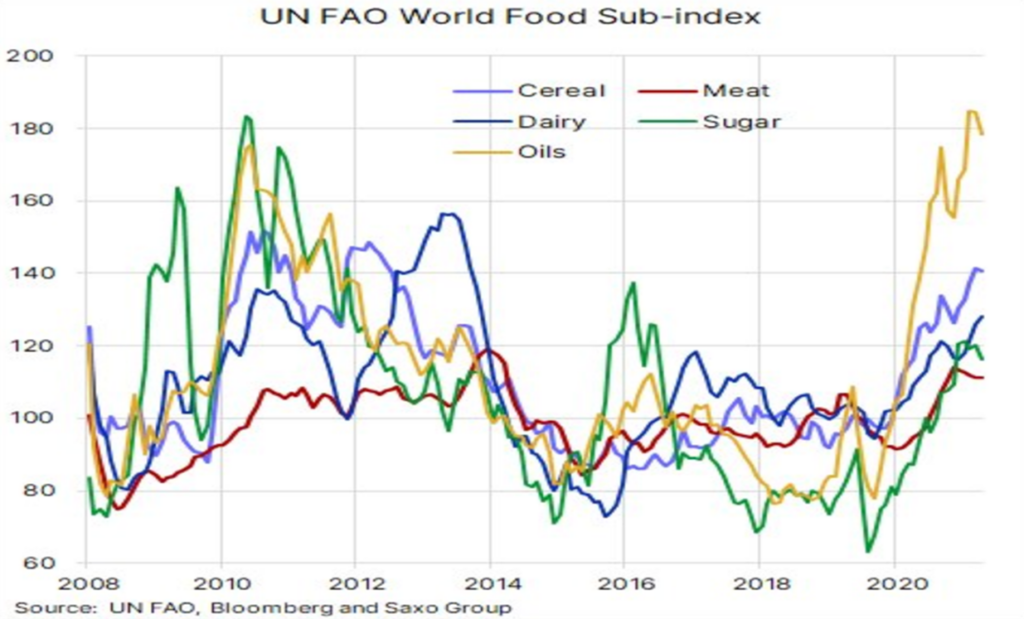

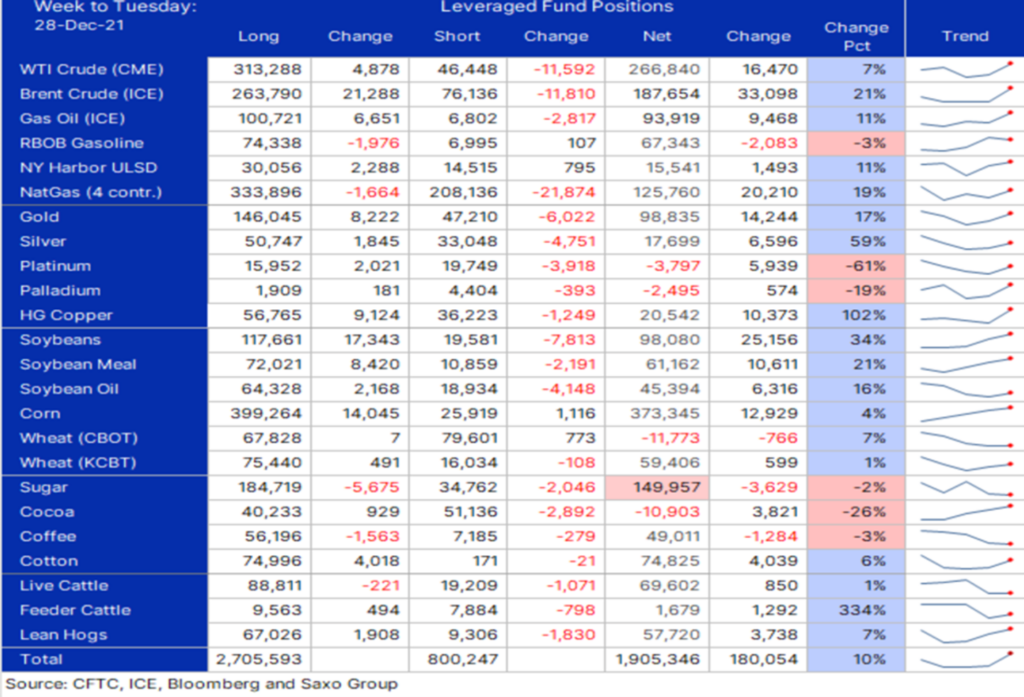

According to Saxo bank, the inflation of the basket of consumer products in December began to decline in almost all positions, but if we talk about cocoa, the positions of hedge funds slightly increase their long positions on price increases. It is not surprising, since cocoa beans were the only raw product with negative growth in 2021.

WEATHER

Weather conditions in West Africa remain favorable with an abundance of rain.

In West Africa, there is a rapid flowering of cocoa trees, it was ensured due to good rains in previous periods.

There is practically no dry wind from the Sahara (Harmattan), which is unusual for this time of year, this is positive news for the development of the summer harvest 2021/2022.

Also, given the anomaly in the amount of precipitation, the upcoming average harvest may well become, if not a record, then at least at the level of last year.

This fact is now the strongest brake on the price of cocoa beans.

The soil has enough moisture, due to heavy rains in the last 90 days in West Africa.

The observation of currents in the Pacific Ocean shows a weak possibility of the formation of the El Nino effect by the end of 2022, which may adversely affect the main crop of 2022/2023.

TECHNICAL ANALYSIS OF THE MARKET

From a technical point of view, it is moving along an ascending trend line. ((London Stock Exchange Chart)

The main points of resistance will be on the London Stock Exchange CK2 (May 2022 trading month)

The last week of 2021 closed above all averages but could not hold its position in the first week of 2022, however, a strong growth momentum on Friday 07.01.2022 still indicates that sooner or later the market will move into a clearly growing trend. Most likely, this will happen when the price (the closing of the trading week) is fixed above 1750 for CK2.

(London Stock Exchange Chart)

200 day average – 1718

100 day average – 1756

50 day average – 1715

On the chart of the NY stock exchange, the range in which we have been trading in the last 3 years is important, which has formed a symmetrical triangle, in the near future trading is expected in the range of 2350-2900 dollars per ton. And breaking through both the lower and upper boundaries will most likely mean the formation of a new trend in prices. Most likely, the breakthrough will take place in 2022.

We can safely say that we are in an uptrend after fixing the price above 2600 by K2 (May), until then the price will fluctuate in the range from 2400 to 2550.

PRICES FOR COCOA BEANS AND COCOA PRODUCTS

Cocoa mass (cocoa liquor)

Ratio spot (instant deliveries) – 1.68

Ratio for the first quarter of 2022 – 1.68

Cocoa powder (cocoa powder)

Natural powder of standard quality IC1 – 2380 EUR/mt

Premium Quality Natural Powder ICP – 2530 EUR/mt

Alkalized powder of premium quality A6 – 2630 EUR/mt the offer is limited

Alkalized powder of premium quality A8 – 2780 EUR/mt the offer is limited

Cocoa beans of Ghana

Deliveries in 1st quarter of 2022

Exchange CH2 (Mar22) +500 GBP/mt

FCA Tallinn Price 2980 USD/mt

Cocoa beans Ivory Coast

Deliveries in 4th quarter of 2021

CZ1 Exchange (Dec 2021) +385 GBP/mt

FCA Tallinn Price 2815 USD/mt

Wishing You Good Health & Happiness

Panamir OÜ is carrying out an investment project aimed at launching a cocoa powder production line. This project is within the framework of the investment support for the processing and marketing of agricultural products of micro and small enterprises (ERDP 2014-2020 measure 4.2.1), the amount of the support is 175,120.80 euros.

Panamir OÜ publishes a monthly market report on the cocoa market.